Hashrate Index Roundup (August 05, 2024)

Bitcoin down bad amidst macroeconomic storm, and hashprice hits an all-time low.

Hello world, happy Monday!

Bitcoin is off to a rough start, plummeting by approximately 18% throughout the past week from around $67,000 to a current price of $55,000. Financial markets experienced a significant sell-off across the board in light of a combination of macroeconomic factors, namely worsening U.S. labour market conditions, an unwinding of the Japanese Yen carry trade resulting from the Bank of Japan's interest rate hike from 0.1% to 0.25%, and rising geopolitical tensions in the middle east.

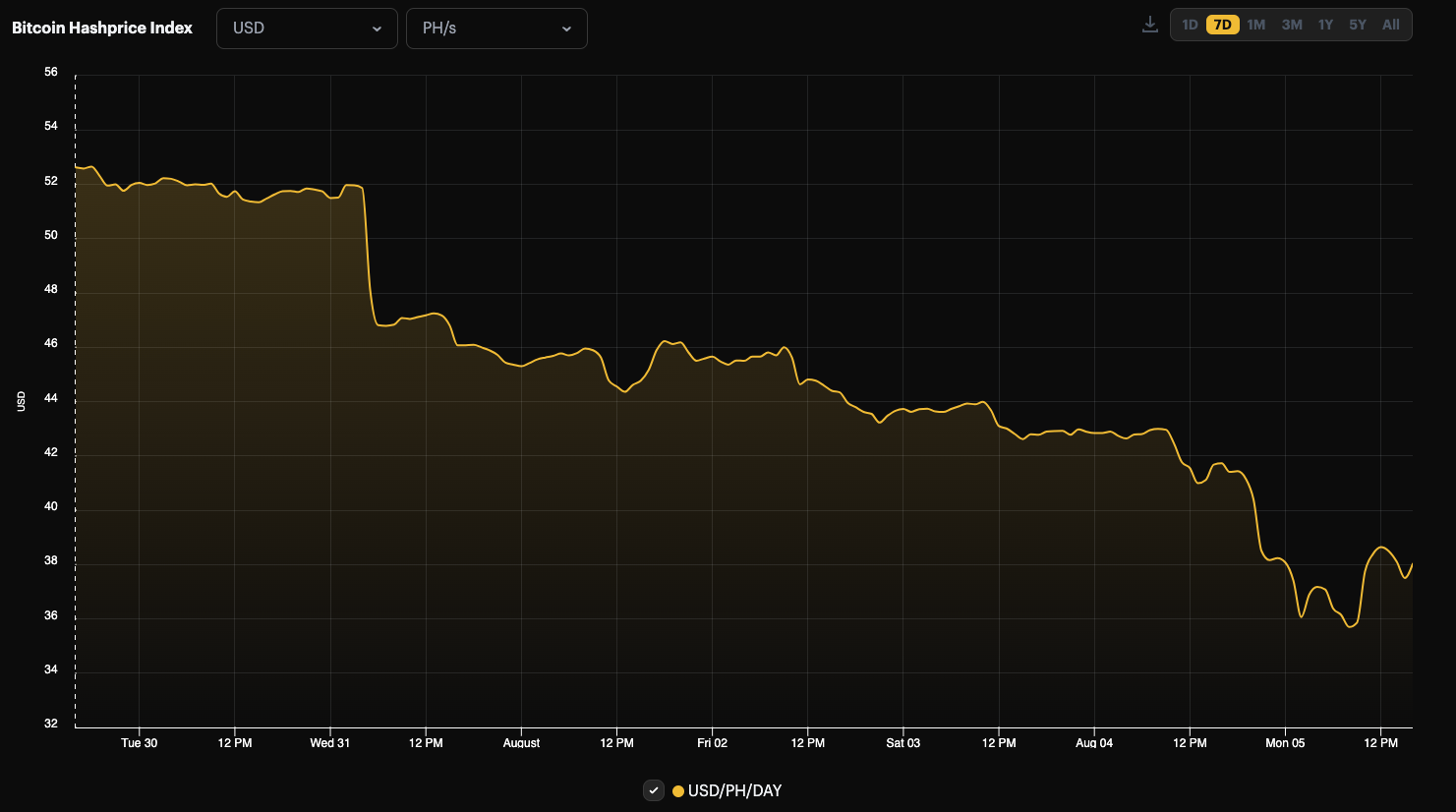

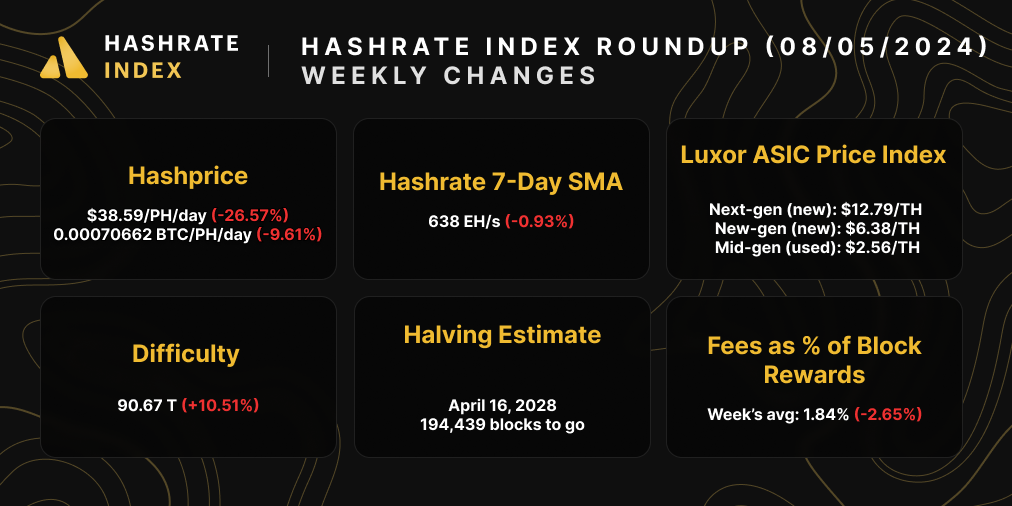

A significant drop in Bitcoin price paired with last week's difficulty adjustment of over 10% reflected painfully on hashprice, which hit an all-time low of $35/PH/Day earlier today, slightly rebounding to $38/PH/Day at the time of writing. Hashprice is down by 28% on a weekly basis, placing stress on miner profitability across the industry.

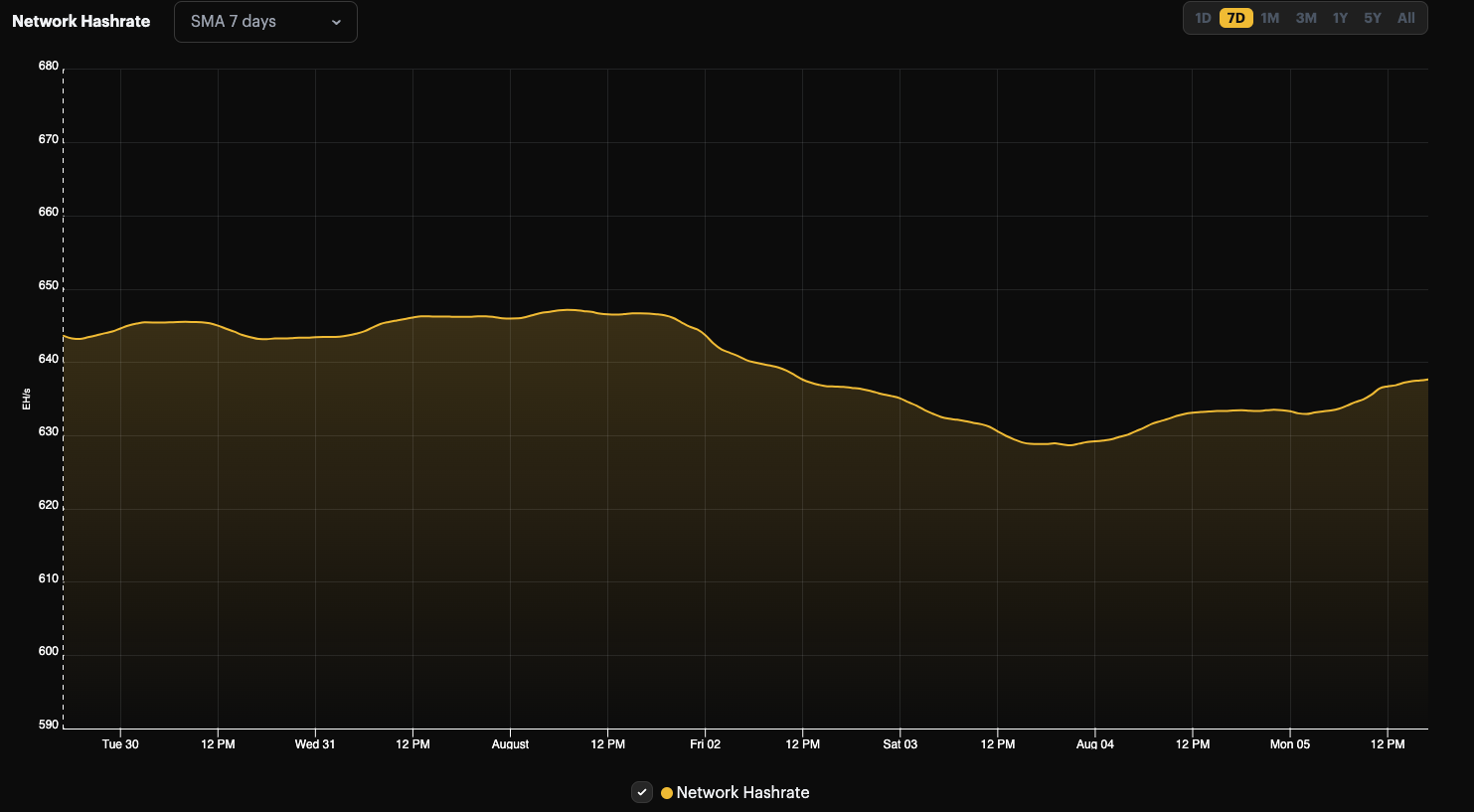

Despite bearish price action in Bitcoin and hashprice, global network hashrate remained relatively steady throughout the week. The 7-day simple moving average (SMA) network hashrate decreased by ~1% from 644 EH/s to a current 638EH/s, at the time of writing. This modest reaction may signal a turn towards lower seasonal hashrate volatility in the coming weeks to months, as energy curtailment programs for hot summer months are expected to calm down.

The modest hashrate decline led to an average block time of around 10 minutes 12 seconds throughout the week. We estimate a slight decrease in difficulty of ~2% for the upcoming adjustment on August 14th.

Sponsored by Luxor Firmware

At $38/PH/Day, hashprice is close to – or at – breakeven for many miners depedning on operating cost and machine model type. Improve the hashrate and efficiency of your S19 and S21 series rigs by downloading LuxOS firmware today!

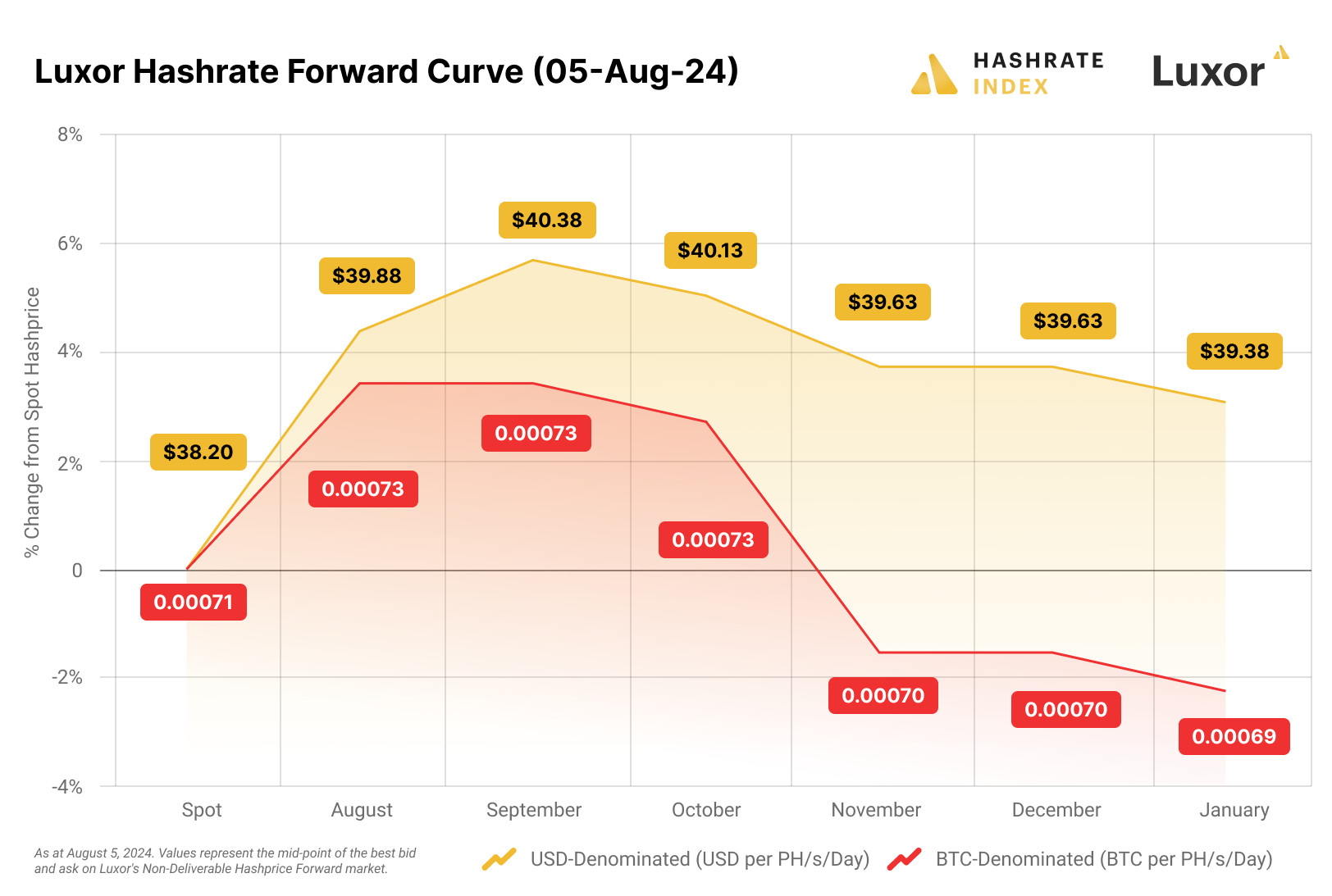

Luxor Hashrate Forwards Market Update

For this week's Hashrate Forwards market update, USD and BTC contracts from August through October are trading in contango. Miners can lock in a ~$39 hashprice up to 6 months in the future.

Bitcoin Mining Market Update

A downward trend for this week's update. Hashprice took a big hit in both USD and BTC terms.

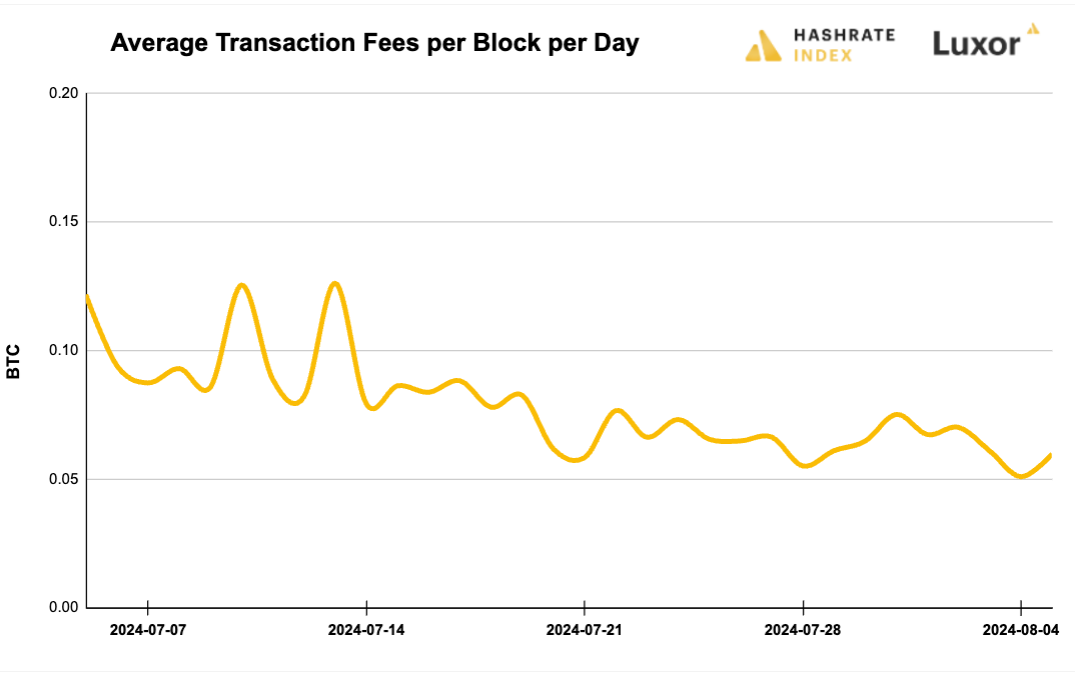

Bitcoin Transaction Fee Update

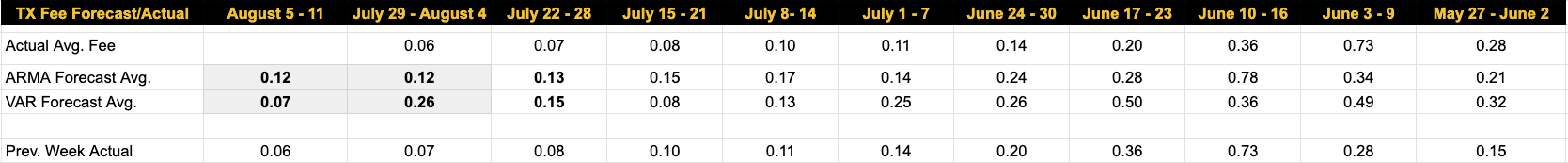

Transaction fees continue to trend down slightly. Over the past week, Bitcoin miners collected an average of 0.0643 BTC per block per day in transaction fees, a 3.89% decrease from the prior week's 0.0669 BTC.

Our transaction fee projection models remain bearish. For this week, our VAR model forecasts 0.07 BTC per block, and the ARMA estimates 0.12 BTC.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- US Senate Moves Bitcoin Reserve Bill To Banking Committee – Details

- Bitcoin Miner Riot Increases Stake in Bitfarms to 15.9%

- Talen Energy offers up nuclear-powered crypto mining campus stake, sources say

Bitcoin Mining Stocks Update

Bitcoin mining stocks continued to trend down throughout the past week, reflecting a 11.06% decrease in our Crypto Mining Stock Index.

5-day changes to Bitcoin mining stocks at prior week market close:

- RIOT: $8.57 (-26.44%)

- HUT: $12.40 (-22.16%)

- BITF: $2.18 (-21.30%)

- HIVE: $3.06 (-22.92%)

- MARA: $17.19 (-23.70%)

- CLSK: $13.48 (-24.27%)

- IREN: $8.62 (-12.31%)

- CORZ: $8.89 (-16.13%)

- WULF: $3.67 (-19.16%)

- CIFR: $4.33 (-28.07%)

- BTDR: $7.36 (-28.59%)

- SDIG: $2.67 (-21.01%)

Have a great week, and Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.