Hashrate Index Roundup (September 09, 2024)

Hashrate up as seasons change.

Hello world, happy Monday!

Bitcoin trended flat throughout the past week, decreasing by 6.37% from $57,725 to a local trough of $54,050 before gaining some ground back to a current price of $57,475. Price action throughout the months of August and September have empirically shown seasonality towards the downside, so this is not surprising. That being said, the month of October marks the beginning of Q4, which has conversely exhibited seasonality towards the upside for bitcoin returns.

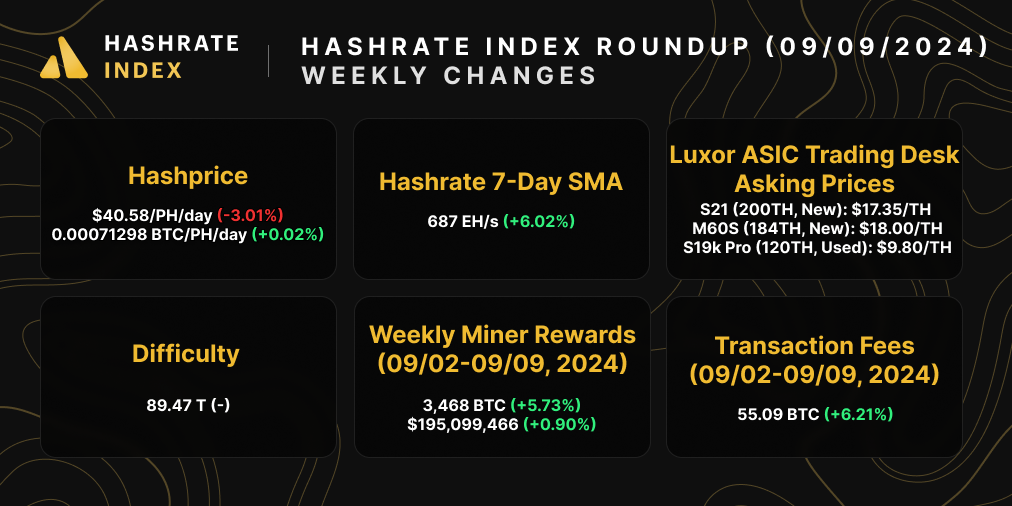

Hashprice also trended relatively flat throughout the week, decreasing by a modest ~2.75% from $42.11/PH/Day to $40.95/PH/Day, at the time of writing. A stable course in week-to-week profitability for miners.

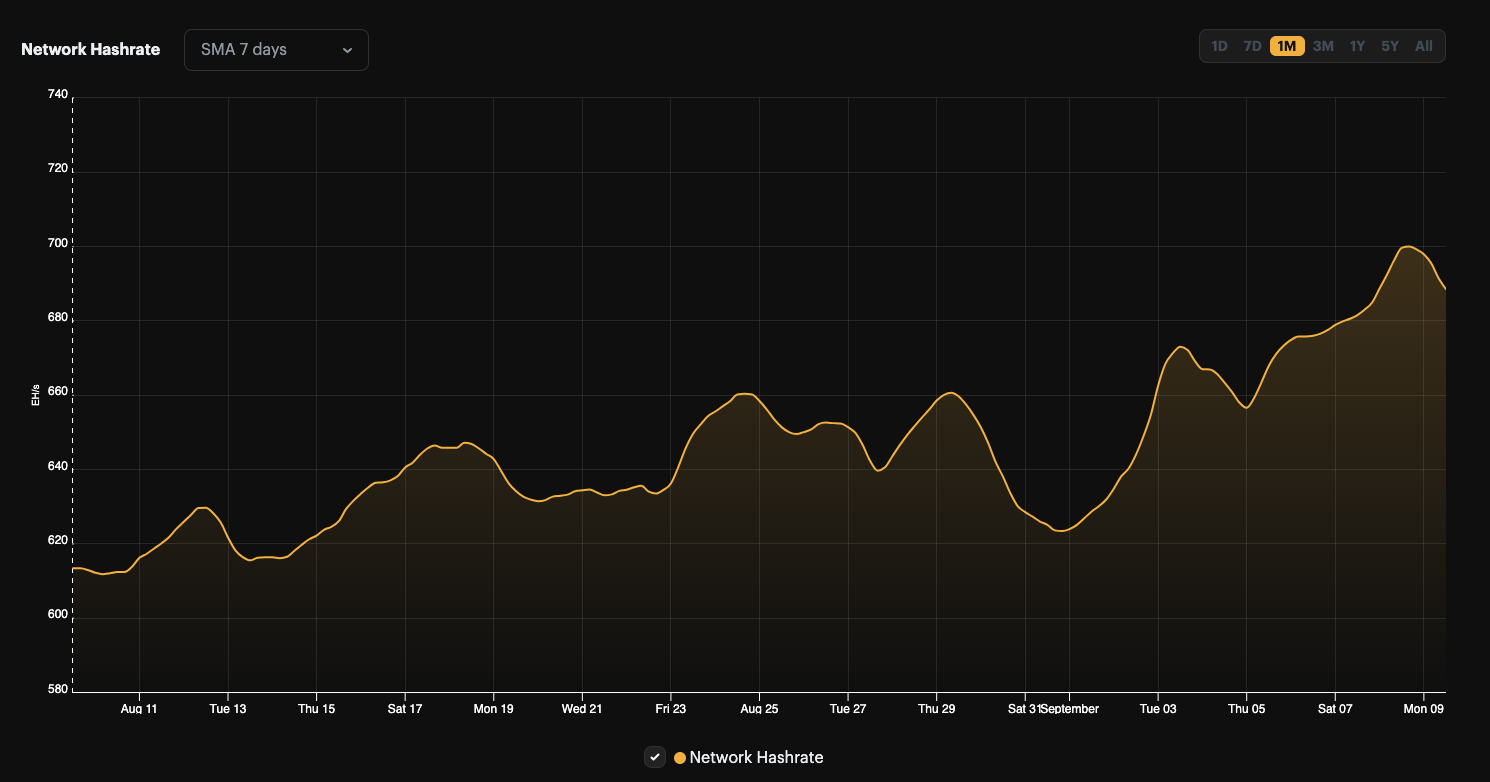

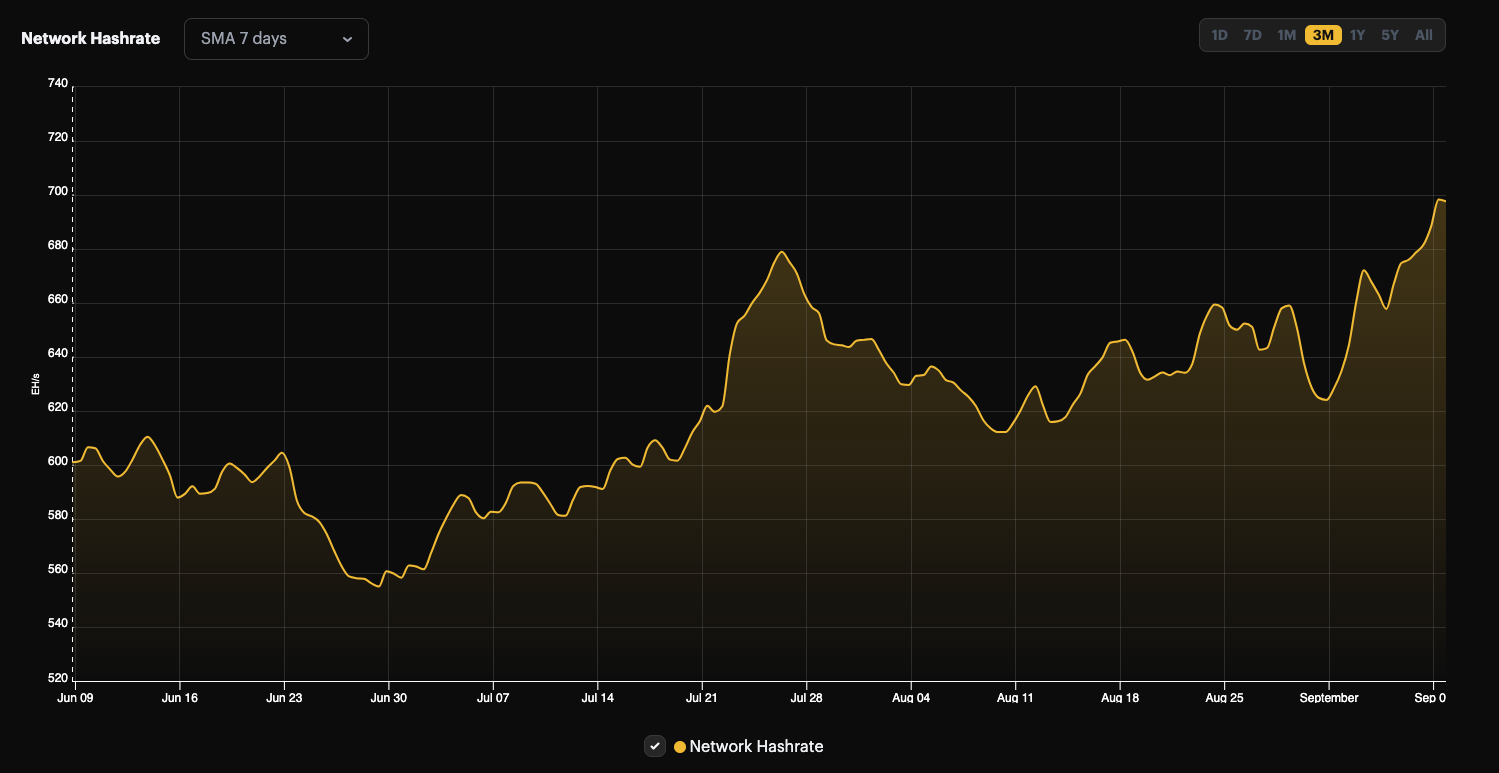

Beyond price action in Bitcoin and hashprice, global network hashrate grew by just over 8% from 648EH/s to 687EH/s throughout the week, with the 7-day simple moving average (SMA) network hashrate briefly touching 700 EH/s yesterday, a new all-time high in network security.

Blocks were found at an average time of around 9 minutes 37 seconds throughout the week. We estimate a healthy increase in difficulty of ~4.37% for the upcoming adjustment, expected to occur on September 11th.

Sponsored by Luxor Firmware

At $41/PH/Day, hashprice is close to – or at – breakeven for many miners depedning on operating cost and machine model type. Improve the hashrate and efficiency of your S19 and S21 series rigs by downloading LuxOS firmware today!

Luxor Hashrate Forwards Market Update

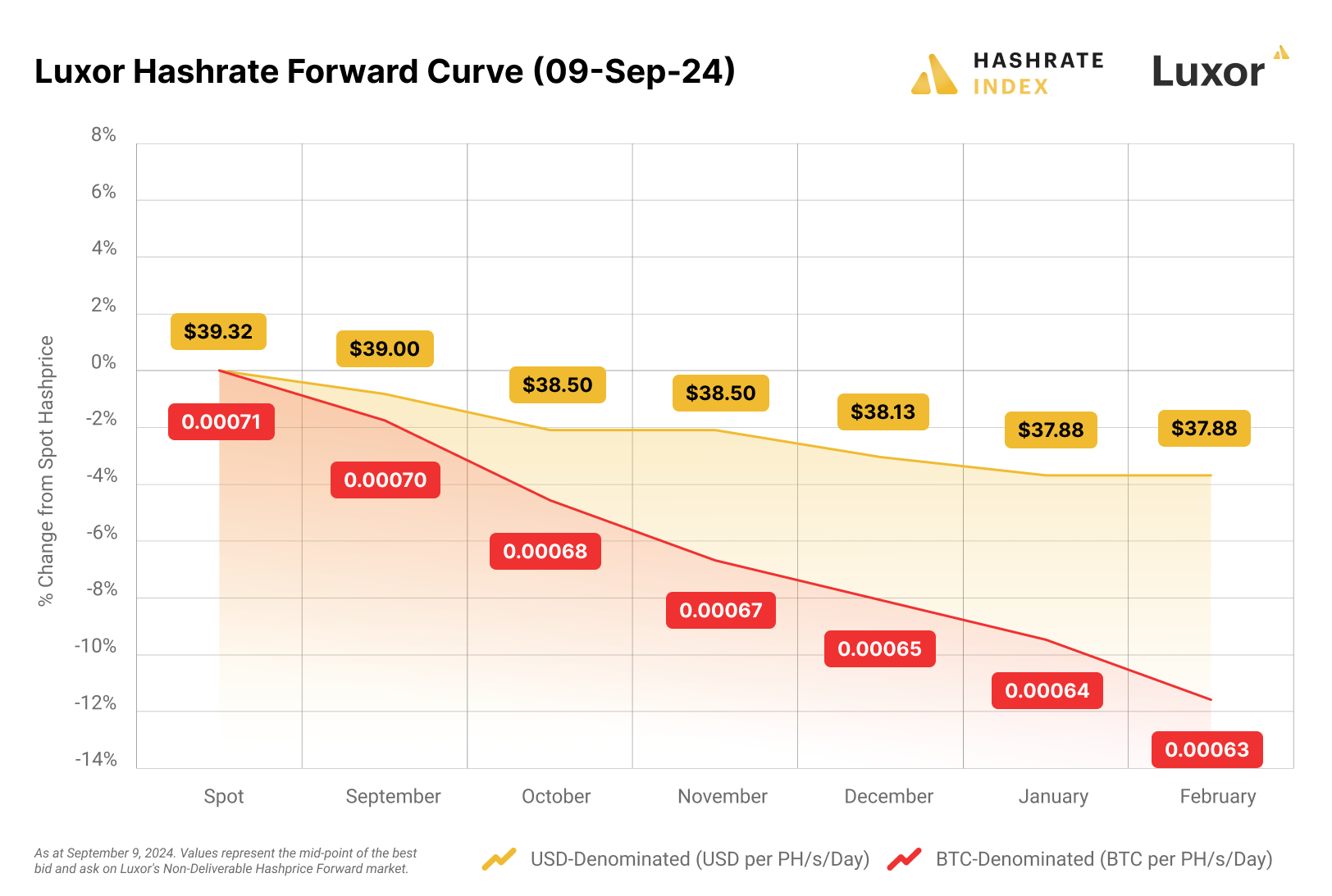

For this week's Hashrate Forwards market update, both USD and BTC contracts are trading in backwardation. Miners can lock in a ~$37.88 hashprice for up to six months into the future.

Bitcoin Mining Market Update

A positive trend for this week's update. Bitcoin and hashprice are relatively flat, whereas hashrate is up and network difficulty is expected to rise. Miners collected a total of ~3,468 BTC in block rewards, equivalent to ~$195.1 million. Transaction fees constituted 1.54% of block rewards, totalling 53.45BTC, equivalent to ~$3.05 million.

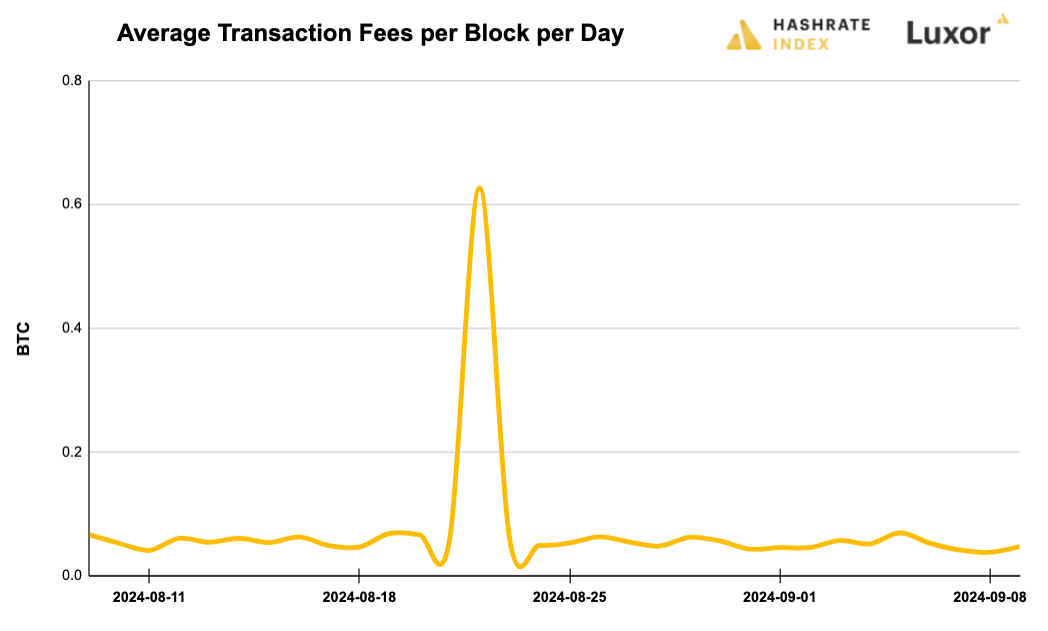

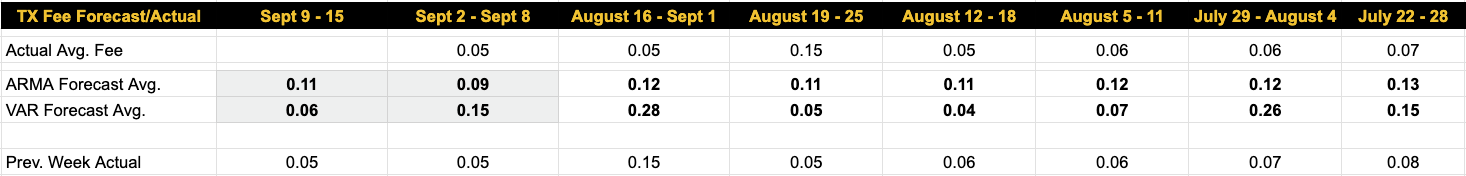

Bitcoin Transaction Fee Update

Over the past week, Bitcoin miners collected an average of 0.0507 BTC per block per day in transaction fees compared to the prior week's 0.0532 BTC, a 4.70% decline.

Our transaction fee projection models remain relatively bearish as we expect a low-fee, low-volatility environment to persist in the medium term. For this week, our VAR model forecasts 0.06 BTC per block and the ARMA estimates 0.11 BTC per block.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- Japan's Largest Power Company TEPCO is Mining Bitcoin Using Renewables

- New Research Shows Bitcoin Mining Cuts Carbon Emissions

- Blockstream Offering Third Round of Tokenized Note, Offering Exposure to Its Hashrate

Bitcoin Mining Stocks Update

Bitcoin mining stocks trended down throughout the past week, reflecting a 7.62% decrease in our Crypto Mining Stock Index.

5-day changes to Bitcoin mining stocks as of prior week's market close:

- RIOT: $6.38 (-17.36%)

- HUT: $9.00 (-14.12%)

- BITF: $1.79 (-17.70%)

- HIVE: $2.58 (-19.63%)

- MARA: $13.37 (-22.36%)

- CLSK: $8.09 (-25.37%)

- IREN: $6.44 (-25.12%)

- CORZ: $9.32 (-9.95%)

- WULF: $3.72 (-13.37%)

- CIFR: $2.70 (-25.21%)

- BTDR: $5.45 (-18.05%)

- SDIG: $3.99 (-18.57%)

- FUFU: $4.37 (-10.08%)

Have a great week, and Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.