Bitcoin Difficulty Adjustment Experiences 28% Drop, Largest Ever As Miners Exit China

Bitcoin's mining difficulty just saw its largest reduction ever, a historic event that reflects a watershed time in Bitcoin's mining industry as hashrate flees China for other countries.

Bitcoin just experienced its largest downward difficulty adjustment ever.

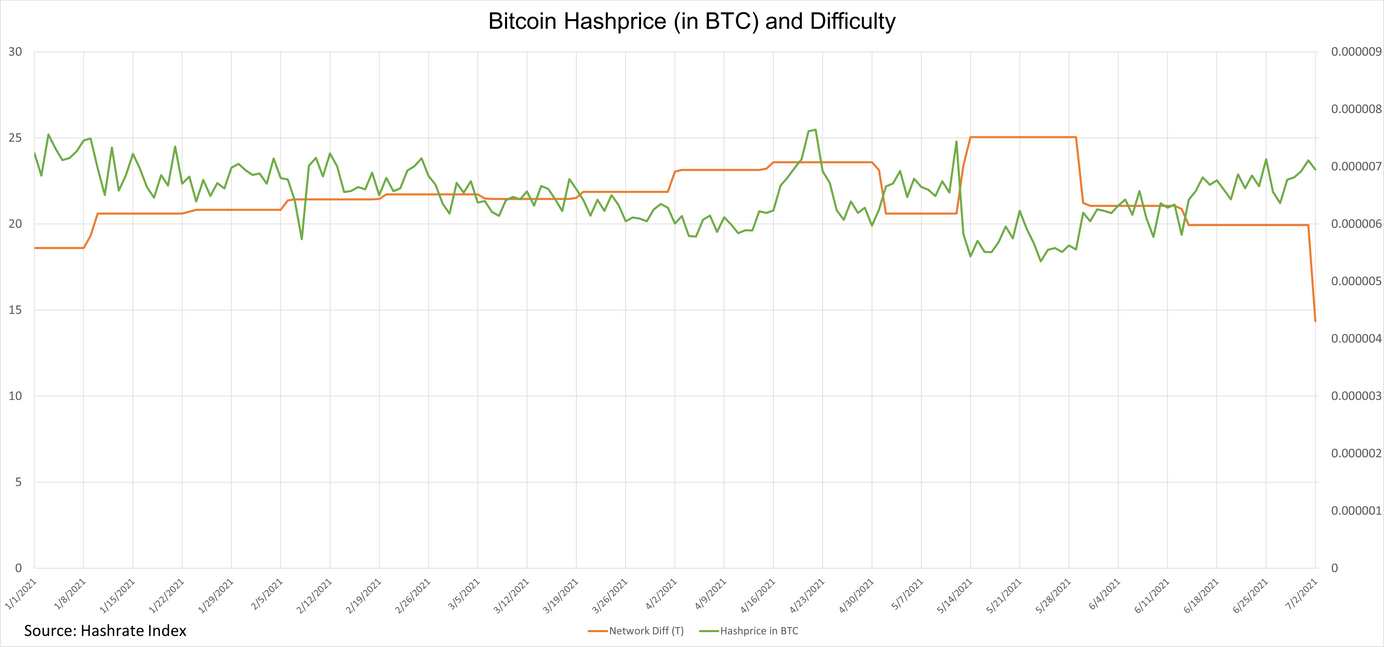

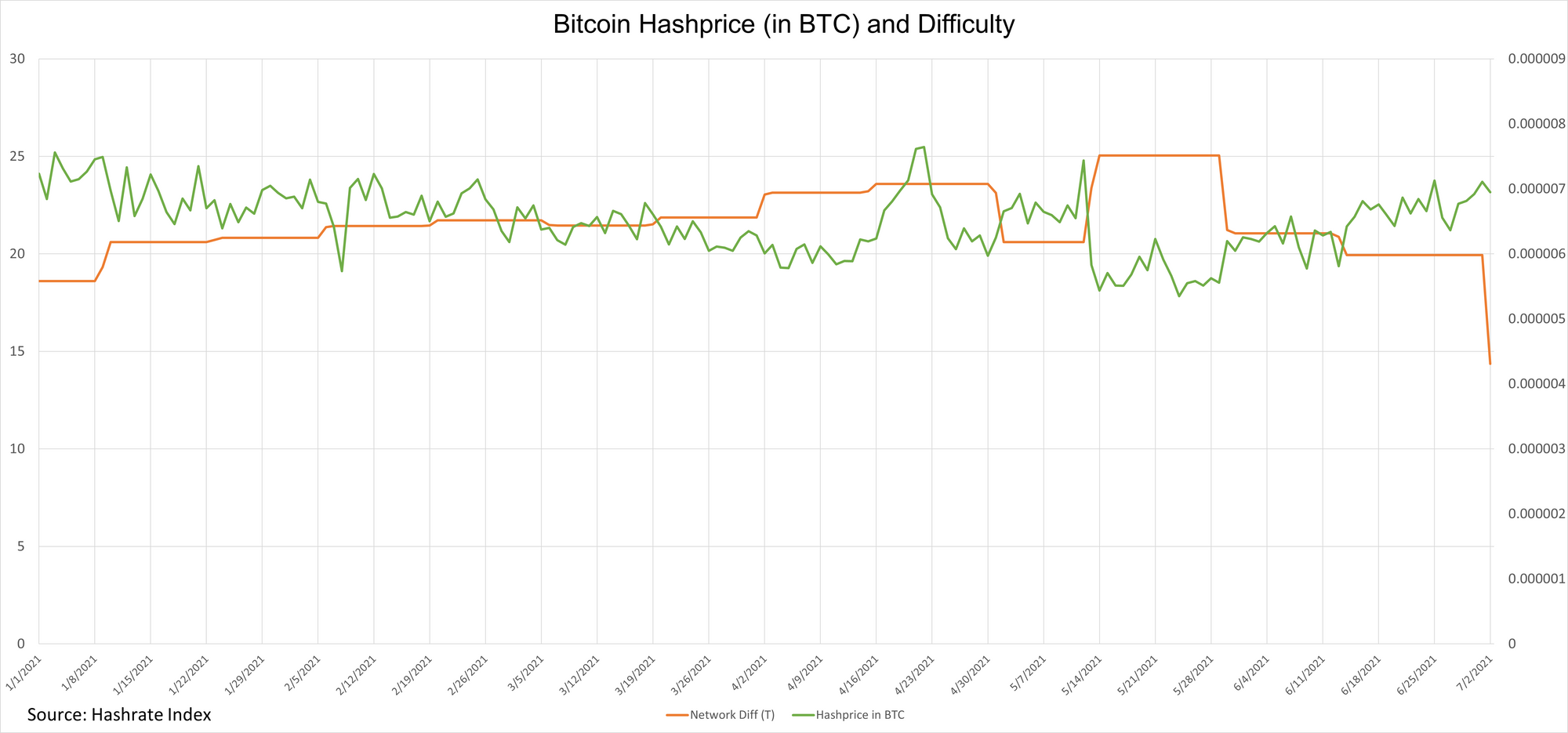

Per data from this author’s node, Bitcoin’s difficulty is currently 14.36T, a 28% decrease from last epoch’s score of 19.93T. The massive decrease in difficulty was expected and is a response to Bitcoin’s hashrate being cut nearly in half after China’s sweeping crackdowns.

The record setting recalibration underscores the severity of the on-going exodus of miners from China, and may be seen in its own right as a watershed moment in Bitcoin's mining history.

Swing Low, Sweet Hashrate

Over the course of the 2020-2021 bull market, Bitcoin’s hashrate chased its surging price as miners turned on fleets of the newest generation equipment, some of which were backlogged from disruptions related to COVID-19 shutdowns.

Bitcoin’s hashrate nearly doubled between the start of 2020 and May 2021, then came China’s crackdown, which sent Bitcoin’s hashrate down with it, reducing it from an all-time high of roughly 180 EH/s to its current 85 EH/s.

This latest, historic adjustment puts mining difficulty at levels not seen since, incredibly, May and June of 2020. It’s also the third negative adjustment in a row, and the fifth one in 2021 (Bitcoin’s hashrate rang in the new year red hot, with 8 of the first 12 adjustment going to the upside).

The next adjustment will be much smaller, most likely, but there’s a good chance it will be negative again as the network continues to respond to the shakeout in China.

We expect the reprieve in difficulty to bring a boost to miner profitability, and we anticipate a rise in Bitcoin’s hashprice to roughly $0.33 following this adjustment (though this is also contingent on price action and could wane if bitcoin’s price continues to decline).

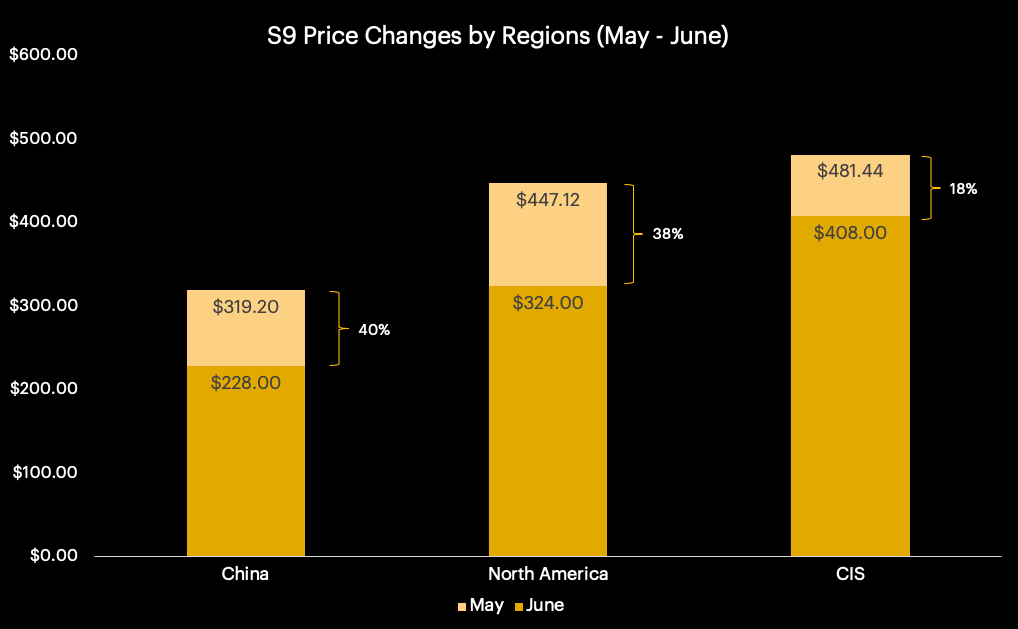

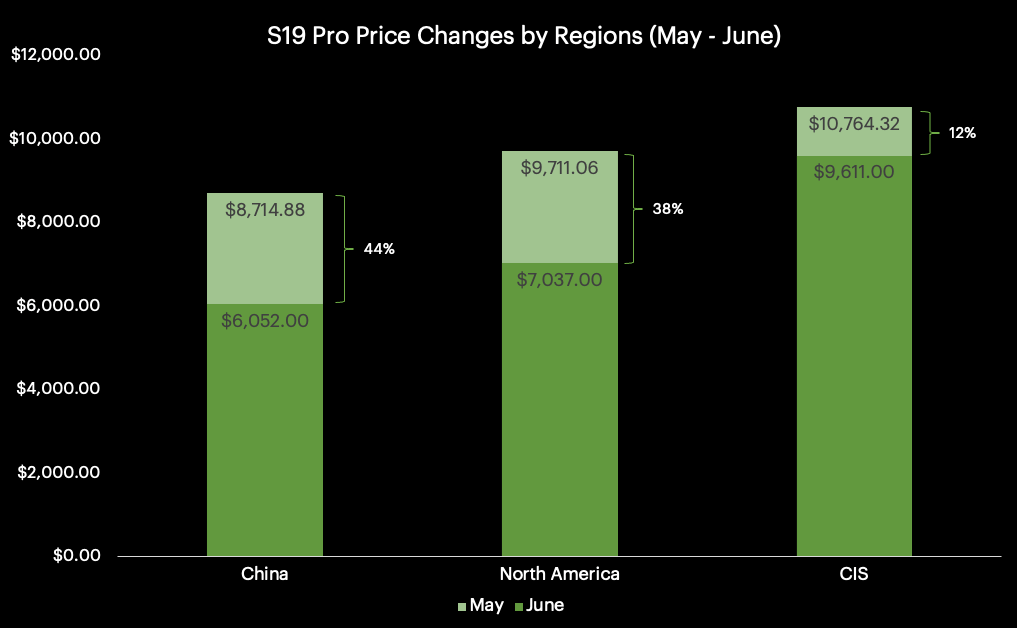

Additionally, we expect rig prices to continue to fall since roughly as teams search for hard-to-find rack space for roughly 2.2 GW worth of machinery.

Those miners who have their machines plugged-in and hashing, though, should have it good in the coming months. To quote Luxor CEO Nick Hansen, “You are in the driver's seat for the rest of the year.”

What is Bitcoin’s Difficulty Adjustment?

Bitcoin’s mining difficulty is a self-correcting, self-referencing scoring system that dictates how hard it is for miners to find a hash for the next block in the chain. The difficulty adjusts every 2,016 blocks (or roughly every 2 weeks) based on the frequency of blocks in the previous period (if blocks come out faster than the targeted 10 minute interval, the network raises difficulty; if blocks come out too slowly, the network lowers difficulty).

This bespoke score was set at 1 on Bitcoin’s Genesis and has been increasing exponentially ever since. Bitcoin’s difficulty adjustment is limited to 75% downward and 300% upward.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.