Bitcoin Halving 2020: Concepts, Case Studies and Predictions

In this post we talk about what the block reward is, why it decreases, the 2016 Bitcoin Halving and predictions for the 2020 Bitcoin Halving.

T-Minus 69 days to Halving. This is one of the most talked about topics in crypto mining right now so we figured it was time to put some of our thoughts down on paper.

In this post we talk about what the block reward is, why it decreases, the 2016 Bitcoin Halving and predictions for the 2020 Bitcoin Halving. (Disclaimer: this is not trading advice!!)

Terms

Block Reward

The block reward simply refers to the new coins distributed by the network to miners for each successfully solved block. You can think of it as the compensation a miner receives for securing the network.

Right now the network “subsidizes” the cost to secure itself by issuing compensation directly to the miner, rather than users of the platform needing to pay them. The users of the network pay for this through inflation (i.e. an increased supply lowers the value per coin).

Over time this subsidy declines, eventually ceasing altogether. For BTC this subsidy stops when 21 million BTC have been issued (Should be in the year 2140).

Transaction Fees

Some networks like Bitcoin have considerable amounts of transactions fees rewarded to miners. These fees equal the total fees paid by users of the Bitcoin network (to execute transactions). In Dec-2019 this was roughly equal to 3–4% of the Block Reward.

Currently mining pools (representing their miners) choose which transactions to include into a block. Almost all of the time the transactions get included based on the profitability (i.e. higher transaction fee).

Case Studies

The past ≠ the future. So it is impossible to predict what will happen in May based on previous halvings. The dynamics have completely changed from a mining and trading perspective.

That being said we do think it is helpful to look at previous examples as you build out your thesis on what will occur.

BTC Halving 2016

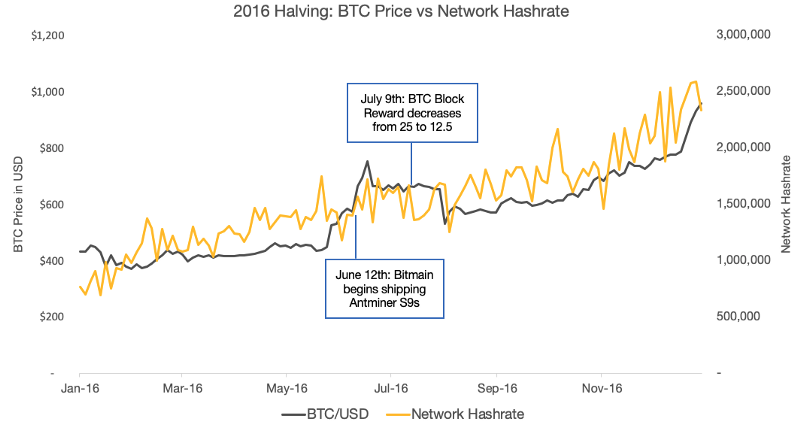

The last halving for Bitcoin was almost 4 years ago in July 2016. The halving ultimately took its price from ~$700 to almost $20,000 over a 2 year run. Although this climb wasn’t a steady one, there were time of downwards and sideways price action. At the time of the halving, the inflation rate was around 9.6%, by mid 2017 this had fallen to under 5%.

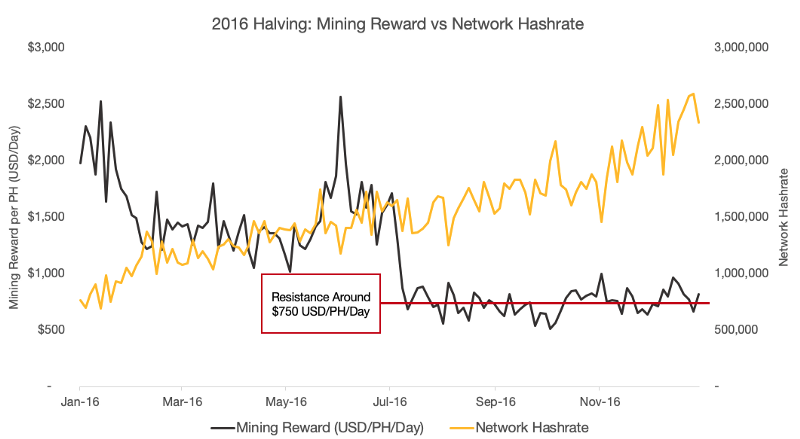

Although the block reward was cut in half we didn’t see a large drop off in hashrate. This was partially due to Bitmain’s new Antminer coming onto the market. However, the larger reason was due to the mining profitability at the time. The decrease in block reward hurt mining operations but it wasn’t enough to put them underwater financially.

After the reward fell, it stabilized around $750 USD / PH / Day for the remainder of the year. For an S9 (11.5TH) this translated to ~$8.60 a day in revenue. At an efficiency of 0.098j/Gh and assuming an electricity price of $0.08kWh this resulted in $6.50 in profit. After the halving, as the price of Bitcoin increased, so too did the Network Hashrate, leaving mining revenue relatively flat.

Overall the last halving has two key takeaways (1) the market isn’t perfectly efficient as it didn’t fully price in the decrease in inflation rate. Decreasing inflation rate seemingly had a positive impact on price (2) the change in hashrate largely depends on miner profitability. If miners are still profitable you won’t see a large decrease in hashrate.

Oil Market 2014–2016

An interesting case study outside of the crypto world was the oil markets in 2014. In Mid 2014, oil was hovering between $100 and $125 a barrel. It then experienced a major price drop, to below \$50. This was cause by a booming supply of oil (U.S. Shale, OPEC, Iran), weak demand and the strengthening of the U.S. dollar.

This is interesting because it replicates the economics of hashrate producers.

When the price of oil goes down -> supply of oil falls as it isn’t profitable for some producers (i.e. U.S. producers shut down) -> the decrease in supply puts upward pressure on oil prices -> some supply comes back online as it is now profitable again.

This is shown perfectly with the U.S. producers in 2015/2016. Right at the beginning of 2016, some producers failed to cover their variable costs and had to start shutting down. Production was finally impacted and the price shored up bringing some of the producers back into business.

Predictions for Halving 2020

As pool operators we get asked often about individual miner profitability. Will it still be profitable to mine once the block reward gets cut in half? What will happen to the price? What will happen to the network hashrate?

We are not professional traders so do not take any of the below as investment advice. We are mearly speculating on what may occur.

Bitcoin Price

This is the most talked about area when it comes to the halving as it impacts everyone in the industry, not just miners. There exists two main theories (1) the market is efficient and has already priced in the halving (2) the market is inefficient and the decrease in inflation will lead to an increase in price.

With block reward decreasing so to does the inflation rate, which theoretically should put upward pressure on the price. The inflation rate is going to be falling from ~3.8% to ~1.8%. For the first time ever, Bitcoin will have a smaller inflation rate than most developed countries’ target (~2.0%).

We don’t have a crystal ball but definitely think that the crypto markets are far from efficient. It is predominantly based on sentiment, speculation and irrational behaviour. Given this, we do not think that the market has fully priced in the halving. It may be similar to the run up after 2016 halving, where there were time periods of decline and flat price action but overall it trended upwards for the two years following.

For this analysis we will assume a $10k BTC price upon halving (currently around ~$8.7k).

Hashrate

Put simply, miners mine when its profitable. So to predict the change in hashrate it needs to be looked at as a function of their reward in USD/CAD/EURO/RMB.

Current Cost

A recent coinshares mining report came out that estimated the average cost of electricity at \$0.04/kWh. This may seem low, especially for people that are paying higher. But we are seeing more hashrate consolidation in low cost areas like China, Canada, Kazakhstan, Iran and the U.S. Many mega-farms are building out at 2–3 cent power.

Coinshares also estimates 15% in additional operating costs and a 30 month depreciation schedule.

Using this analysis we will estimate that the average all-in variable cost, (excl. depreciation), is \$0.05/kWh.

Analysis

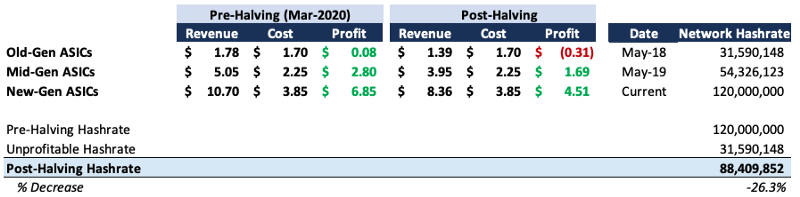

To estimate how much hashrate will go offline after halving we took the list of all SHA-256 ASICs and calculated their revenue (pre and post halving). The post-halving revenue reflected a 50% decrease in block reward, a \$10k BTC price and a circular reference of hashrate dropping off the network.

What we found is that **all of the hardware released prior to June 2018 will not be profitable at \$0.05/kWh. **As of June 2018 there was just under 32EH of hashrate on the Bitcoin network. With that hashrate gone, many of the Mid-Gen ASICs (June-2018 to May-2019) which would have gone into negative profitability after the halving, return to positive profitability.

In regards to other SHA-256 chains, BCH and BSV are halving a month before BTC. So we expect some of that hashrate to come over to the BTC network ahead of the BTC halving and then head back afterwards.

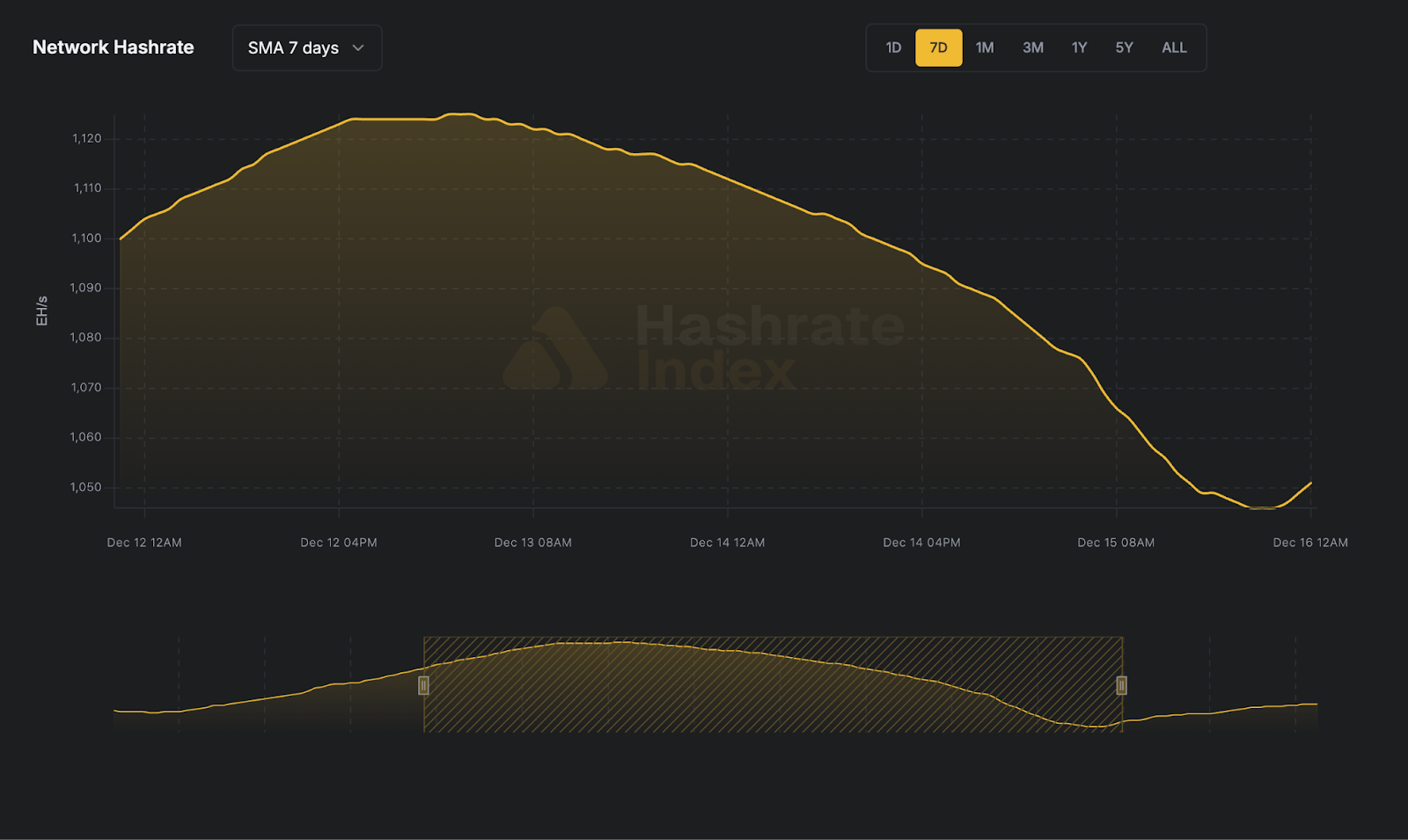

Overall we are predicting a ~26% drop in network hashrate to ~88EH.

Profitability 2020

The only thing we know forsure about this projection is that **it will be wrong. **Just as the past couple of years was impossible to predict so to will the rest of 2020. We made some rough projections below.

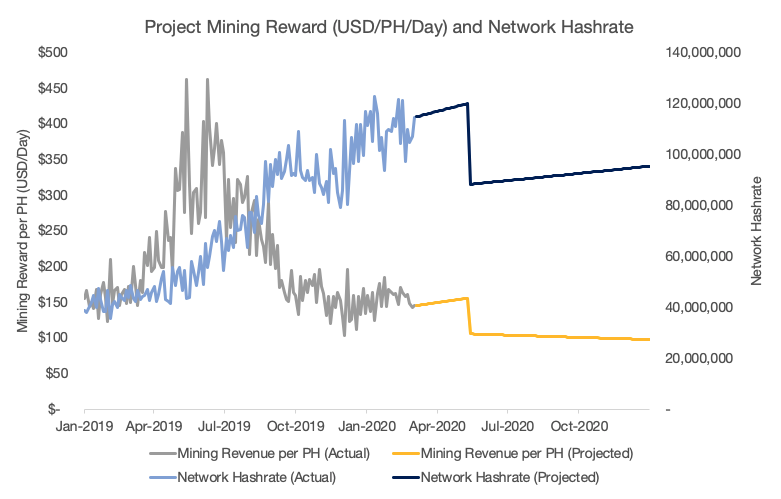

We projected out BTC Emission to increase slowly until reaching its peak right before halving. This was driven by an increase of BTC price to \$10k. At the time of halving this emission rate is cut in half and stays the same for the remainder of 2020.

We then projected out hashrate to increase back to 120EH as we approach halving. It then drops to 88EH after halving. It slowly increases for the remainder of the year to account for the new S19’s and M30s hitting the market.

The value of hashrate is a function of the projections above. It rises with the price of Bitcoin and falls after halving. However, the decrease from the block reward halving is slightly offset by the decrease in Network Hashrate.

Long-term

We believe that decreases in block reward will be offset in the long-term by an increase in transaction fees and/or an increase in coin price given the natural supply and demand of hashrate. Miners need to be incentivized through revenue to burn their electricity. If it isn’t profitable for them they won’t mine and if they don’t mine then BTC will become worthless.

The Bitcoin Network is already highly secure. So the number of physical machines doesn’t need to keep increasing to protect the network. Over time increases in chip innovation alone will increase the network hashrate and increase the difficulty of attacking it.

We are confident that there will always be an industry for miners to get compensated for securing the network. However, it is crucial that miners continue to think through their buildout, getting access to electricity and overall operations.

Implications

This is the most widely followed Block Reward Halving ever. Tens of thousands of Bitcoiners and Miners are counting down the days to the halving. Its effect on price and hashrate will be used to predict the rest of the other chain halvings for the coming years.

It is crucial that the halving has a positive long-term impact on price and overall mining is still profitable for the majority of miners.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.