Hashrate Index Roundup (February 5, 2024)

Bitcoin's hashrate is back with a vengeance after January's winter storms, and difficulty is at an all-time high as a result.

Happy Monday, y'all!

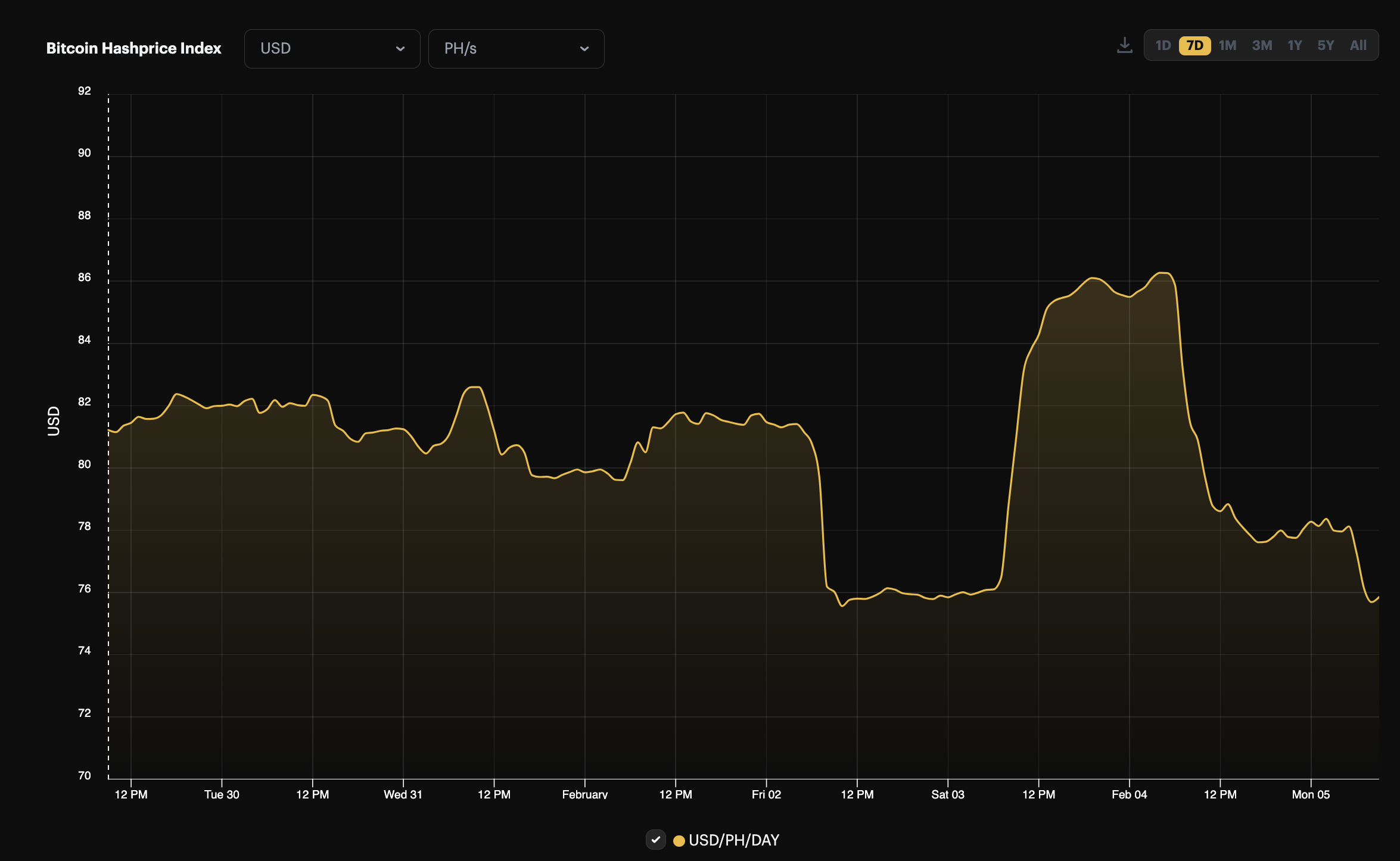

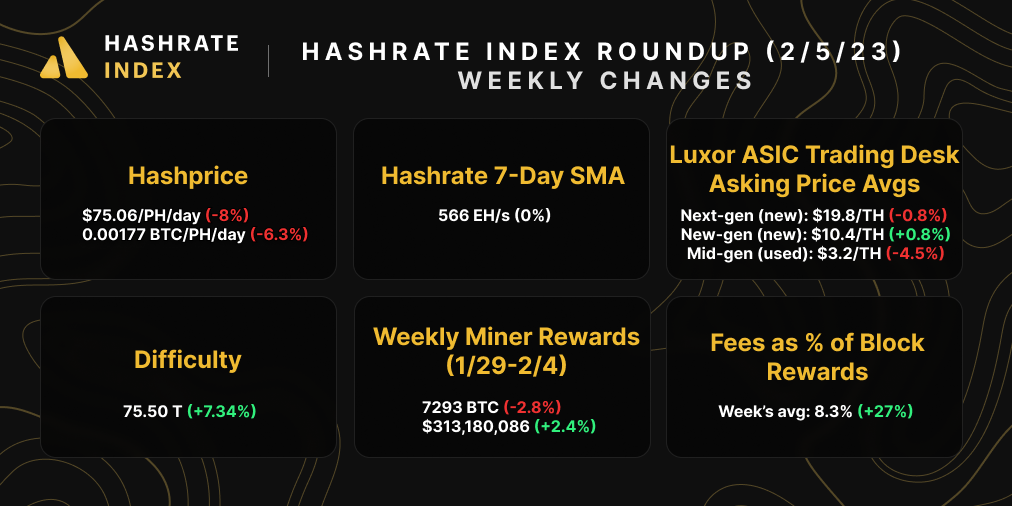

Hashprice is back below $80/PH/day after last week's much-larger-than-usual upper difficulty adjustment. After February 2's difficulty adjustment drove hashprice to $75/PH/day, a short-lived transaction fee spurt from inscription activity pushed hashprice to $85/PH/day at the end of last week, but once this abated, hashprice retreated to its current level.

Sponsored by Luxor RFQ

The Antminer S21 is here, and Luxor's ASIC Trading Desk is accepting preorders for this model right now! If you'd like to place a preorder for the Antminer S21, please fill out this form. Secure your order for Bitmain's most efficient and powerful ASIC miner today!

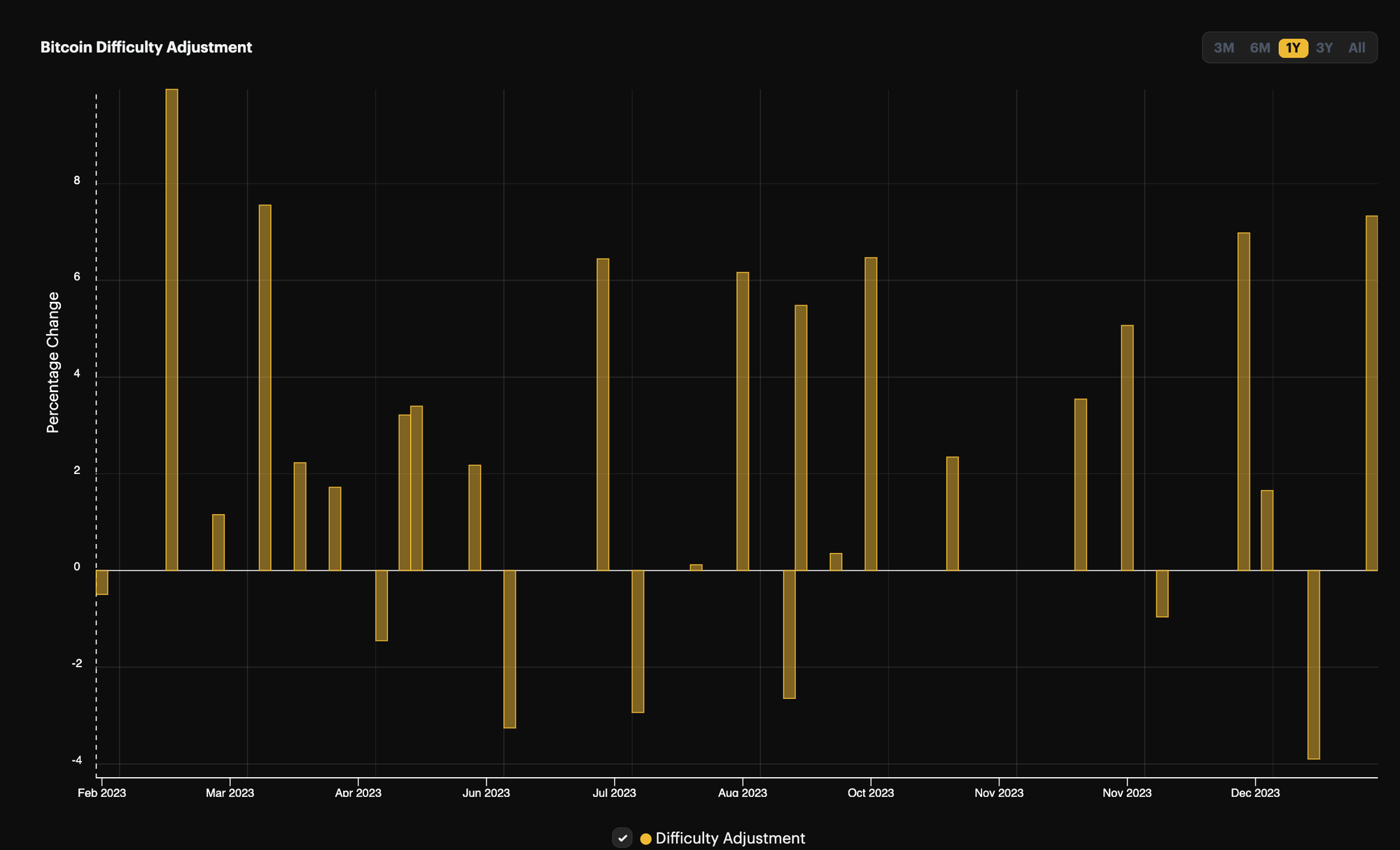

The difficulty adjustment that took hashprice down a peg was the largest positive adjustment since March 23, 2023. The 7.34% increase set an all-time high of 75.5 T for Bitcoin's mining difficulty, and it marked the 20th positive difficulty adjustment of the last year (out of 27 in total). The prior difficulty adjustment (a -3.9% change) was something of a fluke, resulting as it did from the hashrate brown out during the extreme winter storms that blanketed North America in mid-January.

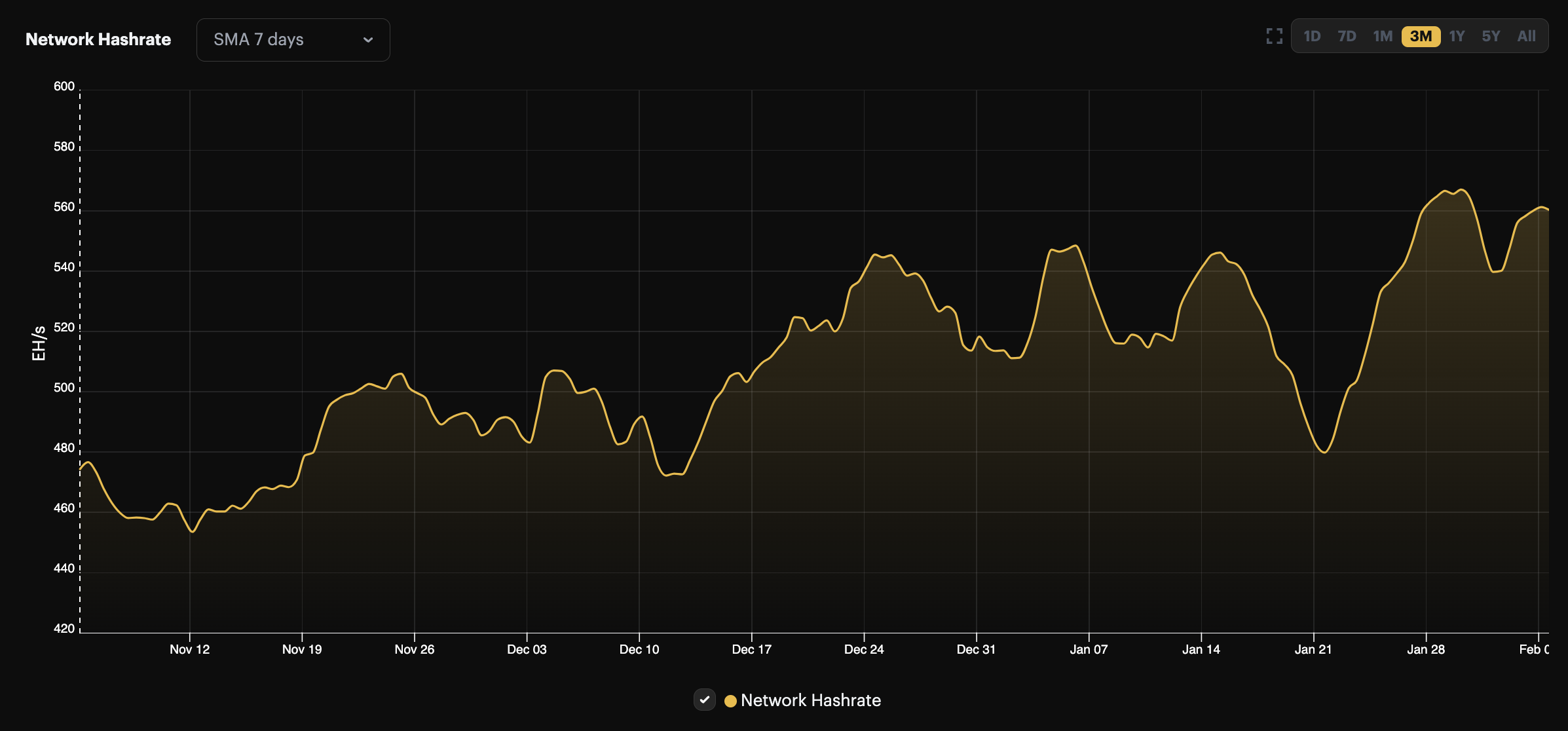

The parabolic recovery that Bitcoin's hashrate has experienced after January's winter storms influenced last week's difficulty adjustment, which is itself compensating for the reduction to mining difficulty that came from a fleeting, quickly-remedied reduction to Bitcoin's hashrate from the winter storms. In other words, that -3.9% difficulty adjustment on January 20 was a head-fake, and the Bitcoin network is returning to its Up Only trend for hashrate growth.

Indeed, Bitcoin's hashrate continues to march upward to all-time high after all-time high, setting a record of 567 EH/s on the 7-day average last week.

The first batches of S21s and T21s are beginning to arrive in mining farms across the world, so we don't expect this hashrate growth to slow anytime soon as miners continue to bulk up their operations ahead of the Fourth Halving in April.

Bitcoin Mining Market Update

Hashprice is down both for BTC and USD denominated figures this week, while hashrate is flat from our last update. Thanks to the inscriptions minting spurt we touched on earlier, transaction fees were up week-over-week, but they were still considerably lower than Q4-2023 numbers. ASIC prices continue to see minor fluctuations, with prices for next-gen models falling slightly, new-gen increasing slightly, and mid-gen falling moderately.

Bitcoin Mining News

Here are last week's top headlines for Bitcoin mining news:

- US Energy Information Agency Launches Survey to Collect Energy Use, Other Information from Bitcoin Miners

- Marathon to pay Hut 8 $13.5 million to take operational control of two bitcoin mining sites

- Celsius' Bitcoin Mining Assets to Restart as New Firm Prepares to Go Public

Bitcoin Mining Stocks Update

Bitcoin mining stocks had a rough week last week, falling precipitously from the gains they enjoyed the week before. Every miner in our update was red to close the week, and our Crypto Mining Stock Index fell 3%.

Weekly changes to Bitcoin mining stocks:

- RIOT: $10.34 (-10.24%)

- HUT: $6.91 (-16.07%)

- BITF: $2.13 (-11.98%)

- HIVE: $3.01 (-13.75%)

- MARA: $16.64 (-9.91%)

- CLSK: $7.76 (-10.49%)

- IREN: $3.65 (-18.89%)

- WULF: $1.56 (-18.32%)

- CIFR: $2.45 (-24.38%)

- BTDR: $6.93 (-21.69%)

- SDIG: $4.29 (-24.47%)

Happy Hashing, and have a great week!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.