Hashrate Index Roundup (October 16, 2022)

All-time low hashprice is here, and we all hate it.

Happy Sunday, y'all!

So it finally happened last week: Bitcoin's USD hashprice slipped to an all-time low.

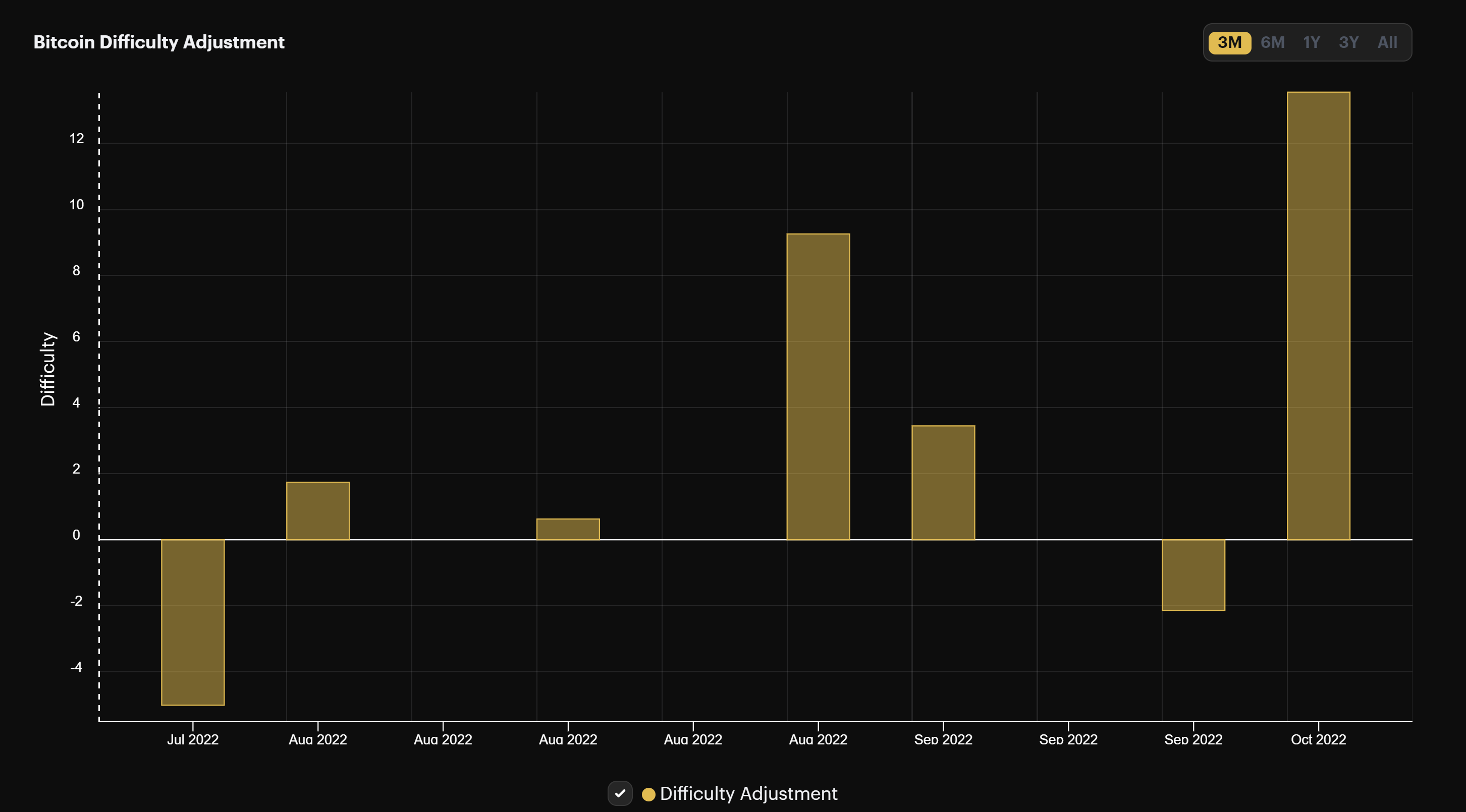

The crack of dawn on Monday brought with it a gnarly 13.55% difficulty increase, the largest such increase since May of 2021. As a result, Bitcoin's hashprice broke below $0.07/TH/day to new lows.

At current levels, miners with new-gen equipment and $0.07-0.08/kWh power costs are underwater, and even miners with new-gen equipment (excluding the S19 XP and M50) are underwater at $0.10/kWH and are basically breakeven at $0.09/kWh.

Q4 is shaping up to a be a brutal one, especially considering that (so far) hashrate is showing few signs of slowing down.

A little side note: we'll be releasing our Q3-2022 report this week, so be on the lookout for a weekday newsletter with the report and a summary of the most interesting findings!

Mining News

- Luxor launches Bitcoin mining derivative contract, the Luxor Hashprice Non-Deliverable Forward

- Binance launches $500 million fund to invest in distressed miners

- Crusoe acquires Great American Mining

- Senator Warren wants to pester Texas miners over electricity use

Mining Market TLDR

- Hashprice: $0.0680/TH/day (-13.2%) | 356 sats/TH/day (-12%)

- Hashrate: 266 EH/s (+1.5%)

- Difficulty: 35.61 T (+13.55%)

Sponsored by Luxor

Hashprice Index (October 16, 2022)

This past week, Bitcoin's hashprice broke below its prior all-time low from September, 2020.

Following Monday's vertiginous difficulty adjustment, Bitcoin hashprice fell sharply to $0.0657/TH/day and 355 sats/TH/day.

This pushes many miners in the mid-efficiency and mid-power cost range into unprofitability or close to it. Below is a sneak peak at one of the charts we're including in our Q3 report (which we'll release this week!), and it shows breakeven hashprice levels in $/PH/day for different machines at different power costs. The chart is color coded according to a benchmark hashprice of $68/PH/day ($0.068/TH/day).

Last week's 13.55% Bitcoin's mining difficulty adjustment was the largest of the year and the largest positive adjustment since May 13, 2021.

Unfortunately, it's looking like we might be in for another positive adjustment in 7 days, with blocktimes coming in at 9 minutes and 31 seconds on average.

Bitcoin Mining ASIC Price Index (October 16, 2022)

Bitcoin mining ASIC prices are still falling, and selling picked up last week.

New-gen models continue to see the largest decline among the cohort, largely due to the fact that older models sold off more heavily earlier in the year (and there are fewer of these older models on the market currently).

With hashprice hitting new lows, Bitcoin miner prices should continue falling steeper still next week, with new and mid-gen ASICs hitting their own all-time low values soon enough.

Keep on the lookout for the new efficiency band we're adding to Hashrate Index to accommodate latest gen equipment like the S19 XP! Read more on our blog post.

When hashing at $0.07/kWh power cost, here is the current bitcoin mining profitability for popular mining rigs:

- Antminer S19 XP (140 TH/s): $4.50

- Whatsminer M50 (114 TH/s): $2.20

- Whatsminer M30s++ (112 TH/s): $1.80

- Antminer S19j Pro (104 TH/s): $1.90

- Antminer S19 (95 TH/s): $1.00

- Whatsminer M30s (86 TH/s): $0.40

- Antminer S17 (56 TH/s): $-0.40

- Whatsminer M20s (68 TH/S): $-1.00

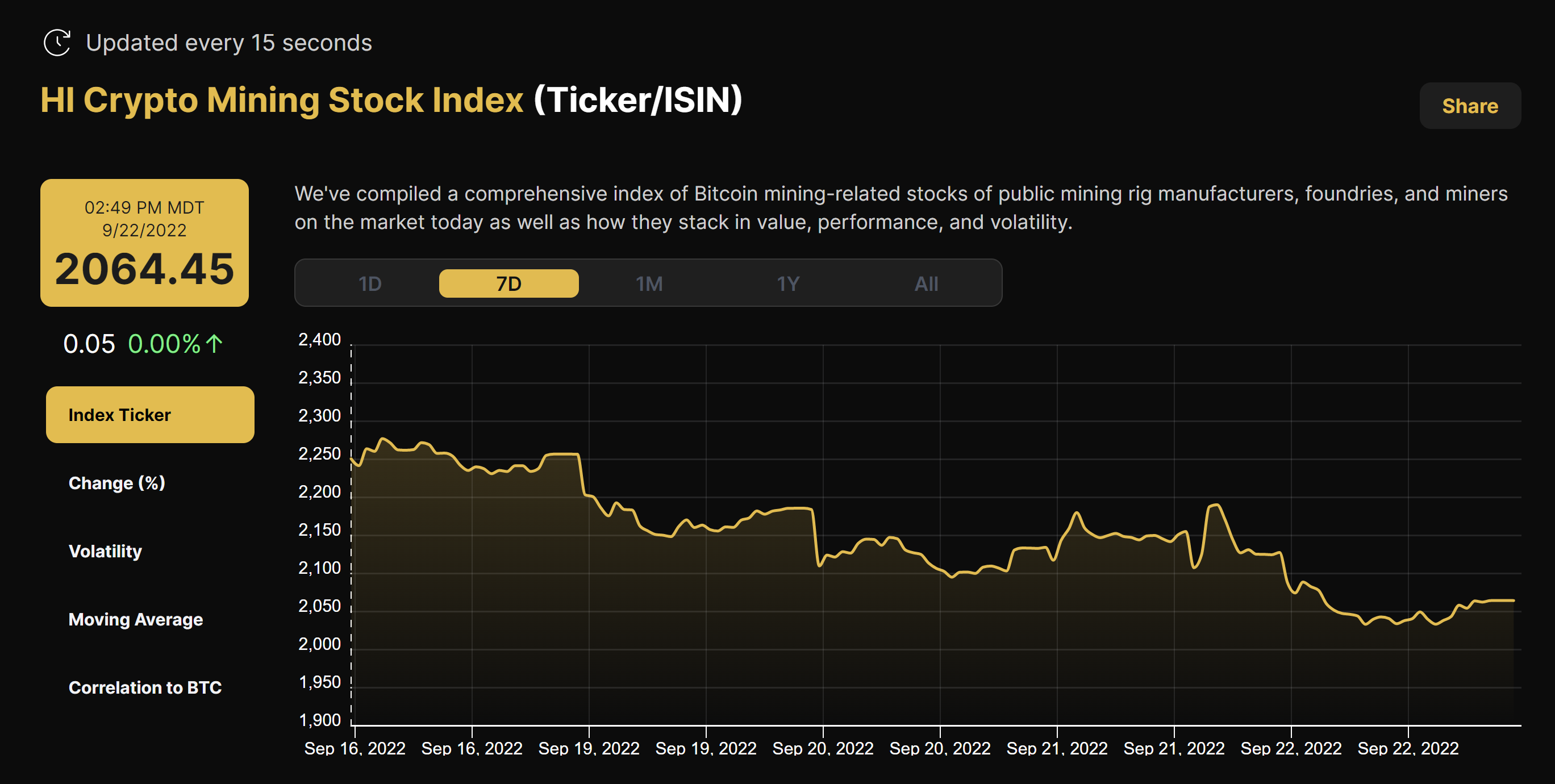

Bitcoin Mining Stocks (October 16, 2022)

Bitcoin mining stocks were pummeled this week in light of Bitcoin's own price decline and hashprice hitting new lows. Our Crypto Mining Stock Index fell steeply by 8.3%.

Have a great week, and Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.