Hashrate Index Roundup (August 12, 2024)

Bitcoin bounces back, hashprice continues to stress.

Hello world, happy Monday!

Bitcoin had a healthy rebound throughout the past week, bouncing back by approximately 9% from $54,250 to a current price of $59,250. Although some lost ground has been recovered, remnants of the recent macroeconomic maelstrom which caused a trillion-dollar wipeout across financial markets remain; reverting back to local highs of around ~$70,000 experienced throughout the year would imply an upswing of 18% from current prices. Bitcoin's year-to-date performance stands at 34%.

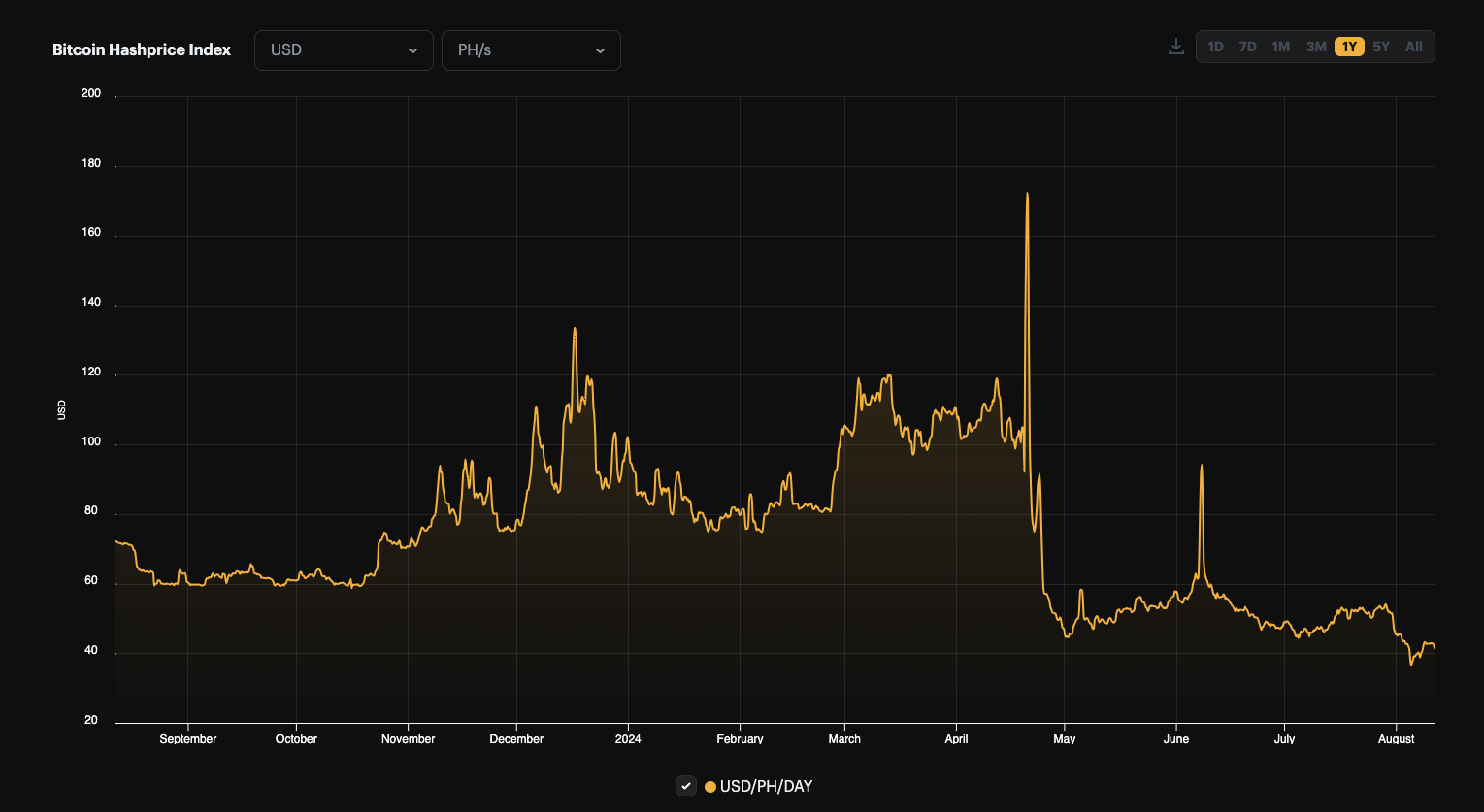

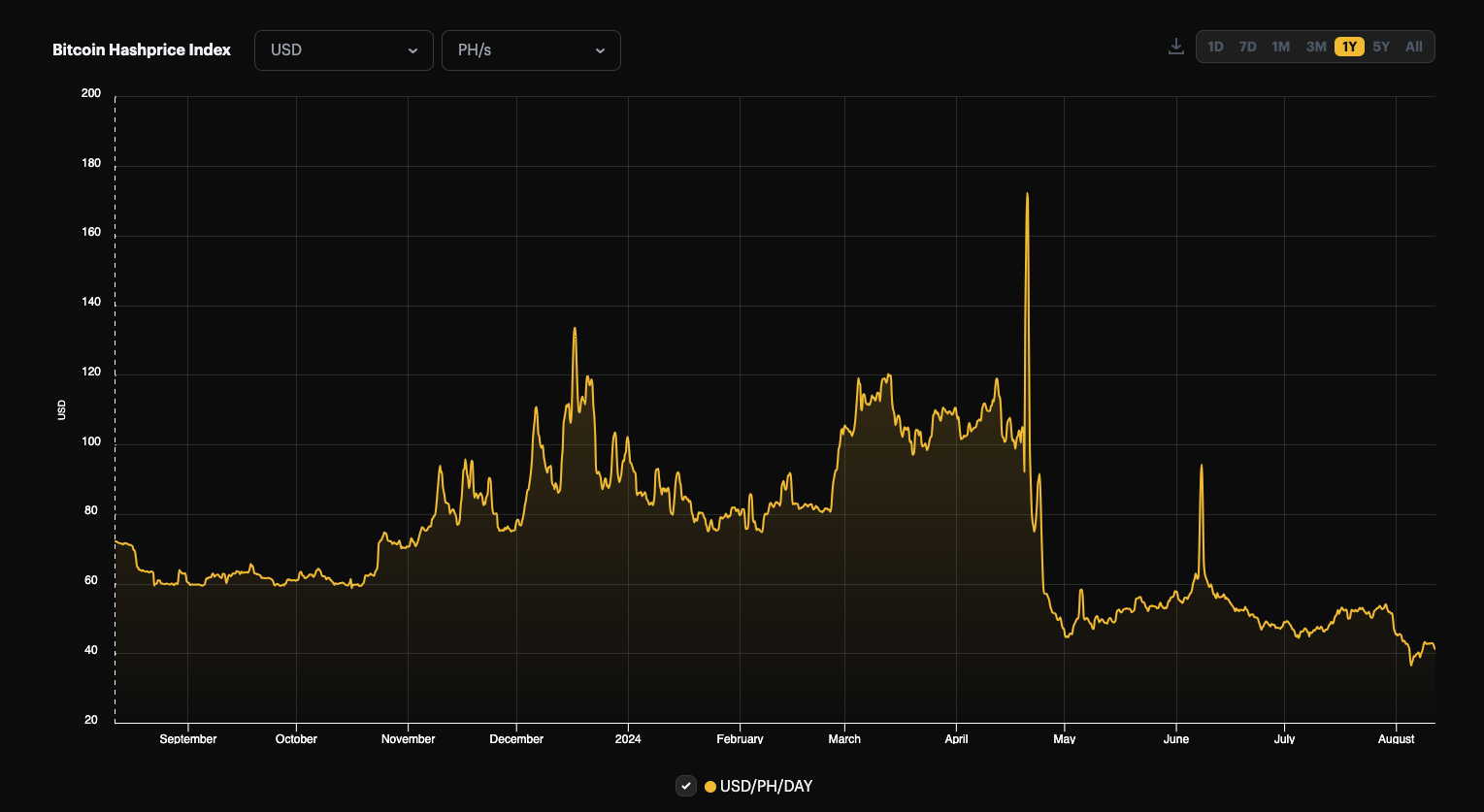

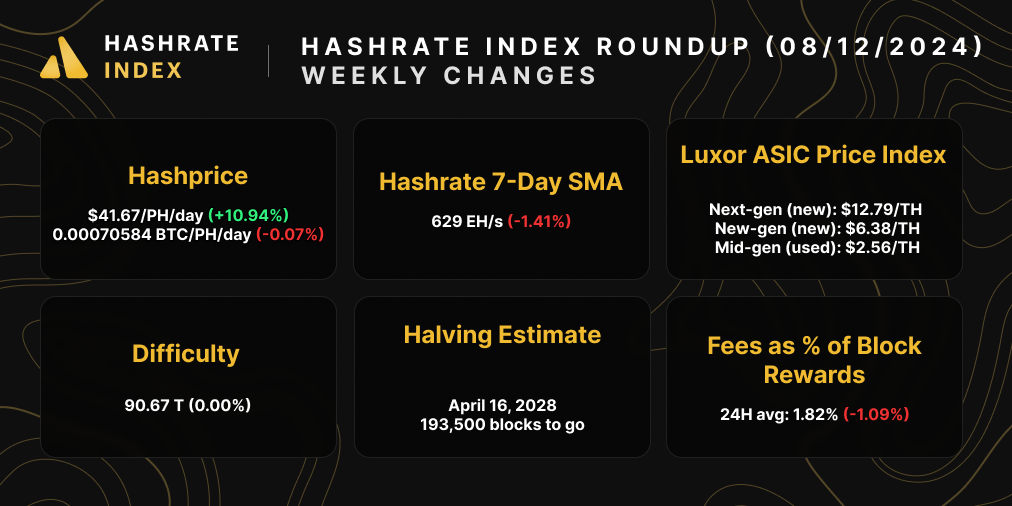

Hashprice also improved throughout the week, increasing by ~11% from $37.50/PH/Day to $41.50/PH/Day, at the time of writing. Although this slight recovery is welcome, profitability remains squeezed as the industry continues to grapple with the economics of this current mining epoch.

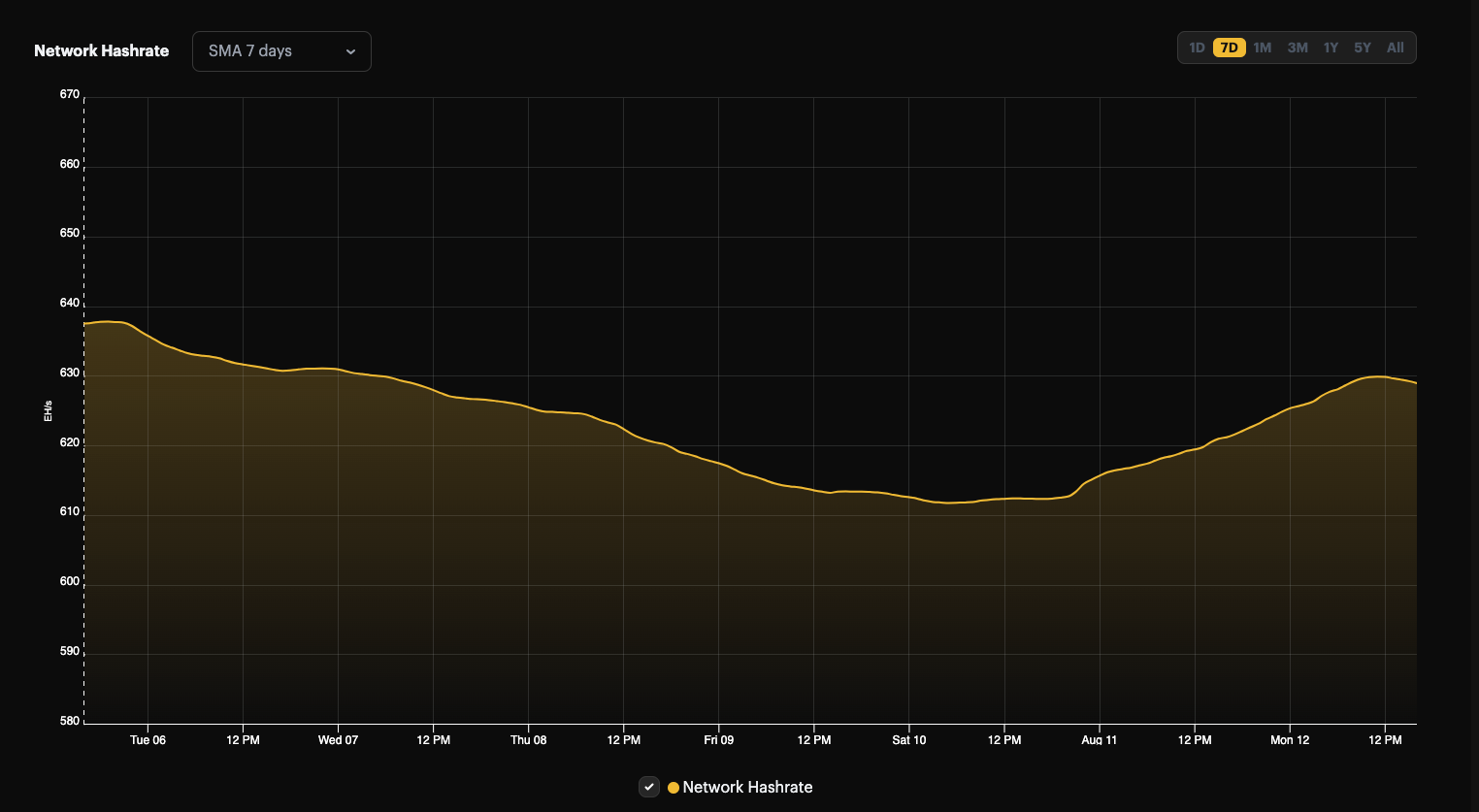

Beyond price action in Bitcoin and hashprice, global network hashrate oscillated by ~1.5% throughout the week, as the 7-day simple moving average (SMA) network hashrate decreased slightly from 638 EH/s to a current 629EH/s, at the time of writing.

The slight hashrate decline led to an average block time of around 10 minutes 26 seconds throughout the week. We estimate a decrease in difficulty of ~4.25% for the upcoming adjustment, expected to occur on August 14th.

Sponsored by Luxor Firmware

At $42/PH/Day, hashprice is close to – or at – breakeven for many miners depedning on operating cost and machine model type. Improve the hashrate and efficiency of your S19 and S21 series rigs by downloading LuxOS firmware today!

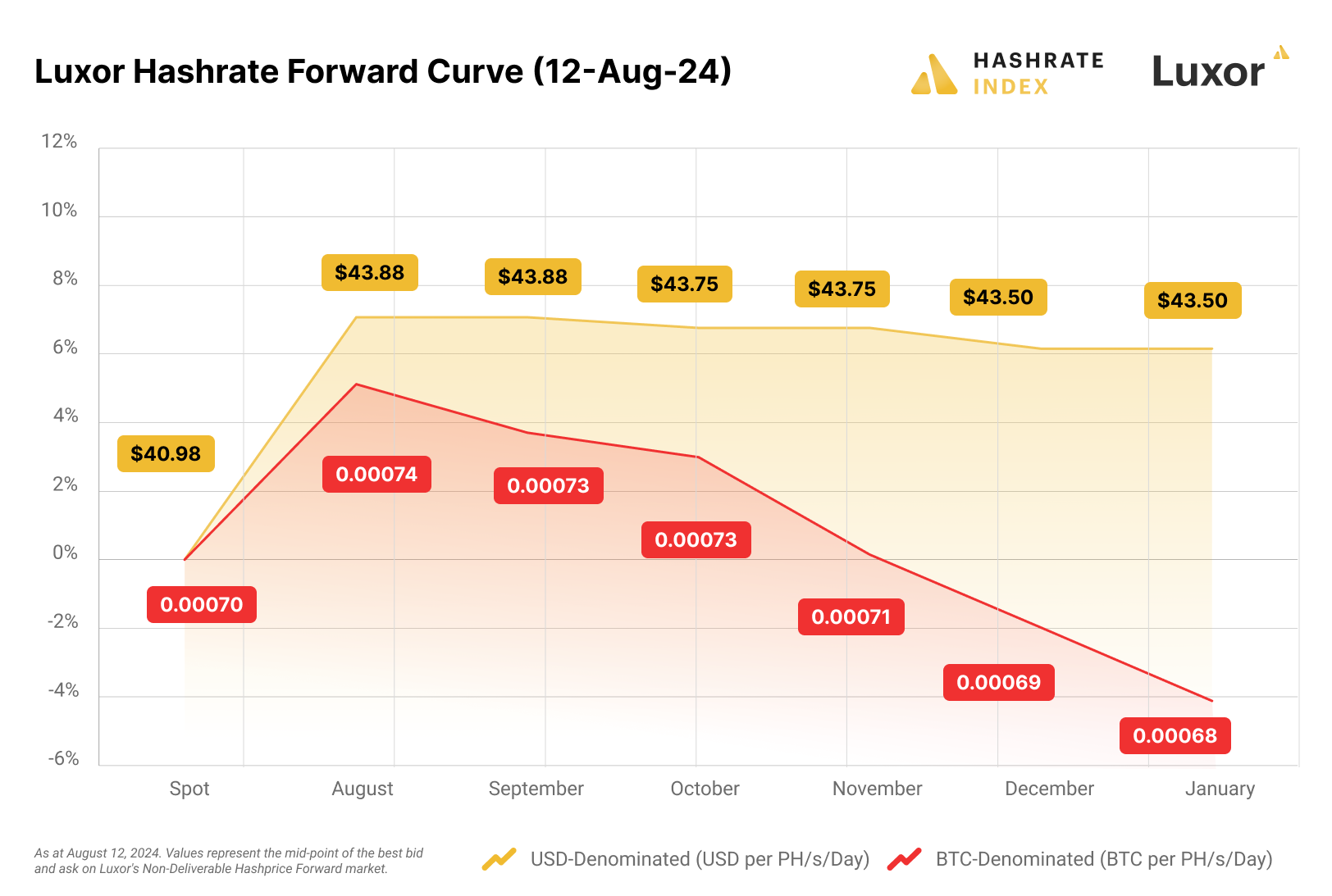

Luxor Hashrate Forwards Market Update

For this week's Hashrate Forwards market update, USD and BTC contracts from August through October continue to trade in contango. Miners can lock in a ~$43.50 hashprice up to 6 months in the future.

Bitcoin Mining Market Update

A stable trend for this week's update. Bitcoin and hashprice ticked up in USD terms.

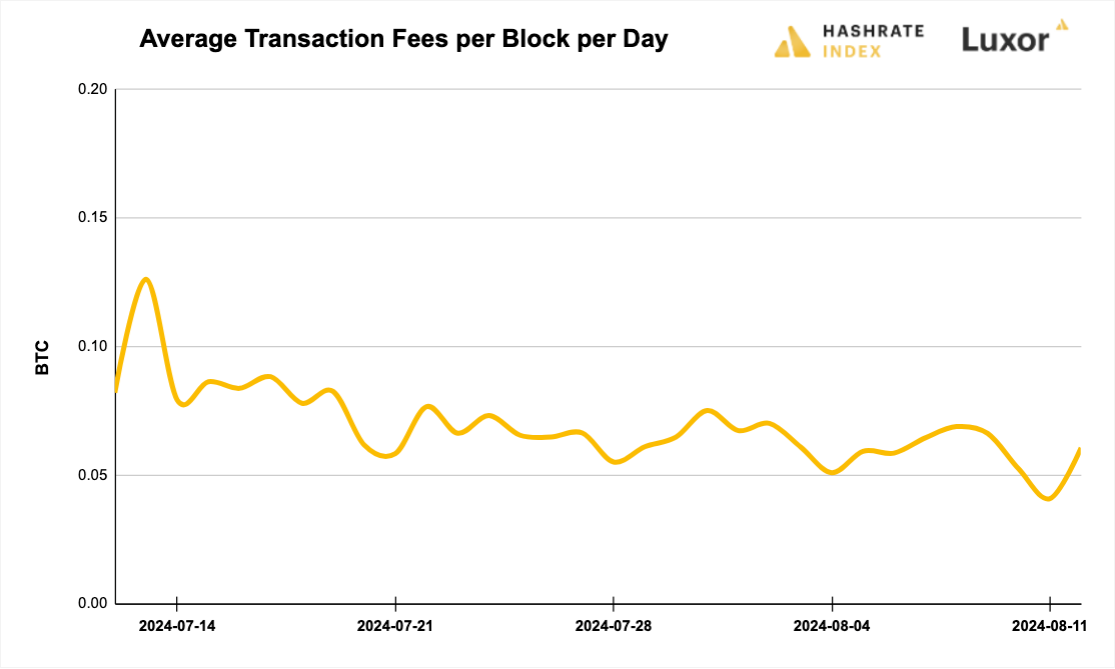

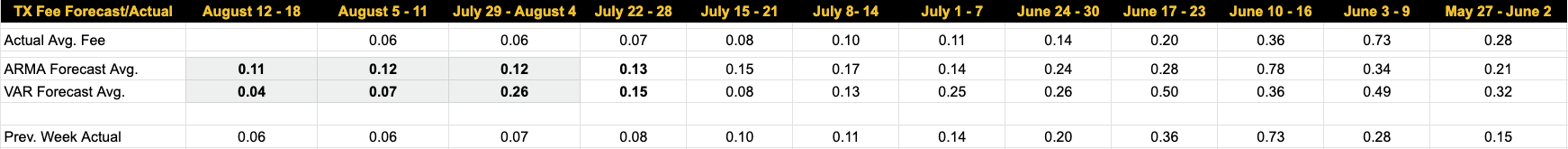

Bitcoin Transaction Fee Update

Transaction fees continue to trend down slightly. Over the past week, Bitcoin miners collected an average of 0.0589 BTC per block per day in transaction fees, a 8.11% decrease from the prior week's 0.0641 BTC.

Our transaction fee projection models remain bearish as we expect a low-fee, low-volatility environment to persist. For this week, our VAR model forecasts 0.04 BTC per block, and the ARMA estimates 0.11 BTC.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- Bitcoin Miner Reserves Drop to 3-Year Low in Wake of Halving

- Paraguay’s Power Chief: No Cryptocurrency Mining Company Has Left Yet

Bitcoin Mining Stocks Update

Bitcoin mining stocks bounced back throughout the past week, reflecting a 9.03% increase in our Crypto Mining Stock Index.

5-day changes to Bitcoin mining stocks as of prior week's market close:

- RIOT: $8.06 (+9.51%)

- HUT: $11.97 (+20.91%)

- BITF: $2.27 (+35.93%)

- HIVE: $2.88 (+10.77%)

- MARA: $17.03 (+22.39%)

- CLSK: $11.46 (+14.14%)

- IREN: $7.51 (+21.62%)

- CORZ: $9.70 (+38.37%)

- WULF: $3.79 (+34.40%)

- CIFR: $4.07 (+13.69%)

- BTDR: $7.89 (+17.59%)

- SDIG: $2.82 (+47.64%)

- FUFU: $4.48 (+40.44%)

Have a great week, and Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.