Timing the Market: Bitcoin Mining ASIC ROIs in 2022

Timing the ASIC market beats time in the market - at least it has in 2022. This article discusses how machine prices have developed over the past year and shows the return differences between purchasing machines on different dates.

Bitcoin mining is a cyclical and capital-intensive industry. Historically, the most significant factor determining investment returns in such sectors is the timing of the capital asset purchase. Being an efficient operator is still extremely important, but purchasing ASICs at elevated prices will still render highly-efficient miners unable to recoup the investment.

This article analyzes how big of an effect the timing of the ASIC purchase has on the investment return. I also explain how ASICs are priced and estimate future ASIC price developments.

How are ASICs priced, and which factors affect their price?

An ASIC’s sole purpose is to generate hashes. Therefore, the price of such a machine is based on its hashrate and energy efficiency. Hashrate Index provides the ASIC Price Index, showing how the prices of ASICs of various energy efficiencies have changed over time. According to the index, the average price of the most energy-efficient ASICs is currently $20 per TH, meaning that an Antminer S19j Pro (104 TH/s) costs around $2,000.

An ASIC’s market value per TH is closely related to the market value of hashrate – the hashprice. This metric is a miner’s expected daily revenue per unit of hashrate. According to the Hashprice Index, the current hashprice per TH/s is $0.0584, giving an Antminer S19j Pro (104 TH/s) a daily revenue of $6. The beauty of the hashprice is that it captures all the variables determining mining revenues: the difficulty, the block reward, and the bitcoin price.

Like any cash flow-generating capital asset, an ASIC is priced based on its cash flow-generating potential in its lifetime, which is almost solely determined by the hashprice. Therefore, ASIC prices and hashprice are highly correlated.

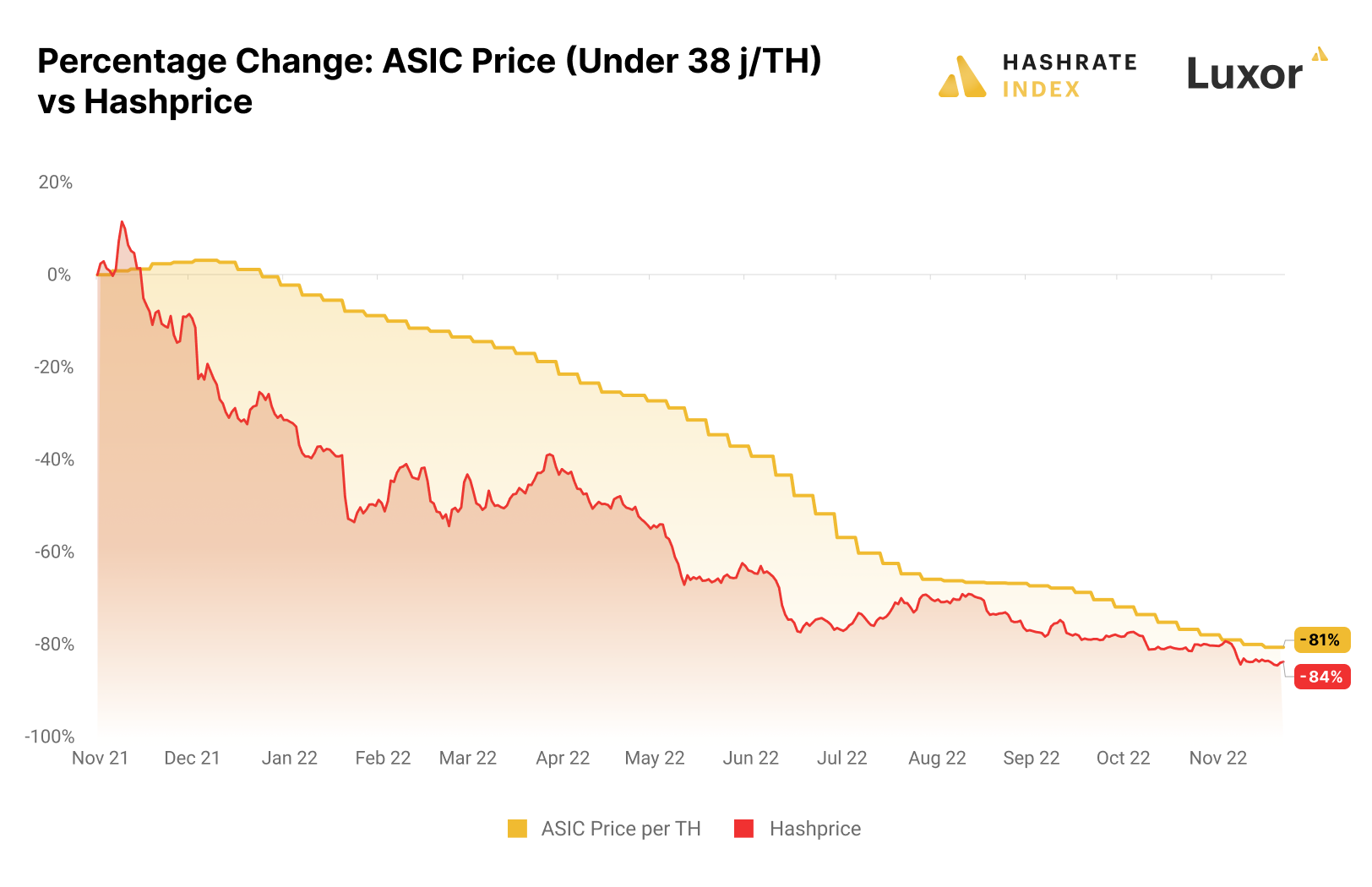

The chart above shows the development in ASIC prices and hashprice over the past year. We see how the ASIC price closely followed the hashprice, albeit with a lag. The falling bitcoin price and rising difficulty led hashprice to plummet from November to February. During this period, ASIC prices stayed relatively flat since the appetite for deploying vast amounts of capital into machines was still high.

From May to August, machine prices steeply fell as the evaporating mining cash flows finally led to lower machine demand, forcing the market to reprice machines. After this tumultuous year, ASIC prices are down by 81%, while the hashprice has dropped by 84%.

You may wonder how the market prices ASICs. A simple way to estimate the intrinsic value of an ASIC is by picking a target payback period and then calculating whether the machine will generate sufficient cash flow to recoup the investment during this period.

Historically, energy-efficient ASICs have been priced at a payback period in the 12 to 24 months range. Let’s look at an example of calculating the intrinsic value of an Antminer S19j Pro (104 TH/s) using a target payback period of 12 months. Such a machine paying $0.05 per kWh will generate $6.1 per day in revenue and expense $3.7 of energy, giving it a daily gross margin of $2.4. We then multiply this daily gross margin by 365 days and get a yearly gross margin of $876, which would be the maximum price you would be willing to pay for this machine at a target payback period of 12 months.

The current market price of such a machine is around $2,000, implying a payback period of 27 months. Given your aggressive 12-month payback target, you would decide not to invest in this machine at the current price.

Timing the ASIC market beats time in the market – at least during the past year

With the ASIC pricing theory from the previous section in mind, let’s analyze the return of ASIC purchases on different dates during the past year.

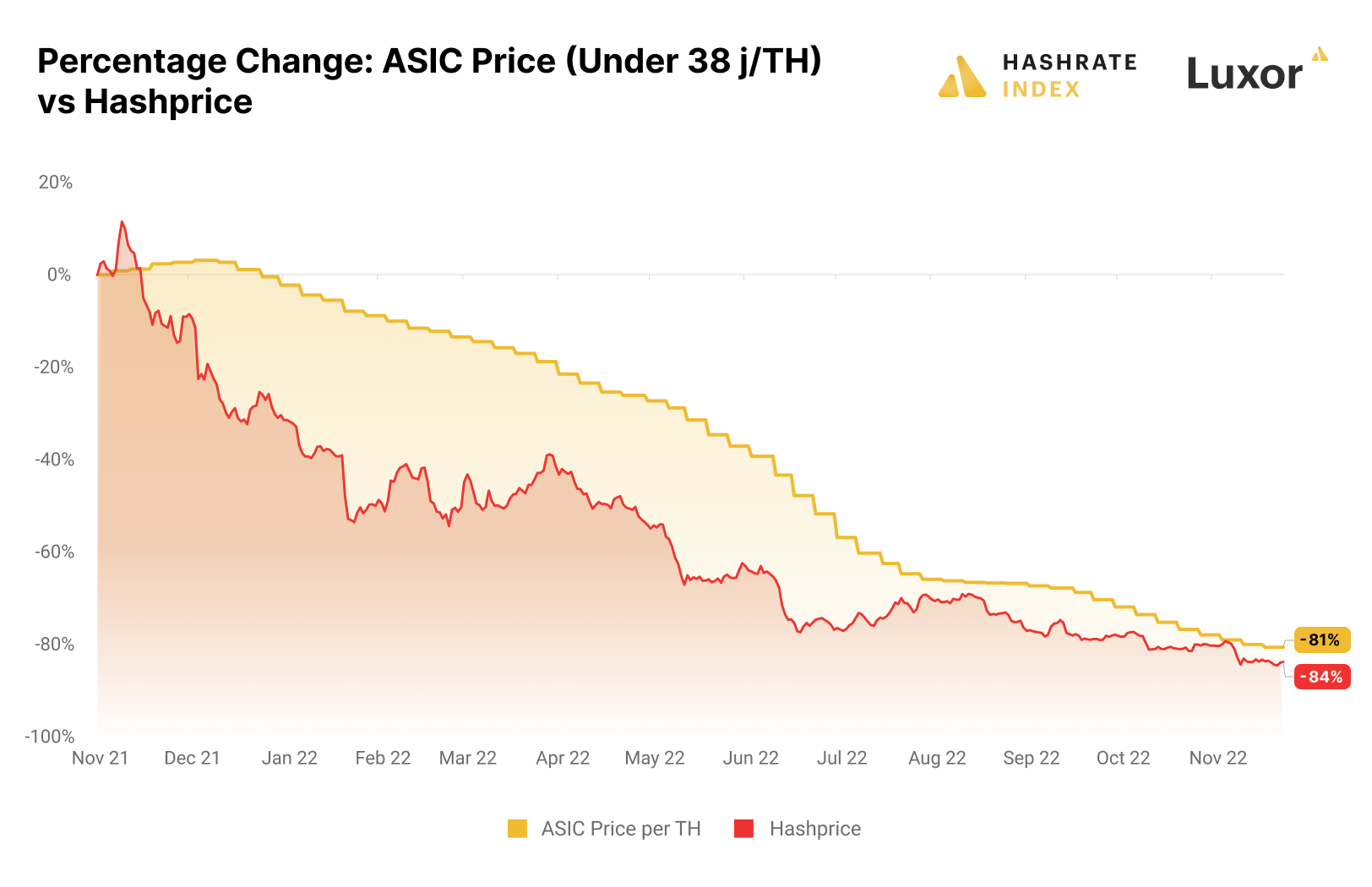

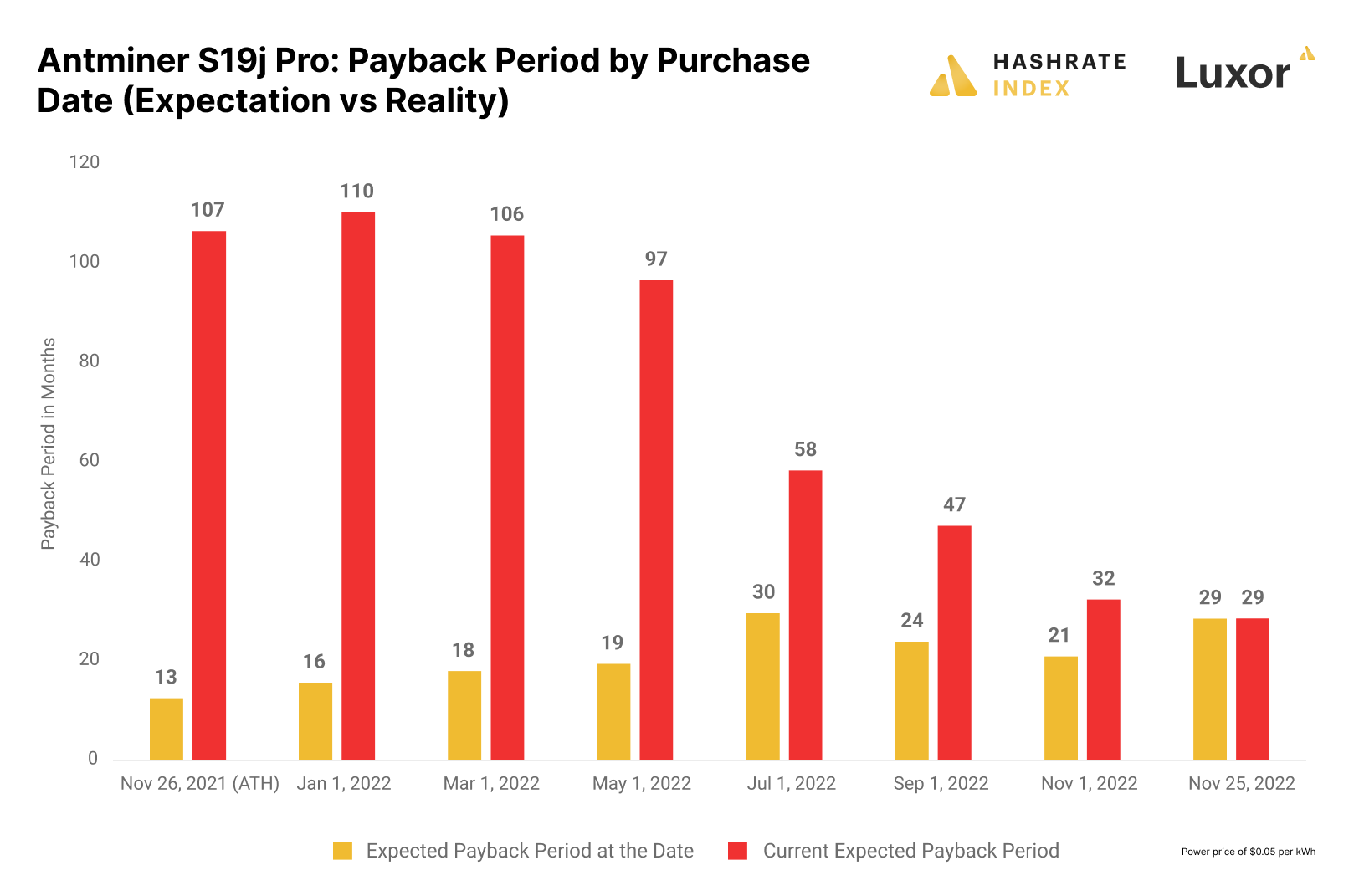

The chart below compares payback periods for the purchase of an Antminer S19j Pro on various dates during the past year. It shows the expected payback period at the date of purchase and the current, updated expected payback period.

During the height of the bull run in November 2021, an Antminer S19j Pro cost around $11,000. Even though the machine price was high, the expected payback period at the time was only 13 months due to the highly profitable bitcoin mining environment. In late November, this machine spent approximately $4 worth of electricity ($0.05 per kWh) to earn $33 per day, giving it a daily gross margin of $29. Bitcoin mining machines literally printed money, and people were willing to pay big bucks for them.

Those who paid big bucks for ASICs at the peak probably regret their decision. The once-promising payback period of 13 months has grown to 107 months, as the daily gross mining margin has fallen from $29 to $2.4. Given current mining economics, a miner who bought the top will not recoup its investment until 2030.

As we can see, miners who bought machines from January to May also look at extremely long payback periods, making it highly uncertain whether they will recoup their investments. The reason is that the ASIC prices didn’t fall that much in the first few months of 2022.

As shown in the previous section, ASIC prices fell steeply during the summer. Investors purchasing machines during and after this price decline are much better positioned than those who bought at the start of the year. July purchasers are looking at an expected payback period of 58 months (5 years), while September buyers are at 47 months (4 years). Even though it surely could be worse, these payback periods are still long for rapidly depreciating assets like ASICs.

Unsurprisingly, the best time to buy an ASIC this year is right now. The expected payback period is 29 months, which is still relatively high historically. Interestingly, the expected payback period of an ASIC purchase is now more than twice as high as the expected payback period on November 26th, 2021. This is due to the bloated and unsustainable mining economics at that time, which we will come back to in the next section.

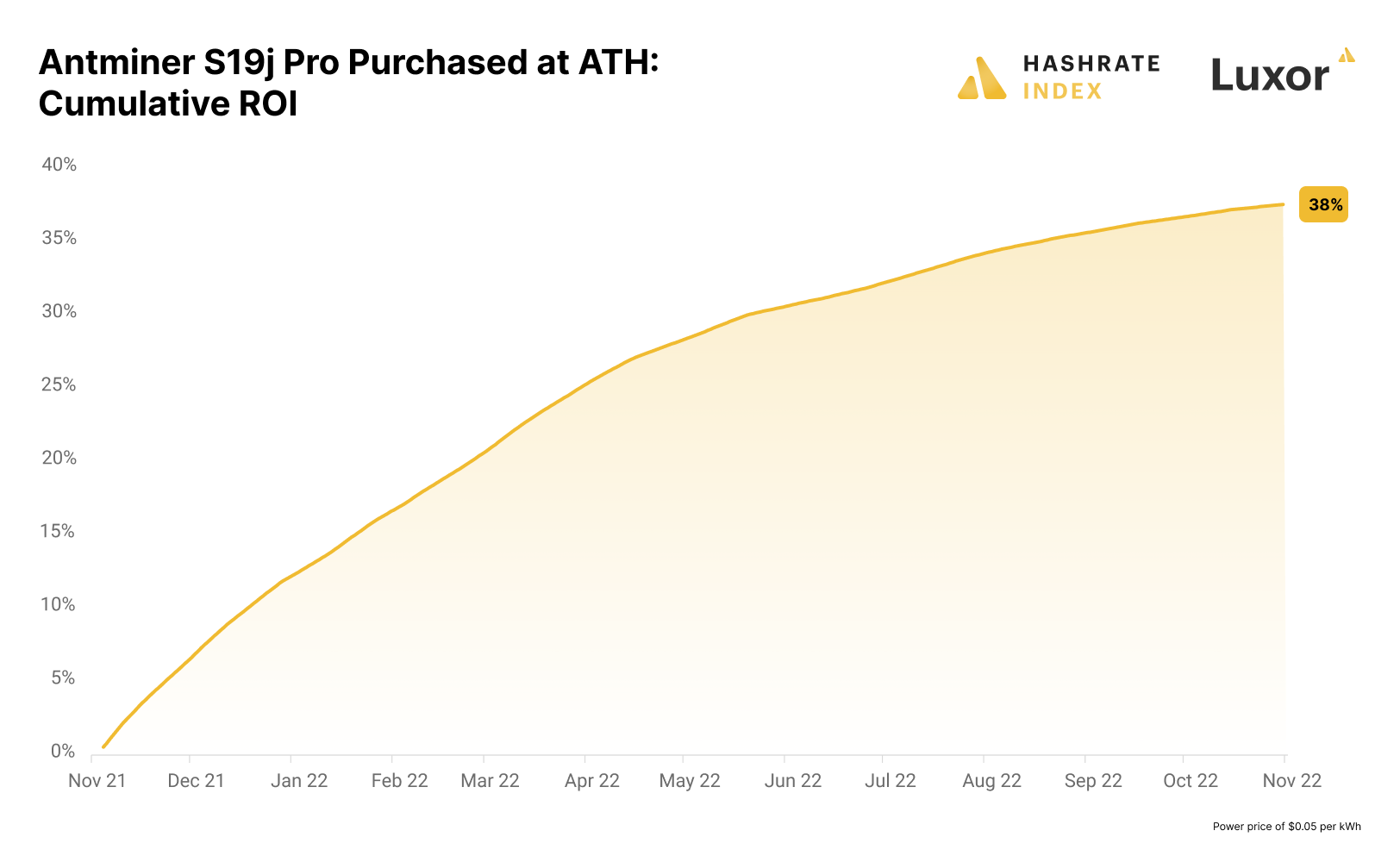

To give some additional perspective on the significance of timing the ASIC market, I have included a chart showing the return profile of an Antminer S19j Pro purchased in November 2021. We see how the high mining margins at the beginning of the period led to an initial rapid return on investment. As the mining margins fell throughout the year, the rate of return gradually declined. Currently, only 38% of the machine investment has been recouped.

The name of the game in late 2021 was to buy ASICs no matter your power price

The extreme mining gross margins in late 2021 made it profitable to mine bitcoin at a relatively high power price. These economic conditions incentivized miners to invest heavily in ASICs and plug them in as quickly as possible.

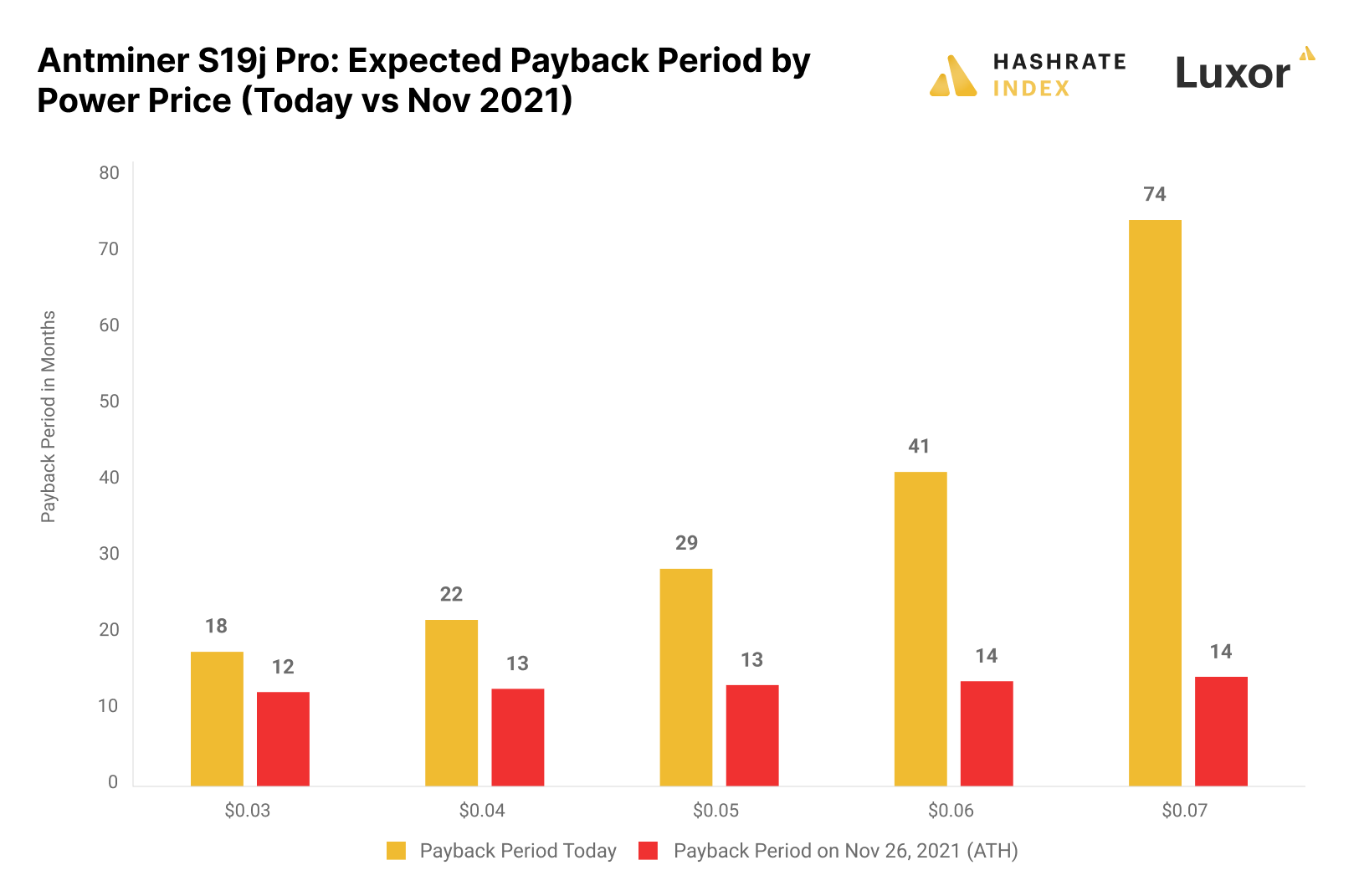

This chart compares the expected payback periods of an Antminer S19j Pro purchase in November 2021 and now. As you can see, for a machine purchased in November 2021, the electricity price almost didn’t affect the payback period. Going from $0.03 to $0.07 per kWh only increased the payback period from 12 to 14 months. Meanwhile, if you made a similar machine purchase now, the difference between $0.03 and $0.07 per kWh is a massive increase in the payback period from 18 to 74 months.

The payback period’s minimal sensitivity to the power price in November 2021 indicates that the ASIC market was overheated at the time. When mining economics are so bloated that miners are willing to plug in ASICs at almost any power cost, it’s a strong signal that the market conditions have gone too far in one direction, and correction might be near. Miners who bought ASICs in November 2021 bet on a continuation of the bitcoin bull run, as that would be the only thing that could keep mining profitability elevated.

It’s rarely profitable to buy an asset in a hot market. The most successful investors are the contrarians who invest when prices are suppressed. Such investors will probably be more inclined to invest in ASICs now as the industry has been forced into prudence as the game has shifted from maximizing capital investments to minimizing operational expenditures.

Historically, the best point to buy an ASIC is when the expected payback period is low while mining economics are tight. Gross margins of 90%, which we saw in November 2021, are unsustainable and can only go one way: down. When margins inevitably fall, machine prices also decline.

Comparatively, buying an ASIC during tight mining margins means there is room for margin expansion, which would lead to a considerably faster payback period. If the ASIC simultaneously is priced at a low payback period multiple, the investment will have a high likelihood of being profitable.

How could ASIC prices develop going forward?

As I showed earlier in the article, ASIC prices are heavily correlated with the hashprice. Therefore, estimating future ASIC prices is a function of predicting the hashprice. The hashprice will keep trending down as long as the bitcoin price doesn’t increase. The reason is that the hashrate will likely keep growing well into 2023. The falling hashprice will lead ASIC prices to contract further.

In addition, the current implied payback period in the ASIC market is relatively high, meaning machine prices could keep falling even if the hashprice stays flat due to multiple compression. A more normal 18-month payback period at today’s mining economics equals a price per TH of approximately $13, which implies a 35% downside from today’s $20 per TH.

There is also an oversupply of machines which I don’t believe has fully impacted the market yet. Many miners are struggling heavily; some have even defaulted on machine-collateralized loans forcing their lenders to seize machines. The supply shock of miners and lenders dumping machines could put significant downward pressure on the ASIC market in the coming months.

Due to these factors, I think ASIC prices will keep falling considerably.

Conclusion

Bitcoin mining is a cyclical and capital-intensive business where the timing of ASIC purchases matters more than most people realize. No matter the efficiency of the operation, purchasing ASICs at elevated prices has historically been the most significant destructive force for bitcoin mining capital.

The simplest way to price ASICs is by looking at their implied payback periods. ASICs rapidly depreciate, meaning investors should aim to recoup their investments quickly. Historically, the ASIC market has implied payback periods of 12 to 24 months. Payback periods outside these ranges may signal that the market is under or overvalued.

It’s still essential to know that when mining economics are unsustainably high, payback periods will look artificially low. Super profitable periods usually don’t last long, and payback periods will significantly increase when they come down. We saw this happen during 2022, as those who bought ASICs during the peak in November 2021 painfully experienced.

ASIC prices have dropped by more than 80% over the past year. This may lead many contrarian miners to want to invest in these machines. Although machines are much cheaper than before, they will likely keep dropping due to growing difficulty, multiple compression, and struggling miners potentially flooding the market with machines.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.