Hashrate Index Roundup (July 30, 2024)

Bitcoin surged throughout Bitcoin Conference 2024 Nashville, and network hashrate hit an all-time high.

Happy Tuesday!

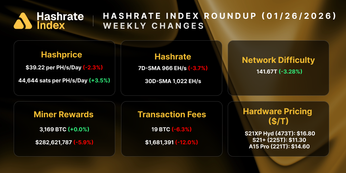

Bitcoin is showing signs of strength, rebounding from a monthly low of $56,000 toward the beginning of July to around $68,000 during the Bitcoin 2024 Conference in Nashville, Tennessee. Price action for the asset remained flat throughout the rest of the week, currently hovering around $66,000.

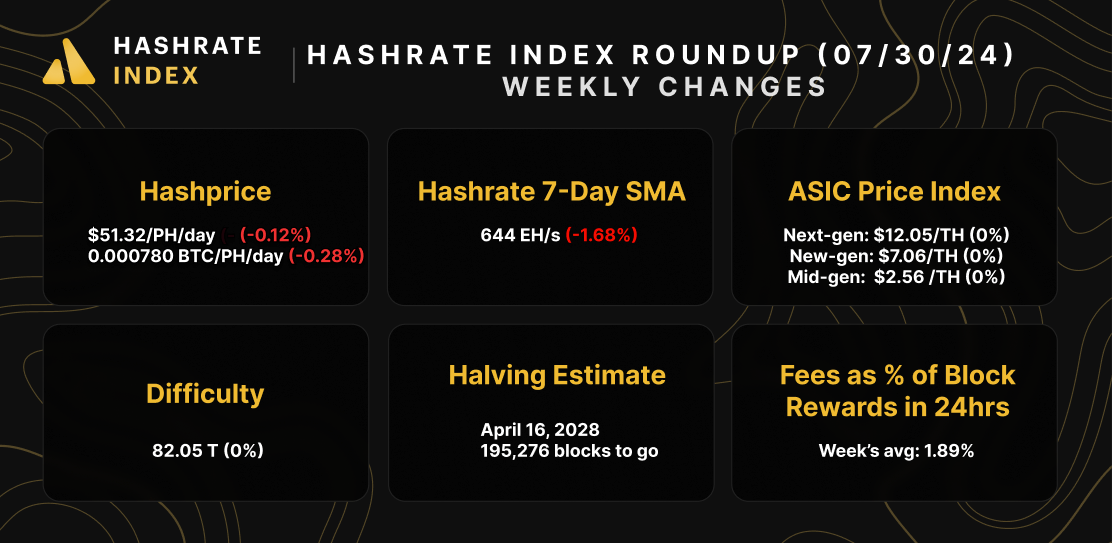

The sudden rally reflected on hashprice, which started the week off at $51/PH/Day, peaking at $54/PH/Day and normalizing back to $51/PH/Day, at the time of writing. Hashprice is up by 8% on a monthly basis, providing some temporary breathing room for miners as the industry continues to adjust to the most recent halving in April.

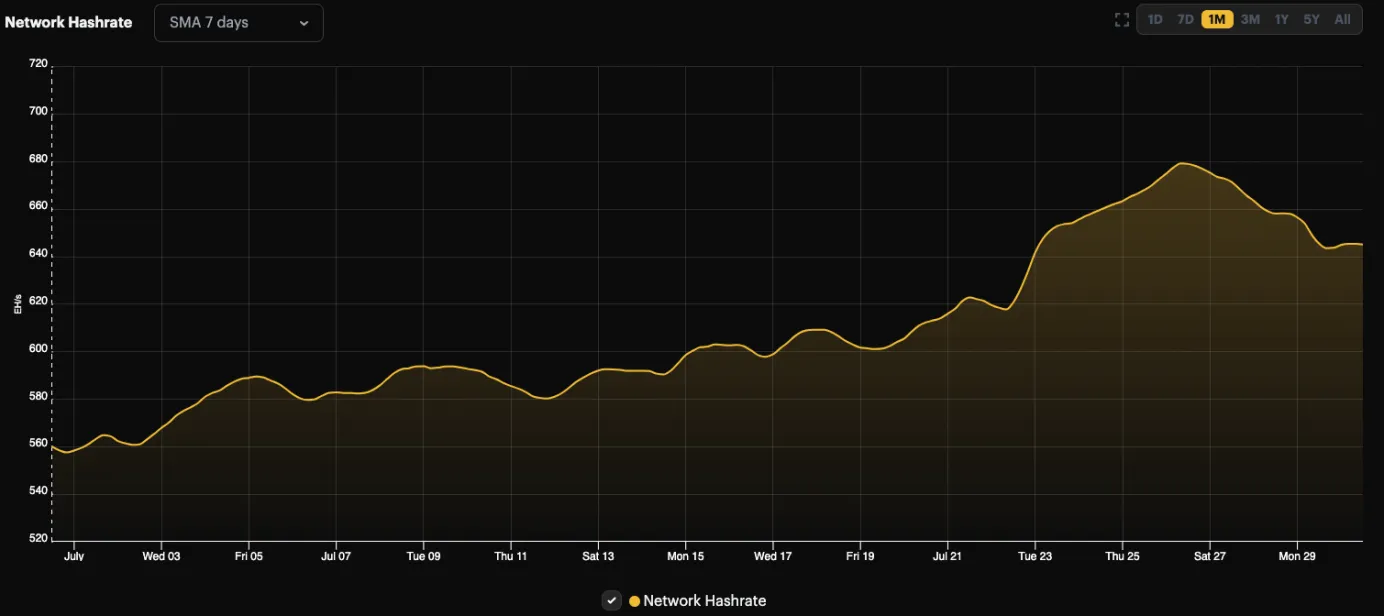

Beyond price action, network hashrate has increased significantly. Bitcoin's 7-day average hashrate marked an all-time high of 680 EH/s on July 26, as major publicly listed miners continue to improve operations through ASICs fleet upgrades and summer's energy curtailment reduces.

Strong hashrate growth led to an average block time of almost 9 minutes over the epoch, resulting in an estimated imminent difficulty adjustment upwards of ~11%.

Sponsored by Luxor Firmware

At $51/PH/Day, hashprice is close to – or at – breakeven for many miners depedning on operating cost and machine model type. Improve the hashrate and efficiency of your S19 and S21 series rigs by downloading LuxOS firmware today!

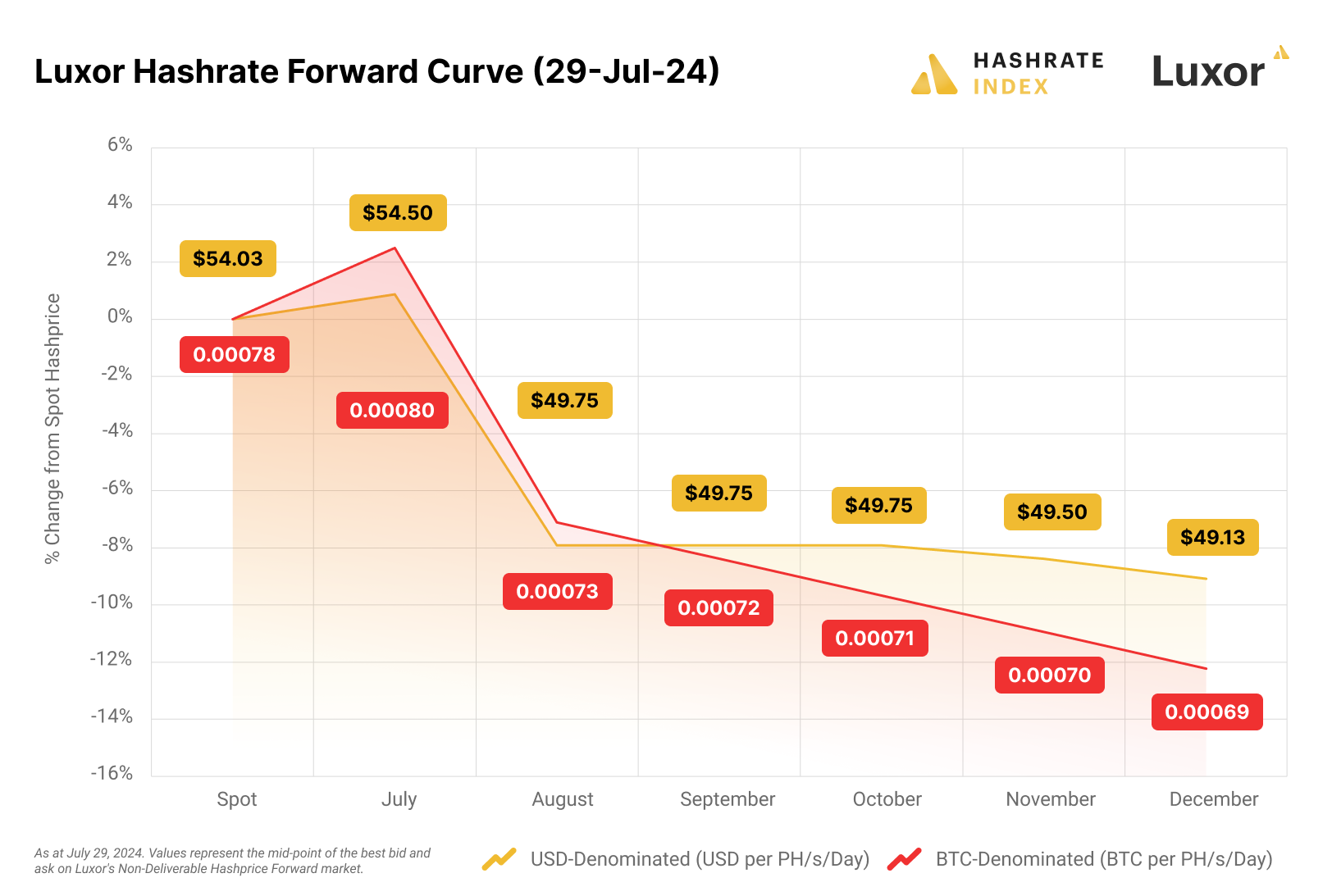

Luxor Hashrate Forwards Market Update

For this week's Hashrate Forwards market update, USD and BTC hashrate contracts are trading in backwardation. The August contract is experiencing a sharp decline as the difficulty adjustment looms. Miners can still lock in a ~$49 hashprice up to 6 months in the future.

Bitcoin Mining Market Update

A relatively stable trend for this week's update. Hashprice remains virtually unchanged in both USD and BTC terms, alongside the ASIC market.

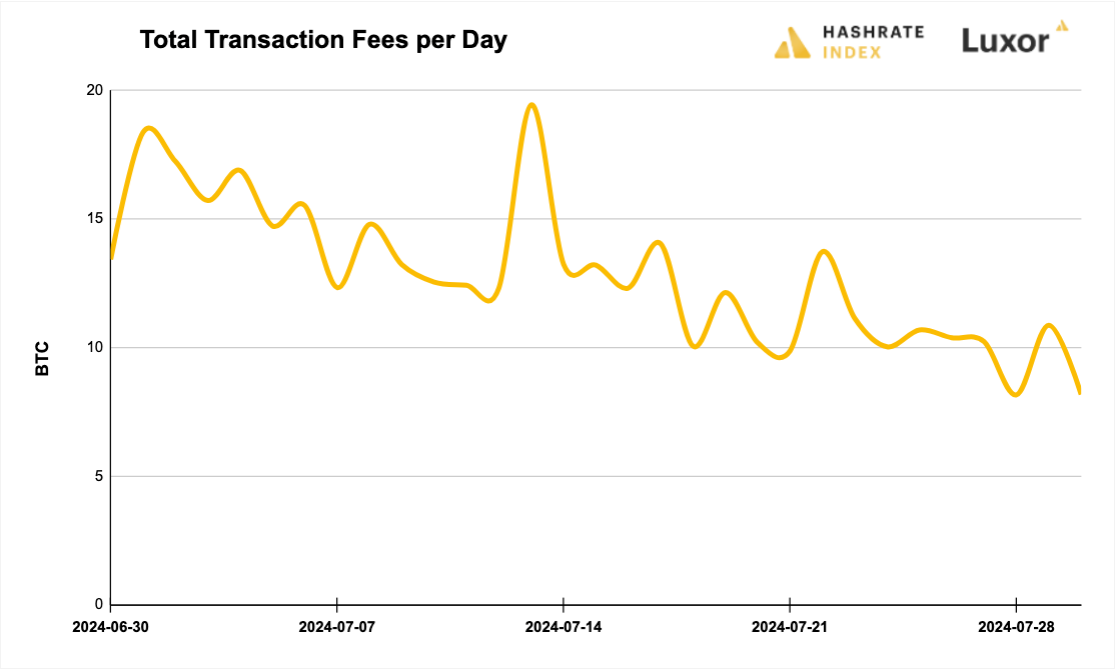

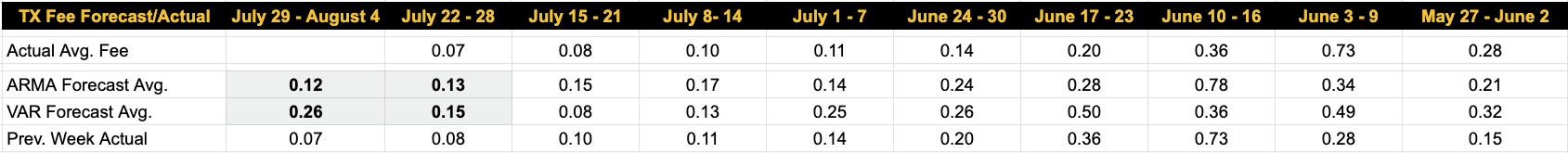

Bitcoin Transaction Fee Update

Transaction fees continue to trend down, which is favourable for users of the Bitcoin network but not so much for miners. Over the past week, Bitcoin miners collected 79.64 BTC in transaction fees, a 19.91% decrease from the prior week's 95.50 BTC.

Unsurprisingly, our transaction fee projection models are still bearish. For this week, our VAR model forecasts 0.26 BTC per block, and the ARMA estimates 0.12 BTC.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- ‘Absolute Game Changer’—Congress Introduces Radical Bitcoin Bill As Trump Primes Price For A $100 Trillion Surge To Replace Gold

- Bernstein says mining hardware is a $20 billion opportunity amid Trump's push to 'make bitcoin' in the US

- Russia Legalizes Crypto Mining and Brings an Experimental Regime

Bitcoin Mining Stocks Update

Bitcoin mining stocks trended down throughout the past week, reflecting a 9.92% decrease in our Crypto Mining Stock Index.

5-day changes to Bitcoin mining stocks:

- RIOT: $10.37 (-11.89%)

- HUT: $13.97 (-29.87%)

- BITF: $2.52 (-1.18%)

- HIVE: $3.58 (-2.98%)

- MARA: $19.37 (-3.52%)

- CLSK: $15.70 (-11.10%)

- IREN: $9.38 (-16.40%)

- CORZ: $9.22 (-15.76%)

- WULF: $3.85 (-30.51%)

- CIFR: $5.31 (-14.29%)

- BTDR: $9.08 (-17.15%)

- SDIG: $2.76 (-27.94%)

Have a great week, and Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.