10 Bitcoin Mining Predictions for 2023

2023 is here, and we can finally put the dreadful bitcoin mining year of 2022 behind us. We are all curious about what this new and fresh year will bring for the bitcoin mining industry.

What will miners focus on this year? What will happen to the nearly bankrupt public miners? And the most interesting question - how could bitcoin’s price and hashrate develop in 2023?

This article attempts to answer such questions by providing our 10 bitcoin mining predictions for 2023.

Here’s a list of Bitcoin Mining Predictions for 2023:

- The bitcoin bear market will come to an end

- Bitcoin’s hashrate growth will slow down

- The number of public miners will decline

- Hosting prices will fall

- Cost minimization will be essential in 2023

- ASICs will become dirt cheap

- Miners will struggle with achieving sufficient up-time

- Regulators will keep targeting bitcoin mining

- Miners will work on strengthening their balance sheets

- Miners will increasingly utilize Bitcoin mining derivatives

1. The bitcoin bear market will come to an end, but we won’t see another full-scale bull market yet

The harsh reality is that bitcoin’s price is the most critical factor impacting the mining industry. Therefore, we first embark on the seemingly impossible challenge of predicting the future bitcoin price.

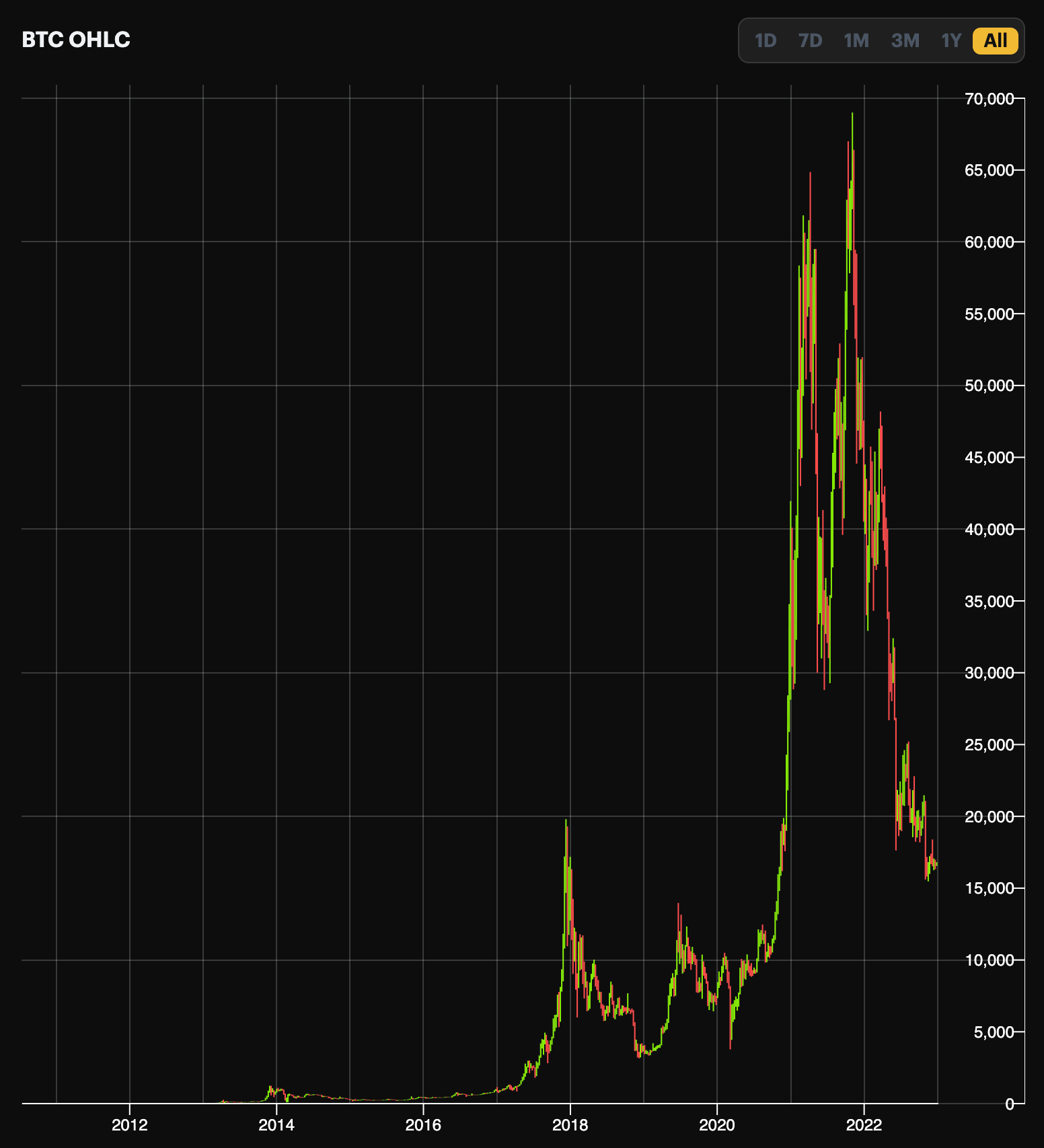

Bitcoin has historically gone through some remarkably similar bull and bear cycles. It can be helpful to compare the current bear market to previous ones to estimate how bad the current one could get and how long it could last. As Arcane Research points out in its 2022 year-end report, bitcoin’s current bear market has lasted for 376 days, a length comparable to the bear markets of 2014-15 and 2018.

The current peak-to-through drawdown of 78% is also not far from the maximum drawdowns of 2015 and 2018 of 85% and 84%. Judging by historical cycles, the current bear market looks like it will soon end.

Also, the only reason bitcoin fell below $25k was extensive forced selling due to the downfall of several overleveraged market participants. Without this forced selling, the bitcoin price would still trade in the $25k to $30k territory. As the overleveraged dominoes finish falling, the bitcoin price could return to these levels.

Although the bear market could soon end, it is still too early for another full-scale bull market to commence. Bitcoin price growth is primarily driven by new capital flowing into the space. In 2023, we will likely see few outsiders starting to allocate capital to crypto and bitcoin, as the extreme market chaos and outright scams of 2022 have scared many away from the sector.

It will take time before traditional finance firms are ready to build bitcoin exposure, and we will likely have to wait patiently for another one or two years before market participants are prepared to embark on the next bull cycle.

2. Bitcoin’s hashrate growth will slow down

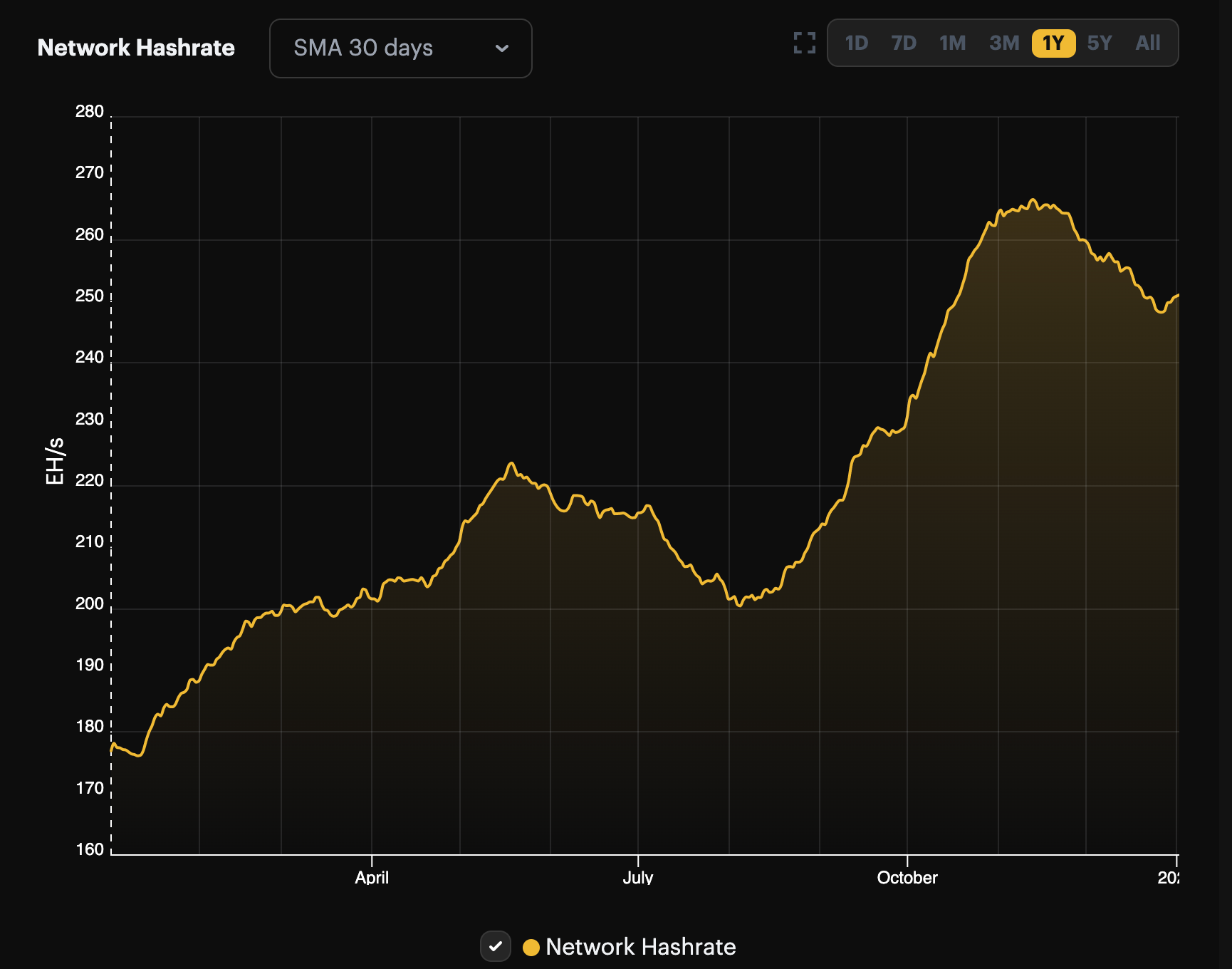

Hashrate steadily grew in 2022 as bitcoin miners finally realized their massive expansion plans initiated during the bull market of late 2021. This year confirmed what we have seen during several cycles historically: Hashrate follows bitcoin's price with a lag of several months, as it takes time to manufacture mining rigs and build sites.

We will most likely see the hashrate growth slow down in 2023, as the poor mining economics of 2022 didn’t incentivize capacity expansion. The hashrate coming online in 2023 will mostly be delayed capacity expansion miners initially planned to add in 2022. This delayed capacity will come online during the first half of 2023. After that, the hashrate will stop growing and perhaps even contract, depending on the bitcoin price.

3. The number of public Bitcoin miners will decline as they go private or merge

Public Bitcoin mining companies have better access to capital than private ones, particularly during bull markets. Still, being public also comes with several disadvantages. Arguably, the most significant burden of being a public company is strict reporting requirements that can be difficult and expensive to comply with.

After a devastating bear market, many public miners have been degraded to penny stocks with market caps below $50 million, which don’t exactly justify spending millions of dollars on annual reporting. These companies could drastically reduce administrative costs by going private.

Some public miners will not go private but merge with other companies to share administrative costs and leverage economies of scale.

4. Hosting prices will fall as infrastructure gets deployed, miners are washed out

One of 2022’s (many) undesirable trends were rising hosting costs.

In the North American context, the Bitcoin mining gold rush precipitated by China’s mining ban in 2021 flushed the US and Canadian mining industry with activity and capital. The North American mining industry was not equipped to accommodate the influx of business from China and the surge of interest in mining from North American investors.

Infrastructure build-outs took time to react to the migration, and in 2021 and 2022, amble rack space was hard to come by in the North American market. It was a hosting providers’ market, so to speak, wherein hosting companies could charge higher rates due to the rack space shortage and market demand. Electricity rates also went up in 2021 and 2022, exacerbating the rise in hosting costs.

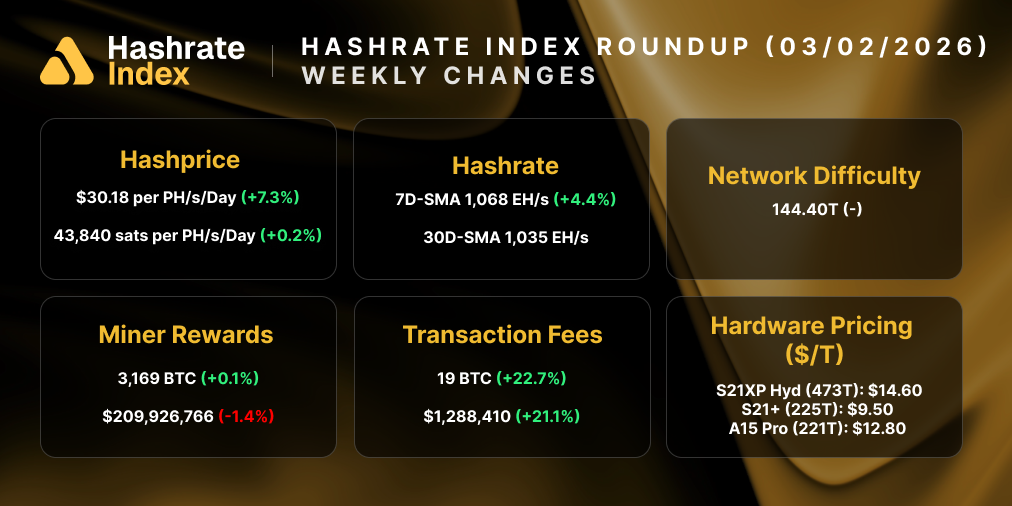

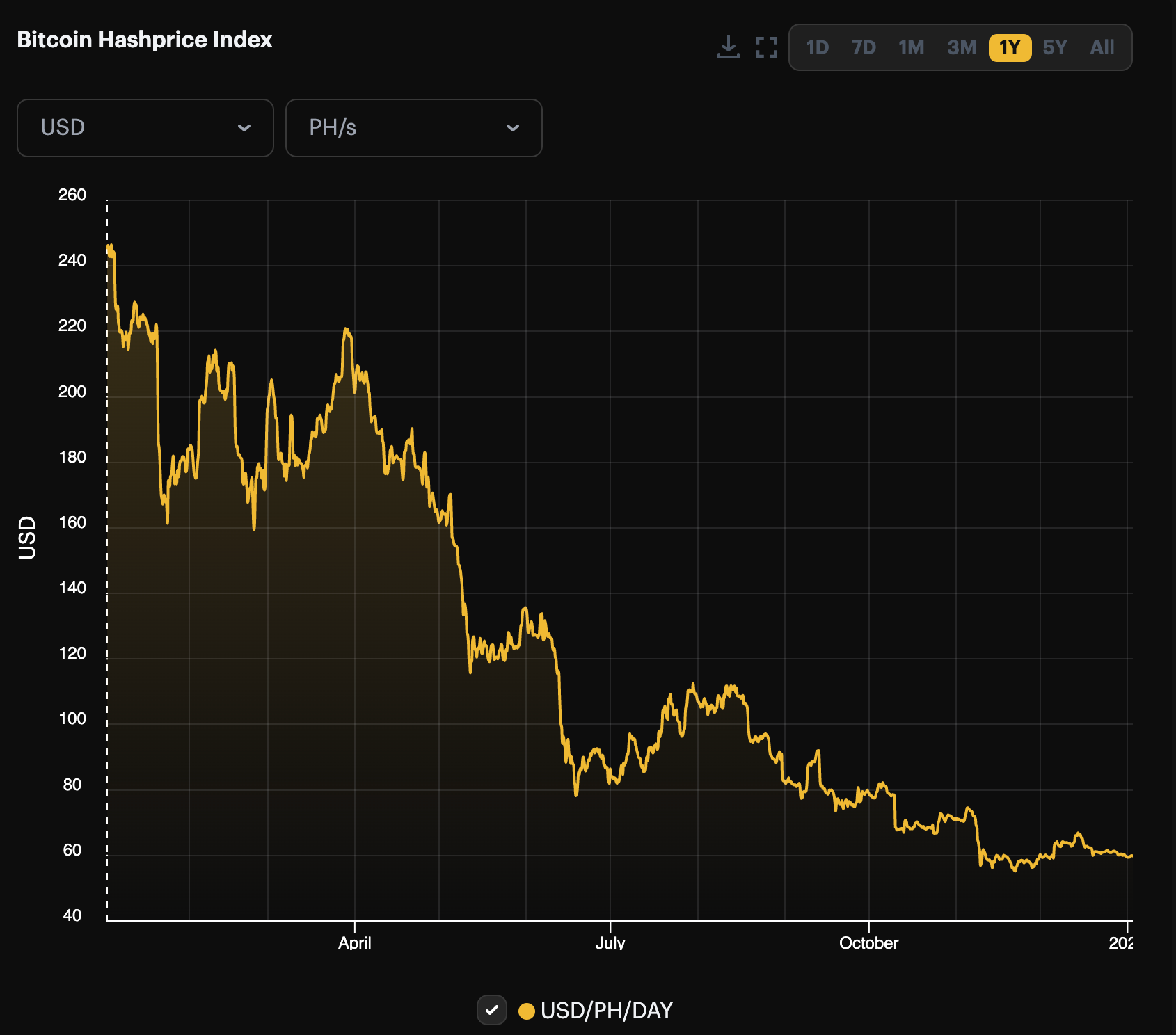

2023 will likely see the opposite trend emerge. As new build-outs finally come online, hosting providers will compete for clients in a much more adverse market environment (hashprice is currently $60/PH/day, compared to 2021 and 2022’s average of $315/PH/day and $124/PH/day, respectively). Moreover, the breakeven cost of a 100 TH/s S19j Pro is $0.082/kWh at current hashprice levels, so many miners higher up the cost ladder are already operating at neutral or negative margins. If hashprice drops further from here – and we expect it will – miners, even with average power/hosting rates, will face breakeven costs or negative margins.

Given the abysmal state of mining economics and the influx of competition, hosting providers will need to lower their costs to remain competitive in 2023. Those hosts who can’t or haven’t negotiated low enough power rates to maintain their own margins will struggle in 2023’s adverse market environment.

5. Cost minimization will be the name of the game in 2023

The profit margin of bitcoin mining has become so slim that miners are heavily incentivized to reduce costs. In 2023, miners will do their best to lower operational expenses.

Electricity is the most significant part of a miner’s operational cost structure and will naturally be the top priority to minimize. Miners can lower their electricity costs by setting up operations close to stranded energy sources, helping balance the grid, or selling excess heat. This bear market will force miners to become more sophisticated in how they consume electricity.

In addition to lowering their all-in electricity prices, miners will attempt to get more hashrate per unit of electricity consumed by improving the efficiency of their mining rigs. The miners with good access to capital will switch their older machines to newer models like the Antminer S19 XP. Others will underclock machines to improve efficiency.

While electricity is the most crucial cost component to minimize in the long term, lowering administrative costs is the most significant immediate potential for cost minimization in the bitcoin mining industry. Many bitcoin miners, particularly the public ones, have seen their administrative costs implode over the past two years as the rapid growth during the bull market didn’t incentivize prudency. These companies will now lower executive compensation and other administrative expenses.

6. ASICs will become dirt cheap, but next-gen machines will keep commanding a premium

ASIC prices are low compared to where they were at the peak of 2021 or even at the beginning of 2022. But they’re not low enough, and in 2023, they’re going to go lower (unless, of course, Bitcoin’s price goes on a run to the upside).

Even at current prices, an S19j Pro at $0.06/kWh would take 925 days to ROI (and that’s the expected ROI at the current hashprice, so the timeframe will only increase if hashprice declines from here).

In light of these difficult market conditions, next-generation machines like the S19 XP are commanding a premium to new-gen rigs.

7. Many miners will struggle with achieving sufficient up-time as electricity prices stay high

This year we have seen substantial hashrate volatility as American miners have adjusted the uptime of their machines based on rapidly fluctuating electricity prices. The hashrate first dropped substantially during the summer, as heat waves in the United States led to soaring electricity prices that forced many miners to turn off their machines. The same thing happened in December but was caused by freezing weather, not a heat wave.

At the current depressed hashprice levels, the break-even electricity price of mining is nearing historic lows at around $0.1 per kWh with the Antminer S19 XP. This low break-even electricity price means that even in electricity markets with generally cheap electricity, spot prices will often fluctuate above the mining break-even, forcing miners to turn off machines.

In addition, electricity prices are relatively high in most markets globally. Some miners operating in electricity grids with relatively high prices will likely be forced to turn off their machines more often than they desire, thereby reducing their bitcoin production per EH/s. For those following bitcoin mining stocks, the comparative analysis of bitcoin produced per EH/s will become increasingly relevant.

8. Regulators in certain jurisdictions will keep targeting the bitcoin mining industry

The regulatory pressure on the bitcoin mining industry got tighter in 2022. Some US states and Canadian provinces enacted various moratoriums on bitcoin mining to prevent the industry from gaining a foothold. On the US federal level, we saw some politicians engaging in saber-rattling against bitcoin miners, but most regulatory attacks happened on the state level.

We will likely continue seeing certain US states and Canadian provinces imposing new mining bans. Regulators in one state will learn from their colleagues in other states, meaning that the current mining bans in certain states and provinces could spread to other jurisdictions. A common factor among the US states that have enacted mining moratoriums is that they are Democratically-governed.

It’s unlikely we will see any new regulation on the federal level in the US and Canada in 2023.

9. Miners will work on strengthening their balance sheets

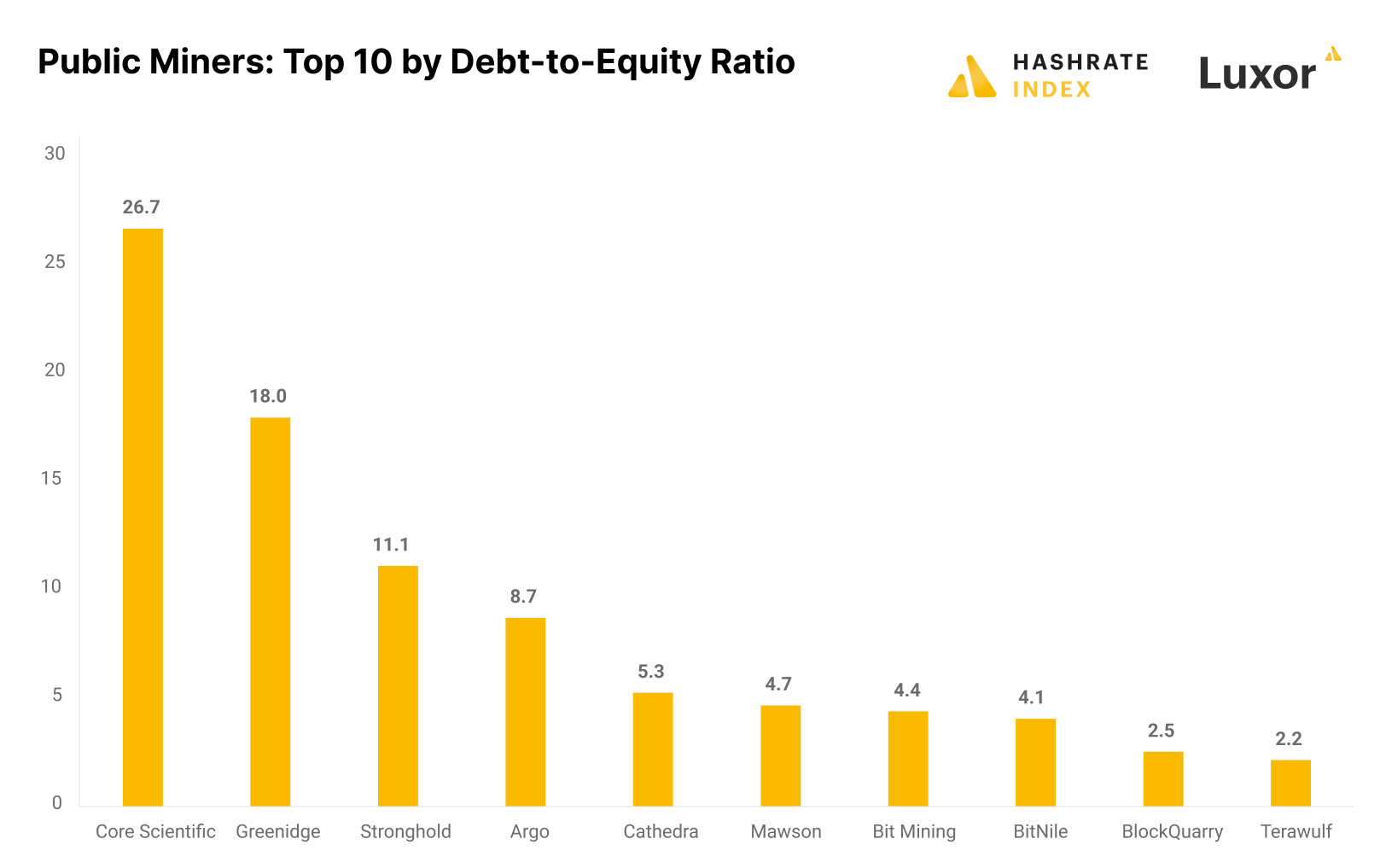

2023 will be a year of restructuring in the bitcoin mining industry. Many companies, especially some of the public ones, have dangerously high levels of debt relative to equity and exceptionally high debt service payments relative to operating cash flows.

The unsustainable debt levels of some companies leave debt restructuring as their only option. Debt restructuring can imply negotiating lower interest rates or extending the due dates of the debt. If the financial situation of the company is particularly bad, the debt can be turned into equity. Many bitcoin miners are in such a poor financial state that this is their only other option than bankruptcy. Core Scientific is an example of a miner going this route.

Another way to strengthen a balance sheet is simply selling assets and using the proceeds to pay down debt. Argo recently undertook this procedure, selling its flagship mining facility to reduce debt. Strengthening balance sheets will be a top priority for bitcoin miners in 2023 as they fight to avoid bankruptcy.

10. Miners will increasingly utilize Bitcoin mining derivatives to protect volatile revenues

2022 proved how critical risk management is for bitcoin miners. Except during the peaks of the bull markets, bitcoin mining is an ultra-competitive, low-margin business. This means that protecting cash flows is exceptionally important for the long-term success of a bitcoin mining operation.

After the traumatic bear market of 2022, miners will become more sophisticated with risk management in 2023. A proper risk management strategy is holistic and consists of optimizing the treasury as well as hedging revenues and costs with derivatives. Until recently, miners have had the possibility of hedging most treasury and cost components but not the revenue. This changed in late 2022 when Luxor launched its hashprice non-deliverable forward contract, allowing miners to sell their future hashrate for a specific hashprice.

In 2023, we will see a trend commencing of miners seeking to hedge everything that can be hedged, just like what is expected in more mature commodity-producing industries.

Conclusion

2022 was a shocking year for bitcoin miners that were suddenly forced to adapt to a new and depressing reality. As the shock has hopefully gone away, miners can embrace the prudence that will be the theme of bitcoin mining in 2023.

This year, miners will prioritize improving the health of their operations by strengthening their balance sheets and minimizing costs. Cost minimization efforts will lead some public miners to merge or go private. Some miners will be forced to restructure their balance sheets, including selling assets to pay down debts or turning debt into equity.

Part of the prudence megatrend that will shape bitcoin mining in 2023 is increasingly sophisticated risk management. Miners will seek to protect cash flows by hedging electricity prices and selling hashprice NDF contracts.

They say that hard times create strong bitcoin miners. We believe this old wisdom is correct, as the industry will rise from the ashes stronger than ever.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.