Hashrate Index Roundup (April 15, 2024)

The Fourth Bitcoin Halving is coming this Friday -- and things are looking OK for miners.

Happy Monday, y'all!

The Fourth Bitcoin Halving is four days away, so we're getting closer and closer to knowing just how much money miners will be able to earn after the event.

Bitcoin's is down 12% in the past week, so expectations for post-Halving hashprice have dropped accordingly. That said, transaction fees are starting to pick up again thanks to inscription / ordinal activity, somewhat offsetting the negative impact that bitcoin's current decline has effected on hashprice.

If the current hashprice of $107/PH/Day sticks, then miners are looking at an immediate post-Halving hashprice of $53.5/PH/Day. Let's compare that to the hashcost (aka hashprice breakeven) for the following popular rigs at $0.07/kWh power cost:

- S21: $29.40/PH/Day

- M60S: $31.08/PH/Day

- S19 XP: $36.12/PH/Day

- M50s++$36.96/PH/Day

- S19j Pro: $49.56/PH/Day

- M30S++: $52.08/PH/Day

Put another way, if the Halving were to happen today, all of the above models would still be profitable at $0.07/kWh, underscoring our findings in our recent 2024 Halving report that it's unlikely that much hashrate (if any at all) will come offline immediately after the Halving.

Now, hashprice likely won't stay at the level we presented for the above breakeven analysis given Bitcoin's volatility. And it's also unlikely to stay put given the current trajectory of ordinal-driven transaction fees, especially given the launch of the new Runes fungible token protocol on Bitcoin that we discussed last week. If these Runes have a similar impact as BRC-20 tokens, it's possible that transaction fees match the post-Halving block subsidy of 3.25 BTC, which would essentially nullify the Halving's negative impact on mining revenue.

Needless to say, this Halving is gearing up to be an unprecedented one and perhaps the most exciting yet. We'll see y'all on the other side.

Sponsored by Luxor RFQ

The Antminer S21 is here, and Luxor's ASIC Trading Desk is accepting orders for this model right now! If you'd like to place a preorder for the Antminer S21, please fill out this form. Secure your order for Bitmain's most efficient and powerful ASIC miner today!

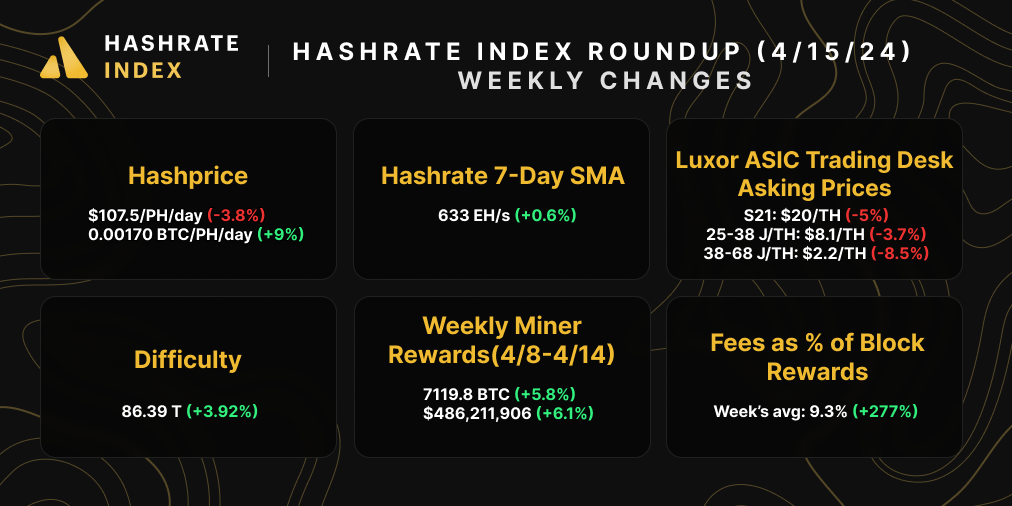

Bitcoin Mining Market Update

Mostly green these week, with the exception of ASIC prices and USD hashprice. Transaction fees surged last week, reportedly from mempool sniping from ordinal traders. ASIC prices are still dropping like rocks as miners and brokers reprice inventory. The last difficulty adjustment of the current Halving epoch occurred last week (surprise! it was a positive one), and hashrate barely budged.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- Bitcoin Halving Has Crypto Miners Racing for 'Epic Sat' Potentially Worth Millions

- Norway Wants to Restrict Crypto Mining by Regulating Data Centers, Lawmakers Say: Report

- Paraguay to Evaluate Enhanced Regulation for Bitcoin Mining

Bitcoin Mining Stocks Update

It was a brutal week for Bitcoin mining stocks. Week-over-week, every stock in our update is in the red, all but one fell by double digits, and our benchmark Crypto Mining Stock Index fell 11% over the week.

Weekly changes to Bitcoin mining stocks:

- RIOT: $8.57 (-13.65%)

- HUT: $7.24 (-18.38%)

- BITF: $1.73 (-13.93%)

- HIVE: $2.68 (-14.54%)

- MARA: $15.15 (-14.98%)

- CLSK: $14.69 (-2.72%)

- IREN: $4.33 (-19.07%)

- CORZ: $2.83 (-15.77%)

- WULF: $1.94 (-14.16%)

- CIFR: $3.65 (-13.10%)

- BTDR: $5.65 (-20.98%)

- SDIG: $2.23 (-36.65%)

Happy Hashing, and have a great week!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.