Hashrate Index Roundup: Dad's Mad Edition (June 19, 2022)

Bitcoin is back to November 2020 prices--just in time for those Father's Day cookouts...

Happy Father's Day, miners!

Congratulations to those of us who convinced our fathers / fathers-in-law to buy BTC at any point in the past year. If they never sold to cover their cost basis, their investment is underwater. And if they bought on Father's day last year, they'd be down 41%.

If your father / father-in-law / prospective father-in-law asks you today "So what the hell is going on with those cryptos?", you can tell him that a bunch of big crypto funds blew up. Like everything else in our financial system, Bitcoin and crypto writ large has been pumped up with leverage. That leverage is unwinding now, leading to the brutal sell-off to $17k we just witnessed.

If he then asks you whether or not Bitcoin's found a bottom, you can tell him that we said it's anyone's guess, but BTC under or at $20k sure feels like an unbelievable buying opportunity. (NOT FINANICAL ADVICE)

Sponsored by Luxor

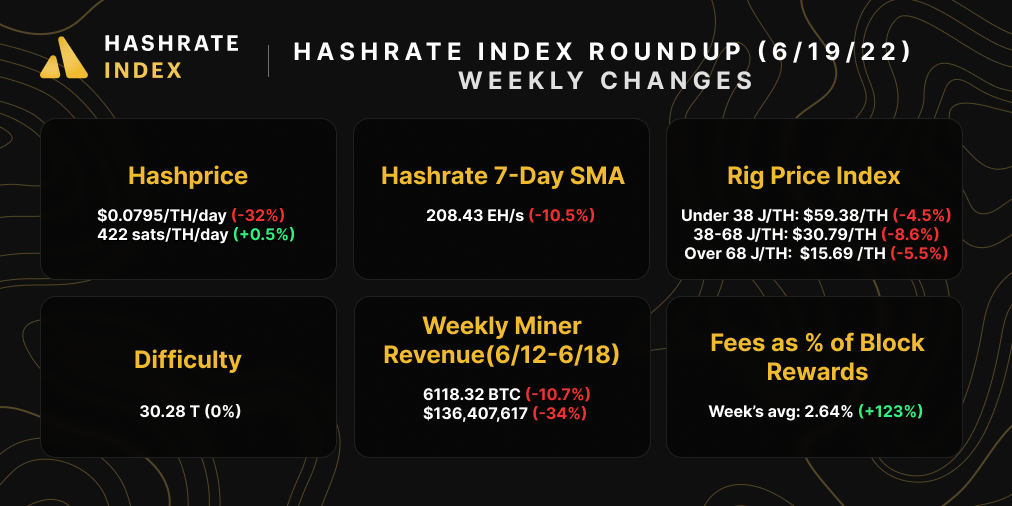

Hashprice Index (June 19, 2022)

Bitcoin's hashprice continues to revisit lows from Q4-2020. After falling over 30% last week, it's currently below $0.08/TH/day for the first time since the last bull-run started, and it's only a cent or so from hitting an all-time low.

The good news, though, is that Bitcoin's difficulty should drop this week. With hashrate dropping as a result of poor mining economics, miners took 10.7 minutes on average last week to find new blocks, so we estimate at least a 1% downward difficulty adjustment sometime on Wednesday.

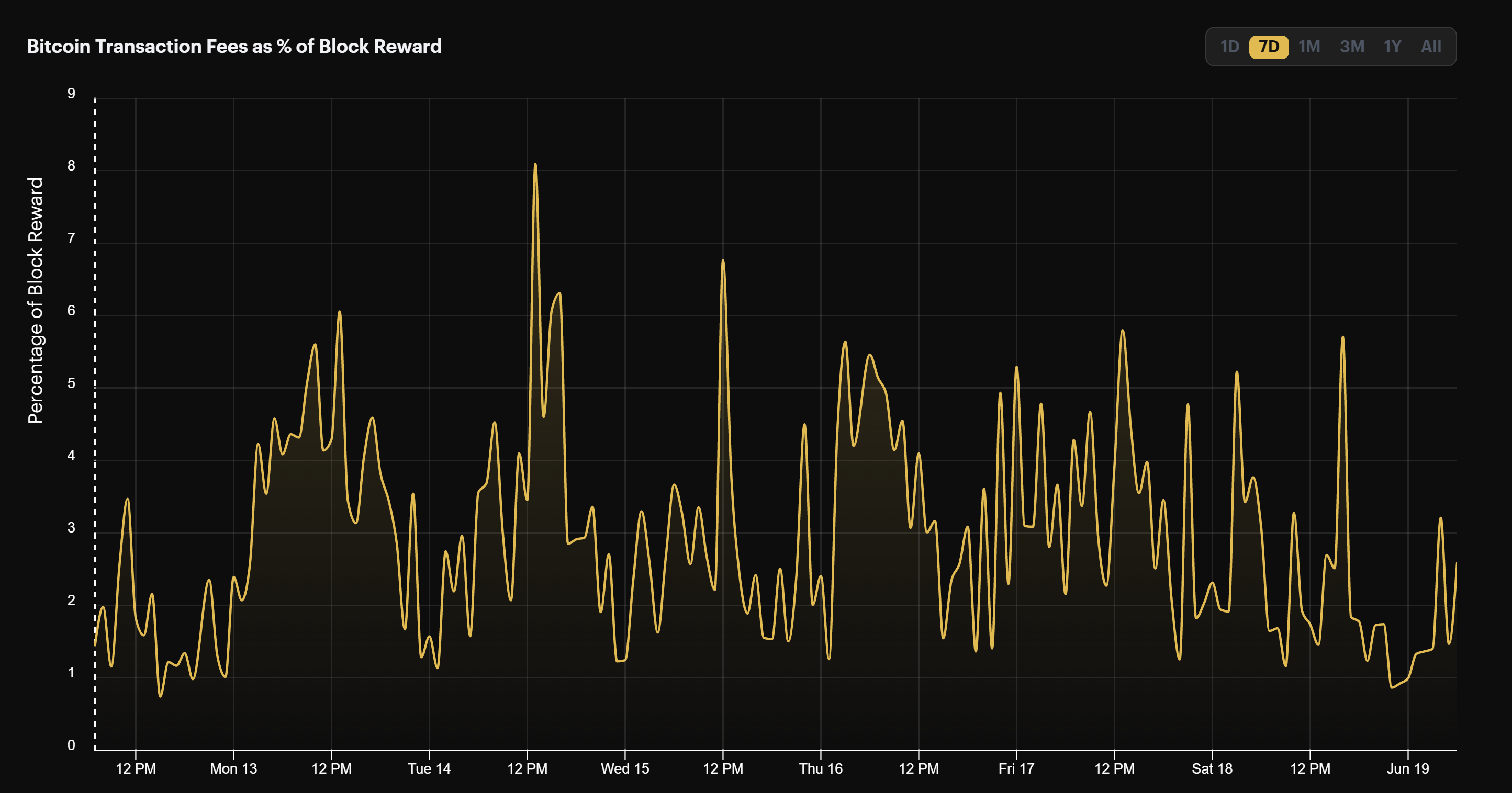

Panic selling means greater transaction volume, which means higher transaction fees. On average, transaction fees made up 2.64% of block rewards last week, a 123% increase from the prior week.

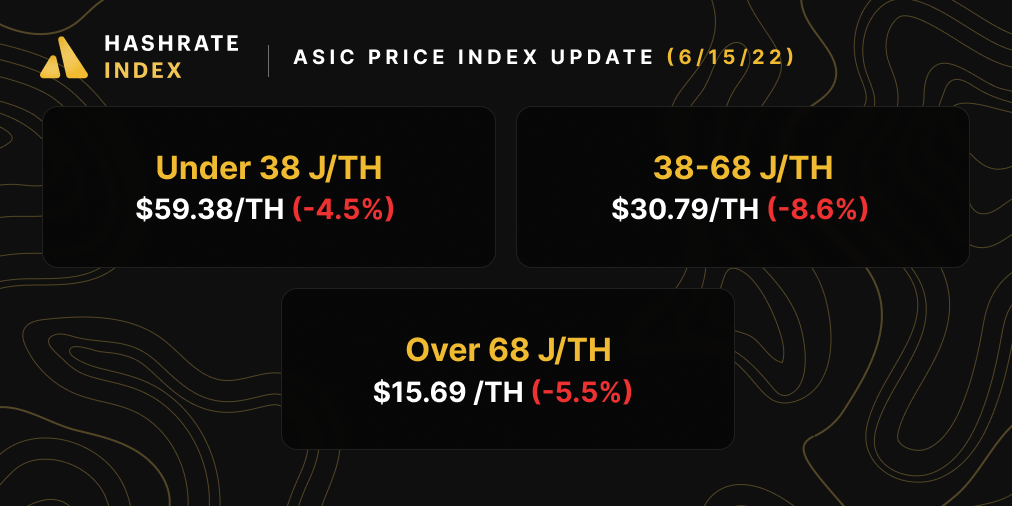

Bitcoin ASIC Index (June 19, 2022)

In line with Bitcoin's own price, we're starting to see seller capitulation in the Bitcoin mining ASIC market. We'll have an update on the ASIC market this week for our weekday newsletter, because prices will be lower than what we're showing today (not to mention the fact that Bitmain has begun repricing factory-new machines).

Bitcoin mining profitability is in the toilet as mid-gen machines approach their shutoff thresholds at $0.06/kWh power cost. The daily revenue potential for popular rigs fell substantially last week:

- Whatsminer M30s++ (112 TH/s): $8.90

- Antminer S19 Pro (110 TH/s): $8.70

- Antminer S19 (95 TH/s): $7.60

- Whatsminer M30s (86 TH/s): $6.80

- Whatsminer M20s (68 TH/S): $5.40

- Antminer S17 (56 TH/s): $4.20

- Antminer S9 (13 TH/s): $0.90

Bitcoin Mining Stocks (June 19, 2022)

Bitcoin mining stocks continue to suffer during Bitcoin's drawdown, and our Crypto Mining Stock Index lost 7.4% over the week.

Happy Hashing, and have a great week!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.