Hashrate Markets Lookback Series - January 2025

January 2025’s hashrate and hashprice trends, forward market participation, trading activity and contract performance.

Luxor’s Monthly Lookback Series is a deep dive into Bitcoin hashrate market activity. In this post, we cover January 2025’s hashrate and hashprice trends, forward market participation, trading activity and contract performance.

Summary

Blocks were slow: The Arctic blast in January 2025 led to a surge in natural gas demand and power prices across the U.S., particularly in Texas and the Southeast. This resulted in increased curtailment of mining operations, contributing to reduced hashrate and the first drop in network difficulty since September 2024.

Fees are Low: In Bitcoin terms, monthly average transaction fees per block dropped in January to their lowest level since April 2012. In USD terms, the average transaction fees per block in January was $4,596 – roughly in line with average fee collection observed in Q3 2024.

Hashrate Hedging: USD denominated contracts benefited long positions, while BTC denominated contracts favored hedgers. The best strategy for miners in January was to hedge network difficulty and transaction fees by selling in the BTC denominated hashrate market and maintaining long exposure to Bitcoin.

Hardware Headwinds: U.S. tariffs on imports could increase the cost of mining hardware, potentially reducing future hashrate growth.

January 2025 Hashprice & Its Constituents

In January, Bitcoin's monthly average price and network difficulty reached new all-time highs for the third consecutive month. However, monthly average transaction fees in Bitcoin per block dropped to their lowest level since April 2012, nearly 13 years ago. On the whole, the average USD hashprice declined by 3% month-over-month.

Similar to December, Bitcoin price action was range-bound between $93,000 and $105,000 throughout January. Bitcoin began the month at just below $94,000, marked a low of $92,991 on January 13th, and ended the month at $104,000 after a high of $105,099 on January 30th. Bitcoin’s daily average price for the month was $99,964, climbing 1.6% from December’s $98,371.

While Bitcoin's network difficulty reached an all-time high on a monthly average basis, it actually declined over the course of January. Difficulty began the month at 109.78T, rising 0.61% to 110.45T following an adjustment on January 12. However, a -2.12% adjustment on January 26 — the first negative adjustment since September — brought difficulty down to 108.11T, resulting in a total monthly decline of 1.5%.

The decline in network hashrate — and consequently, difficulty — was driven by lower temperatures, rising power prices, and increased miner curtailment in the U.S. In January, Arctic air swept across the country, causing a sharp drop in temperatures from the Midcontinent to the Southeast. The cold front brought freezing conditions and even rare snowfall to regions like Texas and the Deep South.

The January 2025 Arctic blast sharply increased U.S. natural gas demand for heating and power. Storage withdrawals reached 258 billion cubic feet (Bcf) for the week ending January 10 — more than double the five-year average of 128 Bcf. Natural gas prices surged (particularly in the Northeast) with daily rates at Algonquin Citygate and Transco Zone 5 exceeding $30/MMBtu, reflecting strains on supply from the cold snap.

Natural gas plays a vital role in powering much of the U.S., meaning higher natural gas prices directly translate to higher electricity costs. During cold snaps, power demand surges as households rely more on electric heating. At the same time, winter storms can disrupt power generation — wind turbines may freeze, solar panels can be buried under snow, and thermal plants risk outages if not properly winterized.

Rising fuel costs, higher demand, and reduced supply drove up power prices across Central and Eastern U.S. markets. Texas, SPP, MISO, and PJM all experienced significant increases in average real-time prices during the January 13th - January 26th mining epoch.

Higher power prices led to more uneconomic mining hours, as cold weather drove up energy costs and reduced mining uptime (particularly in the East, Southeast, and Texas).

The chart below presents Luxor’s estimates for uneconomic mining hours (i.e., periods of negative gross mining margins) based on real-time power prices, hashprice, and hardware efficiency.* The sharp rise in uneconomic mining hours — given that the U.S. and Texas account for an estimated 36% and 17% of global hashrate, respectively — was a key factor in the decline in difficulty. We expect this trend to reverse as temperatures, power prices and mining uptime return to baseline.

*25.4 J/TH assumption based on Luxor’s estimate of the global network’s overall efficiency.

After a weak second half of 2024 for transaction fees, the trend continued into the new year. In BTC terms, transaction fees per block averaged 0.046 BTC — a 47.3% drop from December and the lowest monthly level since April 2012, nearly 13 years ago.

In USD terms, transaction fees weren’t as bad, however still disappointing. Adjusting for the monthly average Bitcoin price, the average transaction fees per block in January was $4,596 – roughly in line with average fee collection observed in Q3 2024.

With a fixed block supply, transaction fees are determined by demand for Bitcoin blockspace. In January that demand, measured by total on-chain transactions and mempool size, returned to pre-Ordinal/BRC-20/Runes levels (i.e., January 2023). In fact, on February 1st, the mempool cleared for the first time since April 2023.

The slight break in network difficulty growth coupled with the continuation of historically low transaction fees had BTC denominated hashprice mostly flat in January. Starting at 0.00058 BTC per PH/s/day, hashprice oscillated around this figure throughout January.

USD denominated hashprice rose in January, mirroring the moves in Spot Bitcoin price. Daily hashprice started the month at $54.45 per PH/s/day, peaked at $61.74 and ended the month at $61.16.

January 2025 Hashrate Market Activity

Our analysis of the January hashrate market focuses on two key points: how the January 2025 hashrate contract traded in previous months and how the forward curve shifted in January based on pricing for forward hashrate during the month.

The two tables below show the evolution of USD and BTC denominated Bitcoin hashrate forward markets throughout August 2024 - January 2025. Rows represent specific monthly contracts, while columns represent each trading month. Cell values indicate the average monthly mid-market price — except for the bold highlighted main diagonal — which shows actual spot hashprice settlement in each month. This table summarizes both the trading history of the January 2025 contract (colored row) and the forward curve in January (colored column).

Note: all values shown in figures represent the midpoint of the best bid and ask on Luxor's Non-Deliverable Hashprice Forward market.

The table below shows the type of market participants on the buy and sell side of Luxor’s deliverable (DF) and non-deliverable hashrate forward (NDF) market. In January, lenders were active on the buy side of the DF market, while public and private miners used the contract to sell forward, receive financing, and expand their fleet.

Since the DF involves upfront payment, it tends to trade at a discount to the NDF to compensate the buyer for the inherent credit risk. We see the discount of DF’s relative to NDF’s as the interest rate in hashrate-based lending markets. Buyers and sellers of the DF with upfront payment can use the NDF to lock-in a fixed yield or cost of capital instead of having exposure to the uncertain and variable returns of hashprice. This strategy was used by lenders (Buy the DF & Sell the NDF) to earn a return and by miners (Sell the DF & Buy the NDF) to obtain non-dilutive financing. In January 2025, that yield or cost of capital was in the 9-13% annualized range.

How January 2025 Hashrate Traded

The contrast between Bitcoin price on the upside and network difficulty alongside transaction fees on the downside continues to play out in the forward market, leading to a third consecutive month of divergent outcomes between USD and BTC-denominated hashrate markets.

In USD hashrate markets, January hashrate settled higher than traded in the prior five months, except for December. Long positions earned a return and hedgers saw a loss in USD terms. In BTC hashrate markets however, January hashrate settled lower than traded in the prior five months: hedgers earned a return whereas long positions saw a loss in BTC terms.

Buyers of the January 2025 USD contract in September saw the highest returns, while late sellers, hedging in November, incurred the smallest losses. Selling the USD contract in December would have earned 3% above spot mining, however, hedgers earned between 8-30% less than spot miners overall. In USD terms, it was best not to be hedged in January and/or buy hashrate from the forward market.

The table below summarizes how a 1 EH mining operation’s USD revenues would have performed, had it sold January 2025 hashrate forward versus mining spot during the month.

In BTC production terms, hedging was the best strategy for Bitcoin miners. If a miner had fully hedged at the average mid-market price in August or September, they could have mined 17% and 12% more bitcoin than those miners which mined at spot prices through January. Those who fully hedged in October, November, and December produced 11%, 3%, and 1% more bitcoin versus spot miners. In BTC terms, it was best to sell early, or conversely, buy late.

The table below summarizes how a 1 EH mining operation’s total Bitcoin production would have performed, had it sold January 2025 hashrate forward versus mining spot during the month.

The best strategy for miners in January was to hedge network difficulty and transaction fees by selling in the BTC denominated hashrate market and maintaining their long exposure to Bitcoin. For those who employed this strategy, it proved successful.

Most public mining companies did not hedge network difficulty and transaction fees in January 2025. The figure below illustrates a hypothetical scenario of how public miners' January Bitcoin production would have differed if they had fully hedged their production back in August.

Note: this figure is strictly for demonstration purposes and based on the simplifying assumption of multiplying actual production figures by the percentage difference between hashrate forward contracts’ locked-in hashprice versus spot hashprice; it excludes fees and bid/ask spreads associated with entering into hashrate forward contracts.

A second caveat: although selling forward proved to be favorable in this instance, it is critical to recognize that hedging is typically a cost of business rather than a revenue generation method. Hedgers willingly pay a price to buy certainty and obtain more predictable cash flows, which increases valuation, reduces cost of capital, and ultimately attracts investments.

How Future Hashrate Traded in January 2025

The two tables below summarize the evolution of Bitcoin hashrate forward markets during January 2025, for the subsequent five months from February 2025 through June 2025. Rows represent specific monthly hashrate contracts, while columns represent specific trading days. Cell values indicate the average daily mid-market price, except for spot prices.

During January trading, both USD and BTC curves traded mostly in backwardation. USD denominated contracts fell over the first half of the month, rose during the third week, and fell back down slightly throughout the fourth week. In contrast, BTC denominated forward hashrate contract pricing was essentially flat.

Given this information, we can use the two contracts (by dividing USD contract values with BTC contract values) to back out implied Bitcoin price expectations expressed by the market:

Like USD hashprice, implied future Bitcoin price expectations fell in the first half of the month, rose during the third week, and fell back down throughout the fourth week. However, implied future Bitcoin prices were in contango.

Combining this information with USD-denominated hashrate contracts being in backwardation allows us to infer the market’s expectation around network difficulty and hashrate: namely that both are expected to grow faster than Bitcoin price and transaction fees.

If we make an assumption around transaction fees, we can calculate the changes in implied difficulty and network hashrate expectations expressed by the forwards market. In the tables below, we assume a 0.05 BTC per block transaction fee assumption on January 6th and February 3rd:

Note: figures assume 0.05 BTC per block transaction fee assumption on January 6th and February 3rd, 2025.

Based on this simplified analysis, we estimate that future hashrate expectations remained relatively stable during the month of January, dropping in the 1-4% range for the February - June contracts.

Looking Ahead and Concluding Thoughts

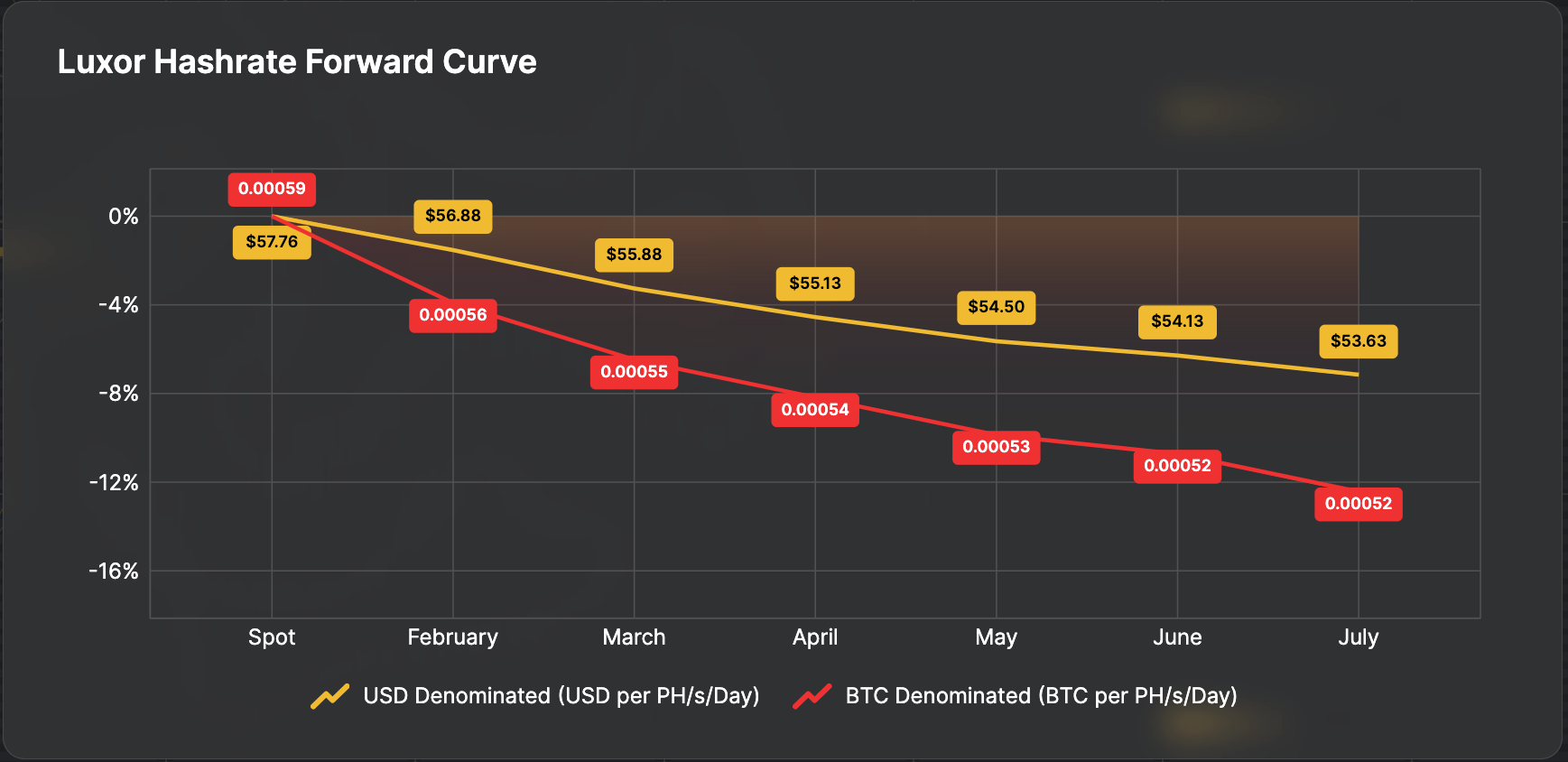

Looking forward, Luxor’s Hashrate Forward Market is pricing in an average hashprice of $55.03 or 0.00054 BTC per PH/s/Day over the next six months. Sellers can currently secure this hashprice while buyers have the opportunity to lock in the same hashcost through to July 2025.

On February 1, 2025, President Donald J. Trump announced the imposition of tariffs aimed at addressing national security concerns. The measures include a 25% additional tariff on imports from Canada and Mexico, with a reduced 10% tariff on Canadian energy resources, and a 10% additional tariff on imports from China.

The implementation of these tariffs may have significant implications for the Bitcoin mining sector. Beyond immediate Bitcoin price fluctuations, the tariffs may have longer-term effects on mining economics. The United States relies heavily on imported mining equipment, particularly from China. The 10% tariff on Chinese goods could increase the costs of acquiring essential hardware, such as ASICs. This rise in operational costs may reduce profit margins for U.S. based mining operations, potentially slowing the growth of mining activity. Conversely, the tariffs may incentivize the development of a domestic manufacturing base for mining equipment, reducing dependence on foreign imports and enhancing supply chain resilience in the long run.

As institutional adoption of hashrate markets continues in 2025, we see miners deploying a key strategy: selling hashrate forward to receive non-dilutive financing for fleet expansion. With durations up to 12 months, Luxor miners can sell forward a portion of their hashrate to receive upfront funds and expand operations immediately. In exchange for upfront payment, miners have two delivery options: fixed hashrate or fixed Bitcoin repayment.

Fixed hashrate repayment refers to the delivery of a specific quantity of Bitcoin mining hashrate to Luxor Pool, for a specific amount of time, in exchange for upfront payment. This is otherwise known as selling a Deliverable Forward (DF) contract.

Fixed Bitcoin repayment refers to the delivery of a specific quantity of Bitcoin through hashrate on Luxor Pool, for a specific amount of time, in exchange for upfront payment. This is otherwise known as selling a Deliverable Forward (DF) contract and buying a Non-Deliverable Forward (NDF) contract.

Our desk is currently seeing financing deals at a 9-13% (annualized) discount to the hashrate forward curve. Since inception, the market-determined annualized spread between the DF & NDF has decreased from 18-21% in favor of miners.

If you’d like to learn more about Luxor’s Bitcoin mining derivatives, please reach out to [email protected] or visit https://www.luxor.tech/derivatives.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

There are risks associated with trading derivatives. Trading in derivatives involves risk of loss, loss of principal is possible.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.