Energy Markets for Bitcoin Miners: Spot vs. Fixed Power Prices

Understand how Bitcoin miners participate in power markets.

As Bitcoin miners become increasingly sophisticated power market participants, their ability to manage energy costs becomes a competitive edge.

This post is the first in a series exploring how miners can navigate power market risk. We’ll start by outlining the two foundational strategies: spot and fixed-price power. Future posts will build on this framework by examining advanced structures such as:

- Fixed-price power with Short Call Options and Hashrate Derivatives

- Ancillary Services & Demand Response

- “As-Generated” Colocation Models with and without Grid Backfill

- Offgrid Mining Setups

Each structure offers a different hedge profile — blending certainty, flexibility, and opportunity in unique ways.

To begin, let’s explore how miners can align their power strategy with market conditions, operational constraints, and risk tolerance.

Understanding Hedge Profiles

Once a mining operation knows its breakeven cost of power* — expressed in $/MWh via Energy Hashprice — it can begin to make informed decisions about how to hedge its exposure to volatile energy markets.

There’s no one-size-fits-all strategy. Instead, miners choose from a spectrum of approaches, each offering a distinct balance between flexibility, certainty, and exposure. Let’s start with the most flexible — spot power — and work toward structures that lock in more certainty.

*Note: in practice, the breakeven cost of power is a moving target for miners leveraging custom firmware — such as LuxOS — which is specialized software that automatically tunes the ASIC fleet’s efficiency profile, unlocking a wider range of economically viable operating conditions.

This series makes a simplifying assumption that mining operations utilize stock firmware. Click here to learn more about how to maximize your mining margins with LuxOS.

Spot Power: Maximum Flexibility, Maximum Risk

Operating on spot power means paying real-time electricity prices with no long-term contracts. This offers miners the ultimate flexibility but also full exposure to volatility.

In this structure, Energy Hashprice becomes a live breakeven threshold. Every five-minute interval is a decision point: if the real-time power price is below breakeven, mine; if it’s above, curtail.

As shown in Chart 1, miners dynamically adjust their load to follow market profitability, curtailing when prices exceed breakeven.

The mining operation’s load dynamically responds to price movements, ramping down during uneconomic intervals, and returning online when profitability resumes.

Chart 2 illustrates how a responsive miner can avoid most uneconomic intervals by curtailing quickly.

While this minimizes short-term downside, it leaves the operator fully exposed to longer-term price volatility. If elevated prices persist — especially during periods of falling hashprice — miners may be sidelined for extended periods, eroding returns on investments.

Bottom line: Spot exposure provides flexibility but no price certainty.

Fixed Price Power: Certainty and Optionality

To reduce exposure to real-time volatility, many miners enter fixed-price power contracts, most commonly through Power Purchase Agreements (PPAs).

Under a PPA, miners commit to buying a fixed volume of power at a predetermined price, whether they use it or not. When the power isn’t used for mining, it can be resold back into the grid at the prevailing spot price.

This structure gives the miner a second revenue option for each MWh: either convert it to Bitcoin or sell it.

Chart 3 shows how load curtailment differs under fixed-price contracts.

Rather than powering down, miners reduce their consumption and divert the surplus power back to the grid when it’s more profitable to sell than to mine.

Chart 4 shows the upside of this approach: curtailment becomes a source of revenue, not just a way to avoid loss.

The miner earns from resale during high-priced intervals, capturing value that a spot miner would miss.

Key takeaway: Fixed-price contracts lock in costs and turn volatility into opportunity.

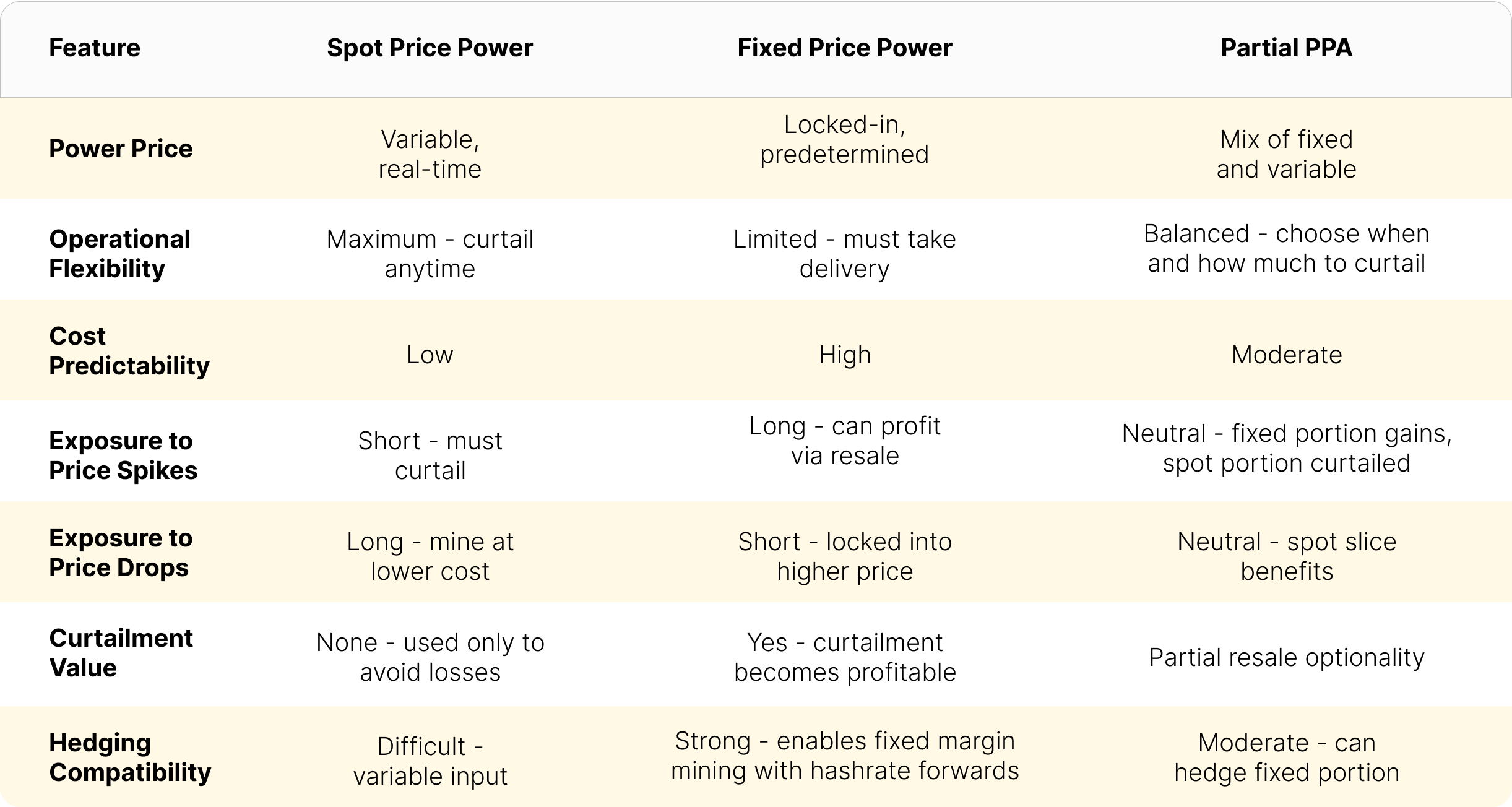

Spot vs. Fixed: Comparing Exposure

Each structure exposes miners to different types of market risk:

- Spot miners are short real-time power — they benefit when prices fall, and suffer when prices rise.

- Fixed-price miners are long real-time power — they benefit from high prices, assuming they can monetize via resale.

There’s also a key difference in how each structure interacts with volatility:

- Spot miners are neutral to price spikes once they shut down. Whether power hits $80 or $800/MWh, it doesn’t matter once they’re offline.

- Fixed-price miners are long volatility. The more prices swing, the more they can profit by diverting power to the grid during price spikes.

This asymmetry in volatility exposure is clearly illustrated by comparing Chart 2 (spot) and Chart 4 (fixed).

Partial PPAs: Blending Certainty and Flexibility

Of course, real-world power strategies are rarely all-or-nothing. Many miners opt for partial PPAs — blending fixed and spot exposure to balance flexibility and price certainty.

As shown in chart 5, this mixed structure produces a profit curve that’s less extreme than either full spot or fully fixed.

The miner captures some upside in favorable market conditions while limiting downside in tougher ones.

For instance, a 20MW site might secure 10MW under a long-term PPA, while leaving the other 10MW exposed to real-time prices. This structure creates two economic modes:

- The fixed slice provides operational stability and resale potential during spikes.

- The spot slice allows responsiveness to price drops and avoids locking into high forward prices.

This is the essence of hedging: reducing uncertainty. Hedging is not about maximizing upside, it’s about avoiding the worst-case scenario.

Conclusion: Hedging Starts with Structure

In today’s volatile energy environment, miners must choose how to balance optionality with protection.

- Spot strategies work for highly agile miners comfortable with short-term volatility.

- Fixed-price PPAs support long-term planning and unlock revenue during spikes.

- Partial PPAs provide a flexible middle ground.

The key is understanding your breakeven — via Energy Hashprice — and using it to inform a hedge profile that matches your risk appetite, operating model, and market view.

In the next posts in this series, we’ll explore advanced strategies miners are using to deepen their exposure to power markets — and extract value beyond just producing Bitcoin.

If you’d like to learn more about Luxor’s Bitcoin mining services, please reach out to [email protected] or visit https://luxor.tech/mining.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

There are risks associated with trading derivatives. Trading in derivatives involves risk of loss, loss of principal is possible.

📙⚡ Glossary: Key Energy Terms for Bitcoin Miners

Energy Hashprice

The revenue a miner earns per unit of electricity consumed, typically expressed in $/Wh. It accounts for both hashprice and machine efficiency, making it the foundational breakeven metric for mining operations.

Hashprice

A measure of expected miner revenue per unit of hashrate, expressed in either BTC or USD per PH/s/day. It reflects BTC price, block subsidy, transaction fees, and network difficulty.

Breakeven Power Price

The maximum electricity cost a miner can pay while remaining profitable. Calculated based on energy hashprice. With custom firmware, this value becomes variable.

Spot Power

Electricity purchased on real-time or day-ahead wholesale markets at variable rates. Prices fluctuate based on grid demand, weather, generation mix, and other real-time factors.

Fixed Price Power

Electricity secured through a long-term Power Purchase Agreement (PPA) or contract at a predetermined $/MWh rate. Offers cost predictability and stability.

Power Purchase Agreement (PPA)

A contractual agreement to buy a fixed volume of power at a fixed price over a defined term. PPAs are common in commercial and industrial energy procurement.

Partial PPA

A hybrid power strategy combining fixed and spot exposure. For example, locking in part of a site’s load under a PPA while leaving the rest exposed to real-time prices.

Load Profile (or Load Flexibility)

The ability of a mining operation to dynamically adjust its electricity consumption in response to market conditions or grid signals.

Curtailment

The act of voluntarily reducing or stopping power consumption, often to avoid uneconomic mining during high price periods or to participate in grid programs.

Resale (or Grid Resale)

Selling unused power back to the grid at prevailing spot prices. Common under fixed-price contracts when mining becomes less profitable than reselling electricity.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.