Hashrate Index Roundup (August 19, 2024)

Bitcoin and mining economics trend steady over the week.

Hello world, happy Monday!

Bitcoin trended flat throughout the past week, decreasing by a mere 0.5% from $59,360 to a current price of $59,030. Price action seems to have normalized since the recent downturn of ~18% caused by macroeconomic conditions; spot prices are oscillating around $59,000 compared to a local low of ~$54,000 a few weeks ago.

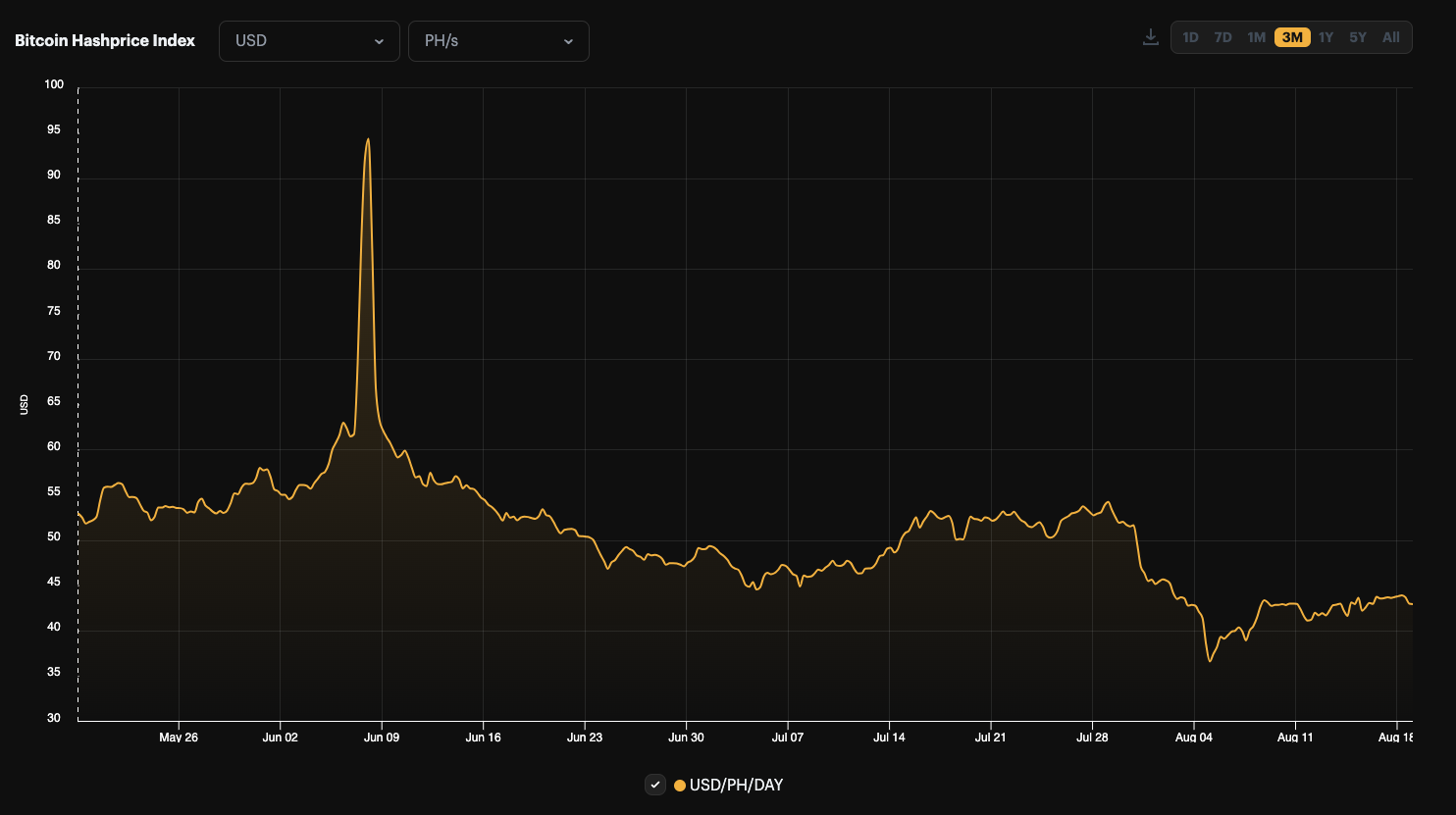

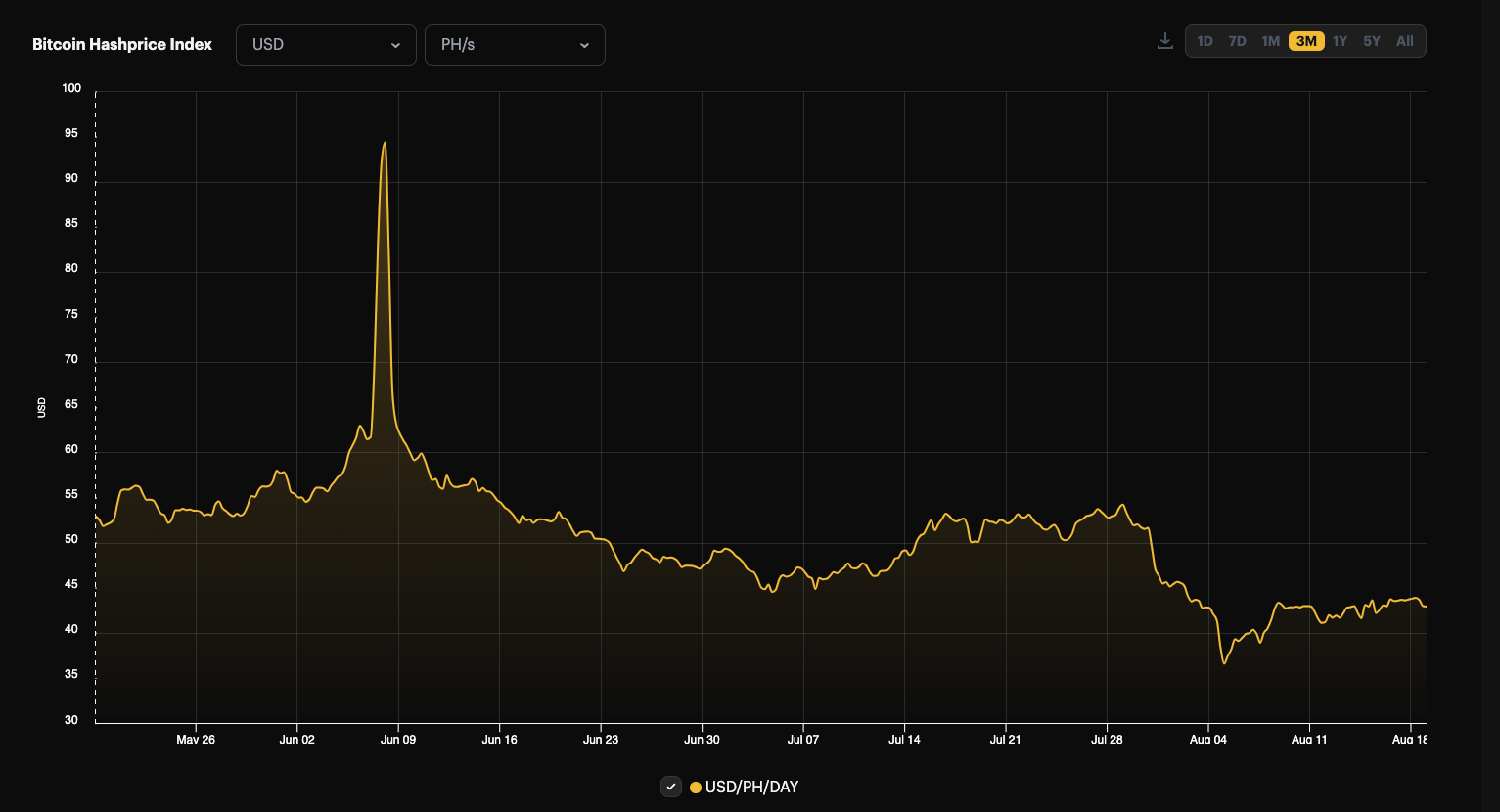

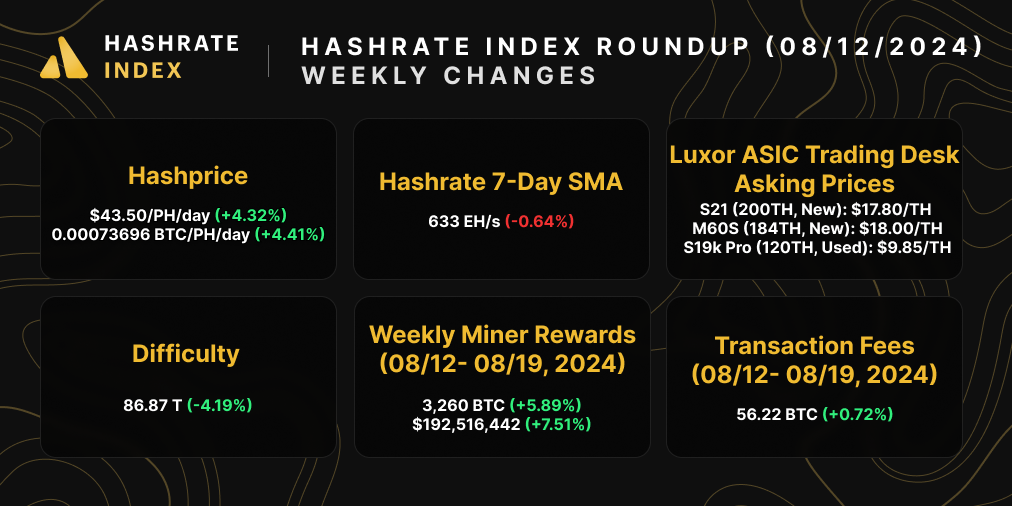

Hashprice also trended flat throughout the week, increasing by ~4.32% from $41.70/PH/Day to $43.50/PH/Day, at the time of writing. A mild improvement in week-to-week profitability, however mining economics remain compressed when zooming out to a wider timeframe. Hashprice has decreased by ~19% over the past three months, demonstrating the stress-test placed on miners through the halving event.

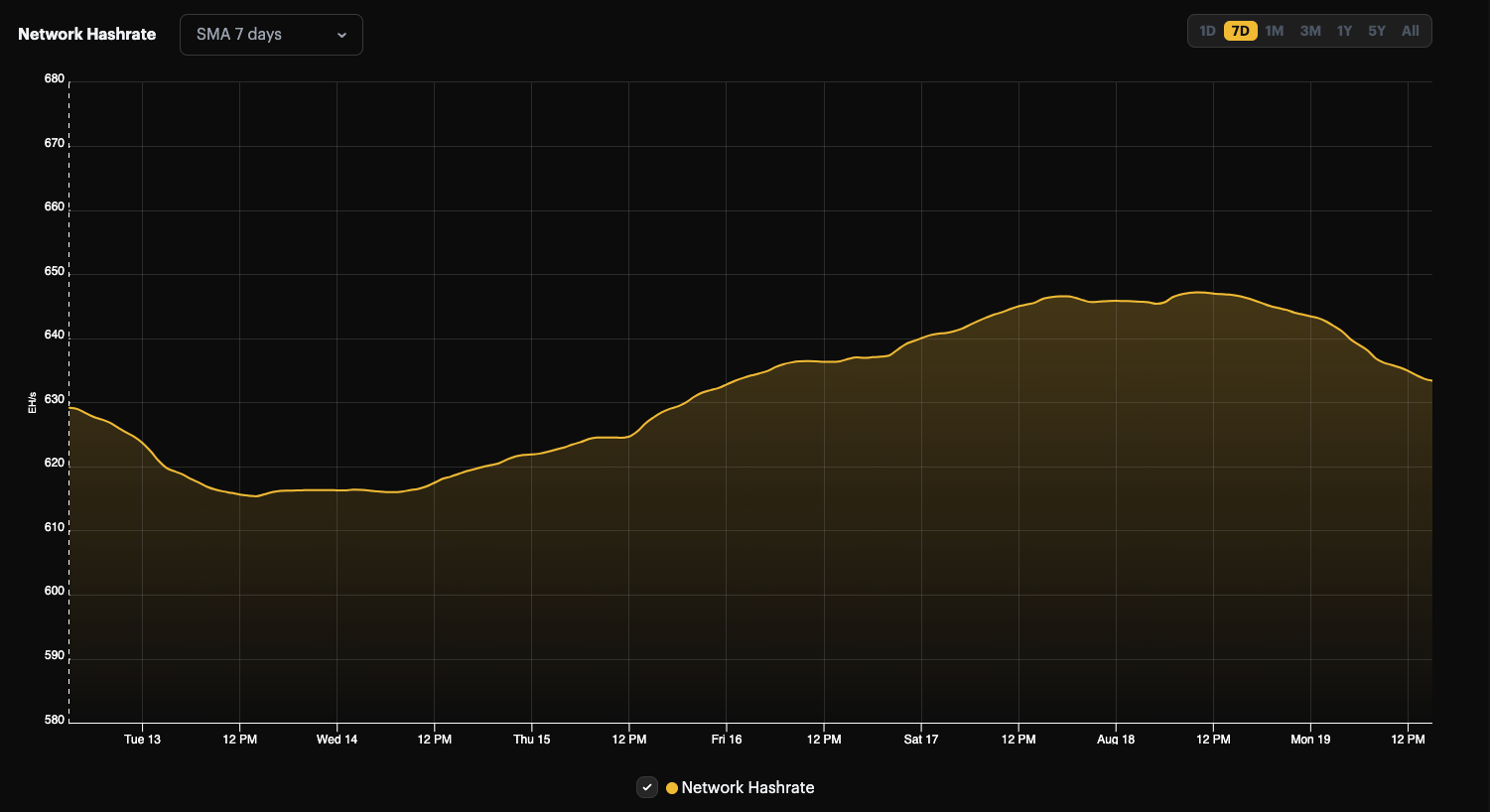

Beyond price action in Bitcoin and hashprice, global network hashrate oscillated by ~0.64% throughout the week, as the 7-day simple moving average (SMA) network hashrate increased slightly from 629 EH/s to a current 633EH/s, at the time of writing.

Coupled with a downward difficulty adjustment of ~4.19% on August 14th, the mild increase in hashrate led to slightly faster blocks at an average block time of around 9 minutes 38 seconds throughout the week. We estimate an increase in difficulty of ~3.66% for the upcoming adjustment, expected to occur on August 28th. Block times may slow down over the coming days, as Texas-based miners curtail operations in line with ERCOT’s 4CP program.

Sponsored by Luxor Firmware

At $43/PH/Day, hashprice is close to – or at – breakeven for many miners depedning on operating cost and machine model type. Improve the hashrate and efficiency of your S19 and S21 series rigs by downloading LuxOS firmware today!

Luxor Hashrate Forwards Market Update

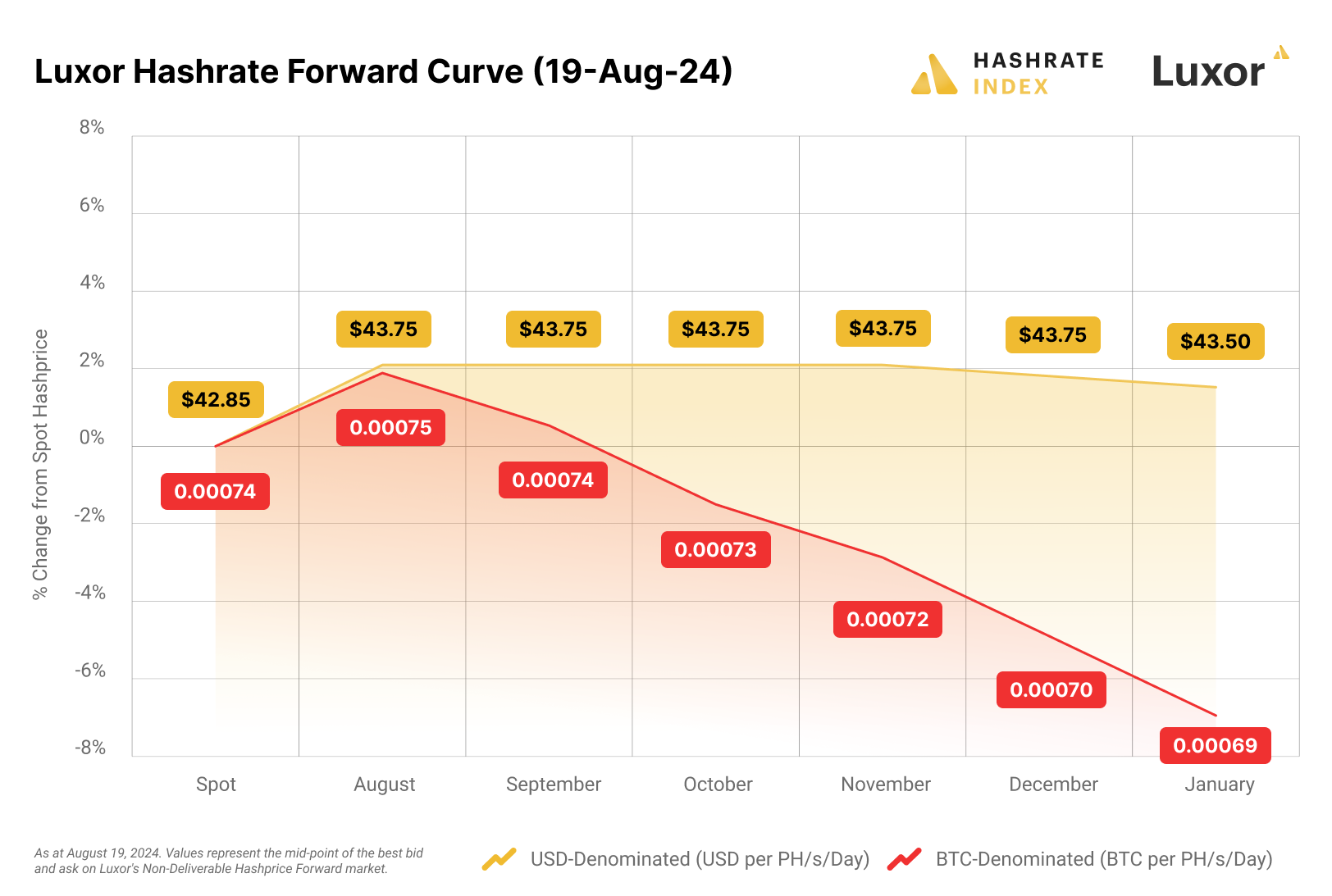

For this week's Hashrate Forwards market update, USD contracts are trading in contango and BTC contracts are trading in backwardation. Miners can lock in a ~$43.75 hashprice for up to six months into the future.

Bitcoin Mining Market Update

A flat trend for this week's update. Bitcoin, hashprice, and hashrate all remained relatively stable. Miners collected a total of ~3,260 BTC in rewards, equivalent to ~$192.5 million.

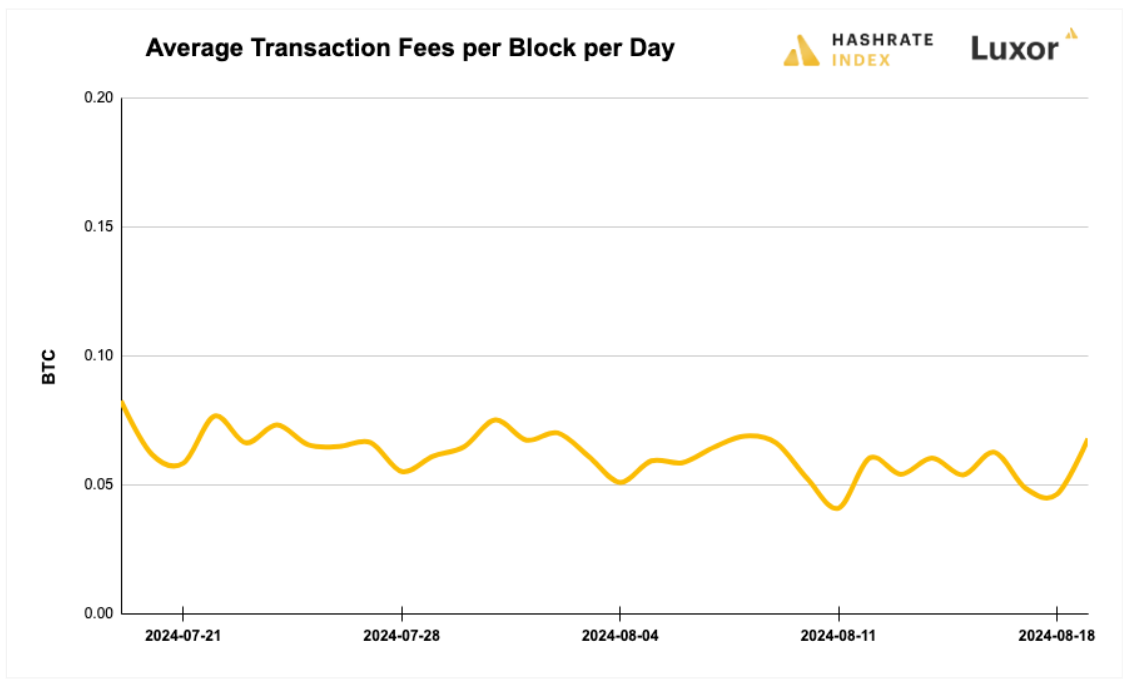

Bitcoin Transaction Fee Update

Transaction fees continue to trend down slightly. Over the past week, Bitcoin miners collected an average of 0.0552 BTC per block per day in transaction fees, a 5.96% decrease from the prior week's 0.0587 BTC.

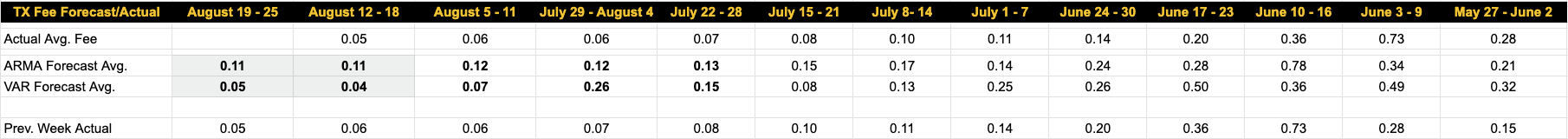

Our transaction fee projection models remain bearish as we expect a low-fee, low-volatility environment to persist. For this week, our VAR model forecasts 0.05 BTC per block, and the ARMA estimates 0.11 BTC.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- Bitcoin Mining Profitability Fell to All Time Lows in August, JPMorgan Analyst Says

- IMF proposes 85% power tax hike on crypto and AI data centers

Bitcoin Mining Stocks Update

Bitcoin mining stocks bounced back throughout the past week, reflecting a 9.03% increase in our Crypto Mining Stock Index.

5-day changes to Bitcoin mining stocks as of prior week's market close:

- RIOT: $7.99 (+2.04%)

- HUT: $11.54 (-0.86%)

- BITF: $2.39 (+6.22%)

- HIVE: $3.05 (+6.27%)

- MARA: $16.24 (+1.18%)

- CLSK: $11.84 (+6.67%)

- IREN: $7.97 (+8.58%)

- CORZ: $10.09 (+5.10%)

- WULF: $4.03 (+8.34%)

- CIFR: $3.84 (-4.95%)

- BTDR: $6.46 (-15.22%)

- SDIG: $2.61 (-4.90%)

- FUFU: $4.92 (+9.82%)

Have a great week, and Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.