Hashrate Index Roundup (November 18, 2024)

Bitcoin is heading for the Sun.

Hello world, happy Monday!

Bitcoin trended up throughout the past week, increasing by over 12% from ~$81,450 to a current price of ~$91,800. A new all-time high of around $93,000 was marked on November 13th. Bitcoin is up by 32% on the month, and year-to-date performance stands at 107.65%.

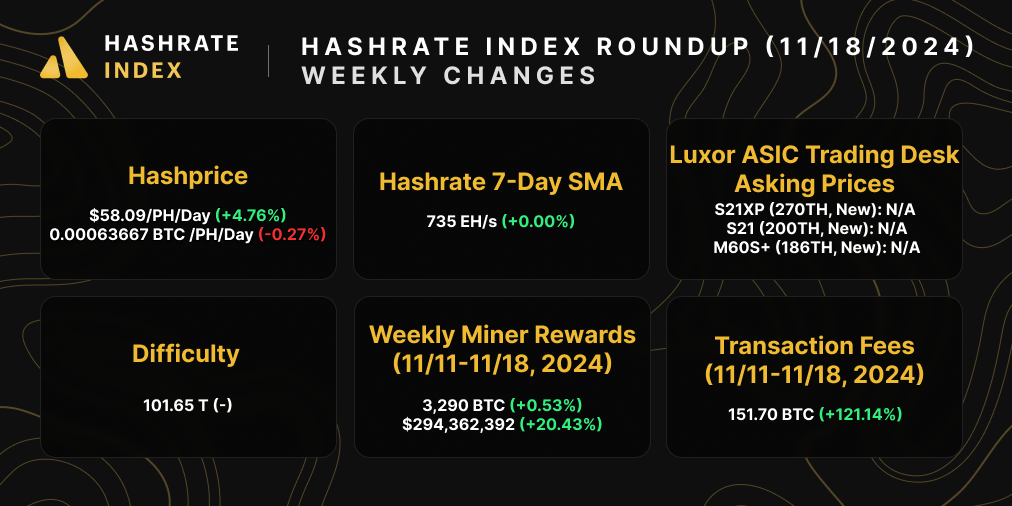

Hashprice followed with a slight uptrend overall, rising by 4.76% from $55.45 per PH/s/Day to a current $58.09 per PH/s/Day.

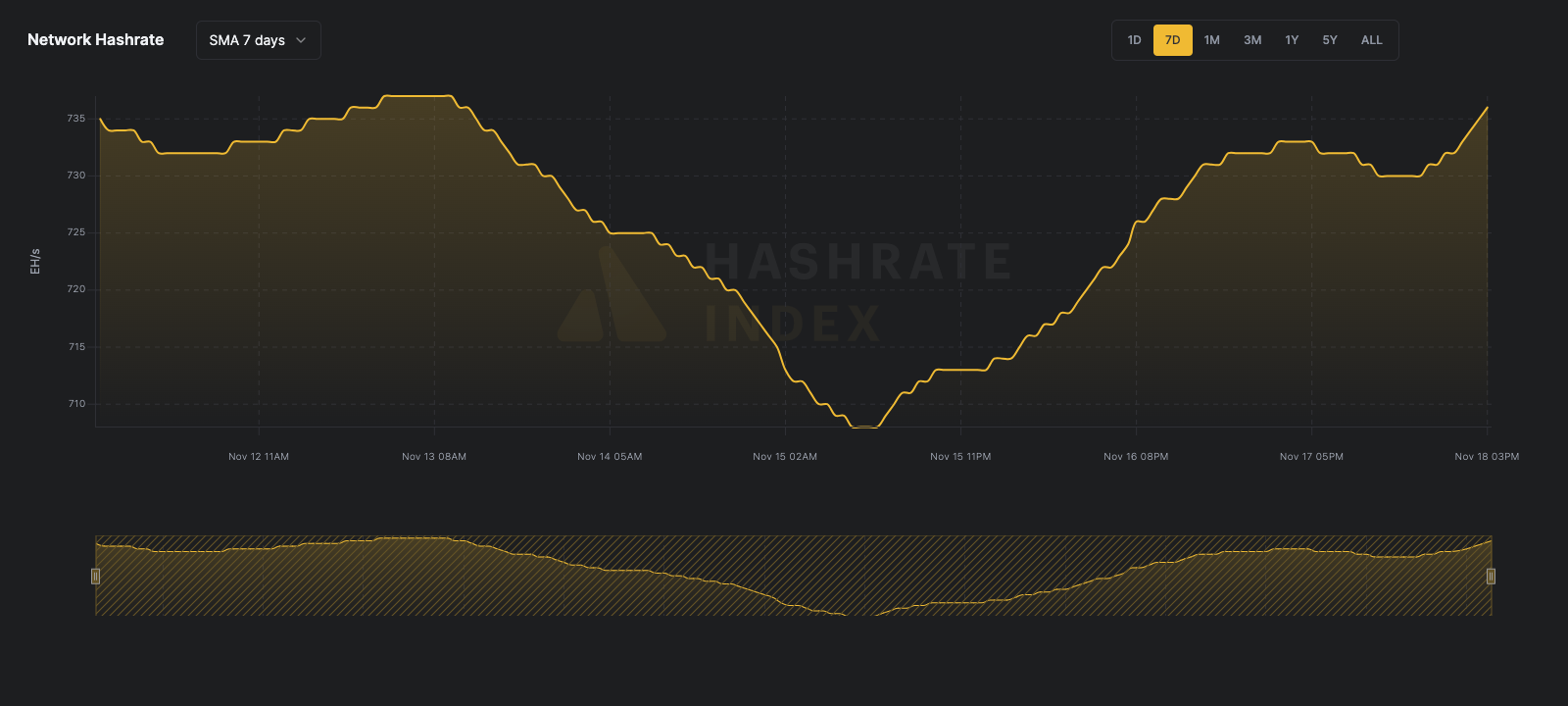

Beyond price action in Bitcoin and hashprice, global network hashrate essentially remained flat, with the 7-day simple moving average (SMA) oscillating from 735EH/s down to a local trough of 708EH/s, before climbing back up throughout the week. The 30-day SMA currently stands at 736 EH/s, up by 9.57%.

Blocks were found at an average time of around 9 minutes 57 seconds throughout the week, a slight speed up in pace as compared to the week prior at 10 minutes 04 seconds. We estimate an increase of ~0.61% for the upcoming adjustment, expected to occur imminently.

Sponsored by Luxor Firmware

We’re thrilled to announce that LuxOS now supports the Antminer S19 XP Hydro. Improve the hashrate and efficiency of your liquid-cooled ASIC miner by downloading LuxOS firmware today!

Luxor Hashrate Forwards Market Update

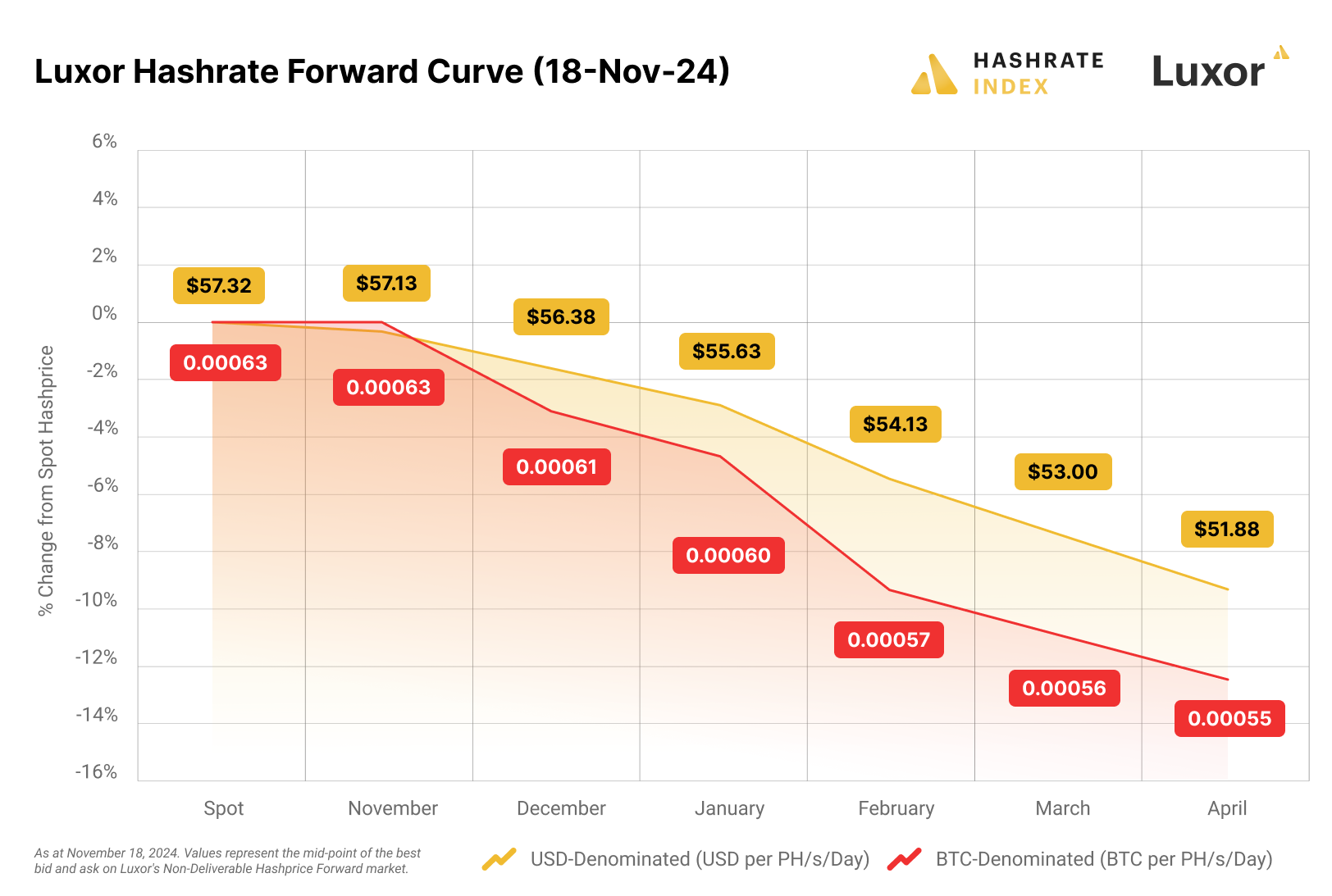

For this week's Hashrate Forwards market update, both USD and BTC contracts are trading in backwardation. Miners can lock in a ~$54.69 hashprice for up to six months into the future.

Interested in curated alpha for traders? Get the latest on hashrate derivatives in your inbox every other week. Click here to subscribe.

Bitcoin Mining Market Update

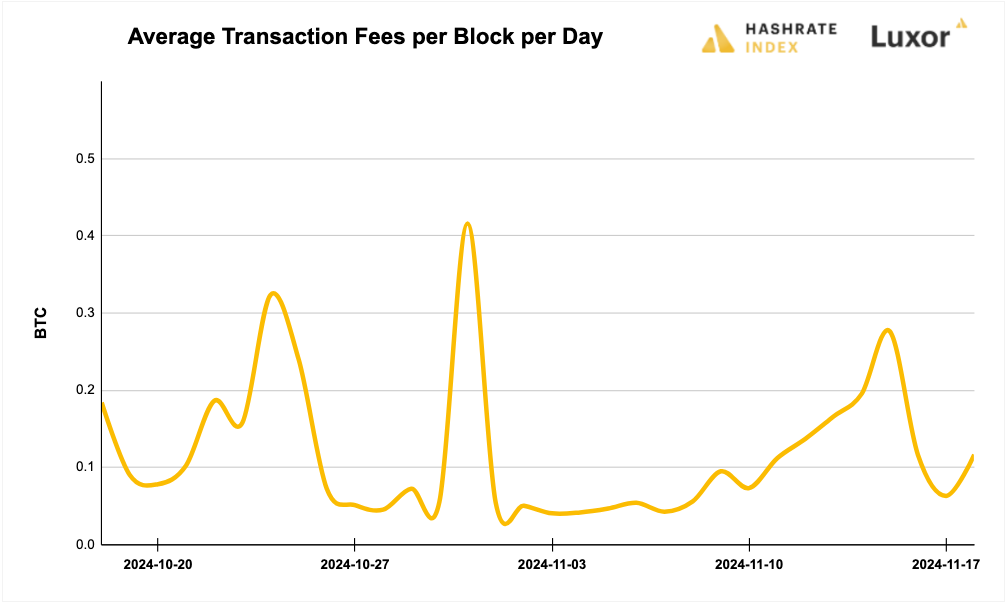

An upward trend for this week's update. Hashprice is on a roll, hashrate is steady, network difficulty is at an all-time high. Miners collected a total of ~3,290 BTC in block rewards, equivalent to ~$294.4 million. Transaction fees constituted 3.58% of block rewards totalling 151.70 BTC, equivalent to ~$13.85 million.

Bitcoin Transaction Fee Update

Over the past week, Bitcoin miners collected an average of 0.1529 BTC per block per day in transaction fees compared to the prior week's 0.0685 BTC, a whopping 123.08% decrease.

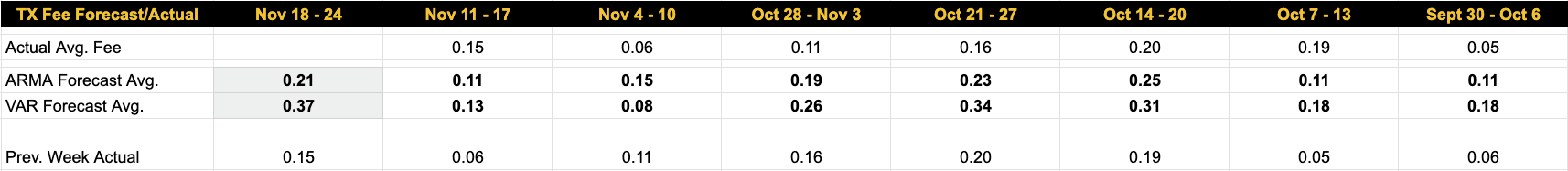

Our transaction fee projection models remain relatively bullish and in line with our expectations of the typical range of fees (i.e., above the summer's all time lows) and moderate volatility. For this week, our VAR model forecasts 0.37 BTC per block per day and the ARMA estimates 0.21 BTC per block per day.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- MARA Plans $700M in New Notes to Boost Bitcoin Holdings

- Russian Energy Ministry Proposes Periodic Crypto Mining Restrictions in Certain Regions

- Judge Rejects Efforts to Shutter New York Bitcoin Mine over Climate Concerns

Bitcoin Mining Stocks Update

Bitcoin mining stocks trended flat throughout the past week, reflecting a 1.67% increase in our Bitcoin Mining Stock Index.

5-day changes to Bitcoin mining stocks as of last week's market close:

- BTDR: $11.09 (+11.01%) | Mkt Cap: $1.54B

- BITF: $2.25 (-9.64%) | Mkt Cap: $1.02B

- CIFR: $6.63 (-11.01%) | Mkt Cap: $2.31B

- CLSK: $14.03 (-14.92%) | Mkt Cap: $3.62B

- CORZ: $15.83 (-11.42%) | Mkt Cap: $4.42B

- HIVE: $4.42 (-11.13%) | Mkt Cap: $0.56B

- HUT: $25.26 (+18.37%) | Mkt Cap: $2.36B

- IREN: $10.67 (-12.11%) | Mkt Cap: $2.02B

- MARA: $21.07 (-5.35%) | Mkt Cap: $6.78B

- RIOT: $12.37 (-12.24%) | Mkt Cap: $4.11B

- WULF: $7.18 (-17.47%) | Mkt Cap: $2.75B

- FUFU: $5.40 (+5.88%) | Mkt Cap: $0.88B

- CAN: $1.65 (+13.01%) | Mkt Cap: $0.47B

Have a great week, and Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.