Hashrate Index Roundup (September 23, 2024)

Mining economics trend steady as September turns.

Hello world, happy Monday!

Bitcoin trended up throughout the past week, increasing by 8.46% from ~$58,500 to a current price of ~$63,450. Price action continues to exhibit seasonality in line with empirical data, i.e., towards the downside during the latter end of Summer and towards the upside as seasons shift into Fall.

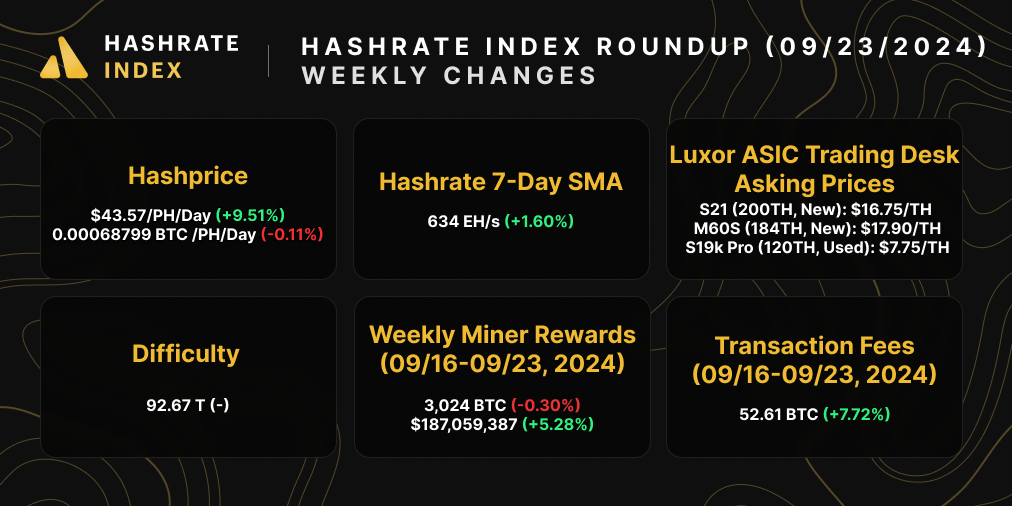

Hashprice responded with a healthy uptrend throughout the week, increasing by 9.51% from $39.80 per PH/s/Day to $43.57 per PH/s/Day, at the time of writing. A welcome boost in week-to-week profitability for miners.

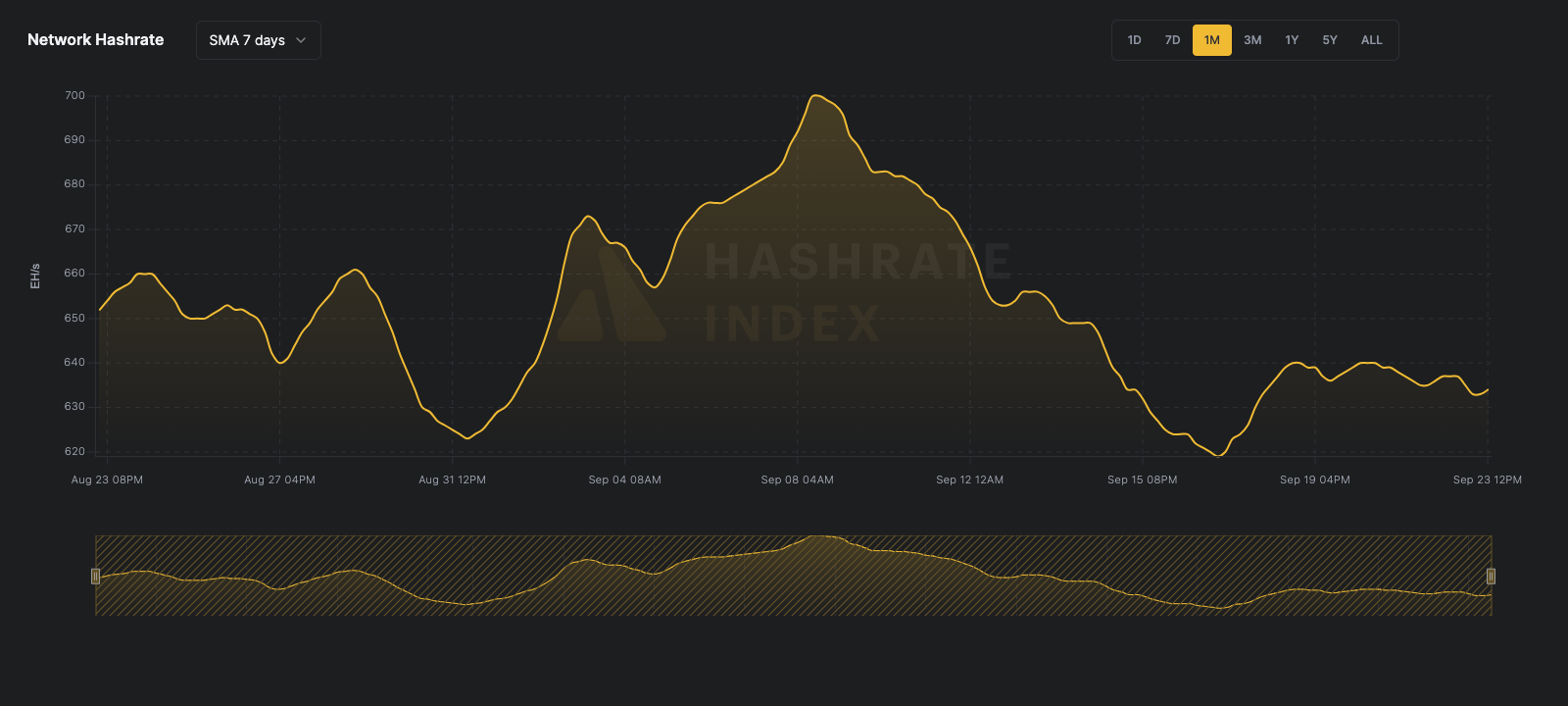

Beyond price action in Bitcoin and hashprice, global network hashrate showed a very slight rebound with the 7-day simple moving average (SMA) increasing by 1.60% from 624EH/s to 634EH/s throughout the week. Compared to the steep downturn experienced two weeks ago, the 7-day SMA remains ~2.16% below the 30-day SMA of 648EH/s and ~9.43% below its all-time high of 700EH/s.

Blocks were found at an average time of around 10 minutes 34 seconds throughout the week, a very slight pick up in pace as compared to the week prior at 10 minutes 40 seconds. We estimate a healthy decrease in difficulty of ~5.19% for the upcoming adjustment expected to occur on September 25th.

Sponsored by Luxor Firmware

At $43/PH/Day, hashprice is close to – or at – breakeven for many miners depedning on operating cost and machine model type. Improve the hashrate and efficiency of your S19 and S21 series rigs by downloading LuxOS firmware today!

Hashrate Index V.30

Building on our recently released revamp of Hashrate Index, we are excited to introduce two new metrics in addition to a new REST API for improved access to Hashrate Index data:

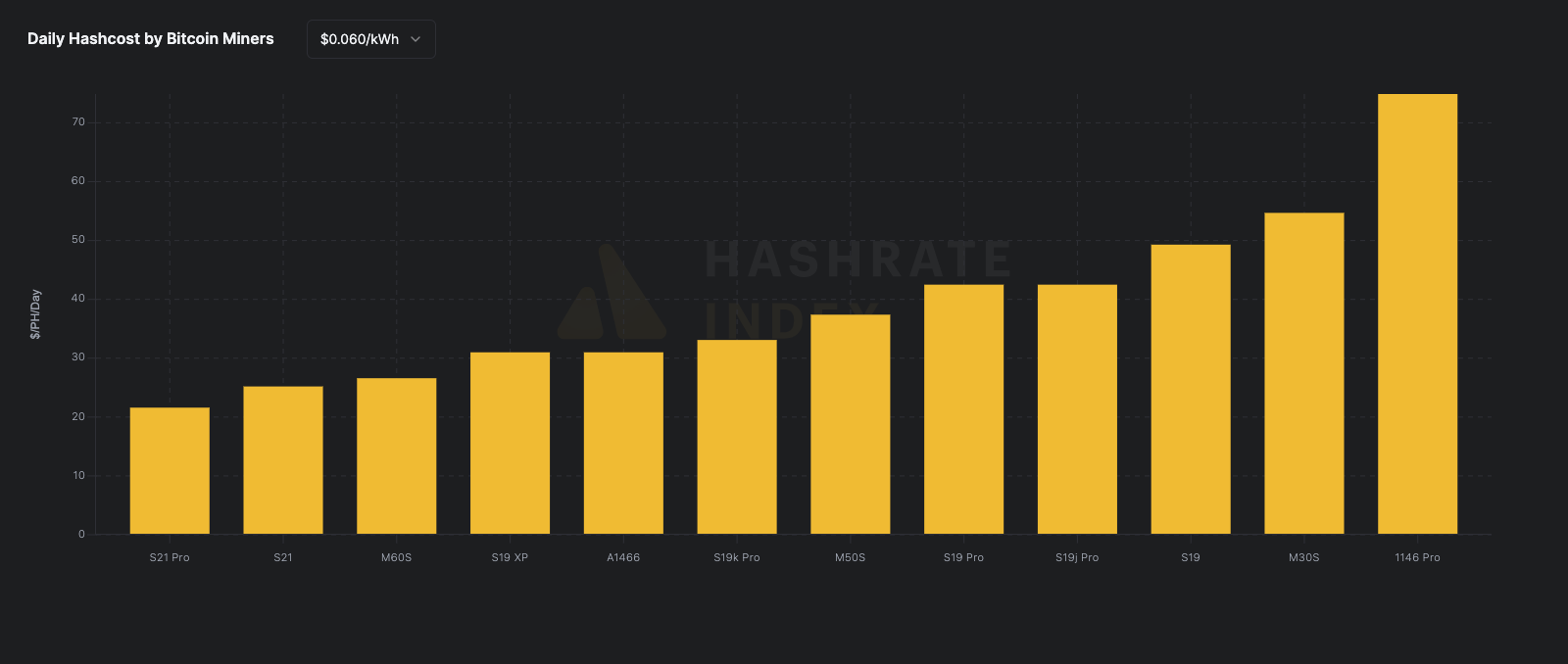

Hashcost refers to the total economic cost of producing a certain amount of cryptographic hashes for bitcoin mining, which is measured in USD/TH/s/day. It represents the expense Bitcoin miners face to generate one terahash of computational power per second over a 24-hour period.

By comparing their hashcost with the open market hashprice (the revenue miners can earn per terahash), miners can assess whether their operations are cost-effective and analyze how fluctuations in energy prices, mining difficulty, and Bitcoin's price may affect their business.

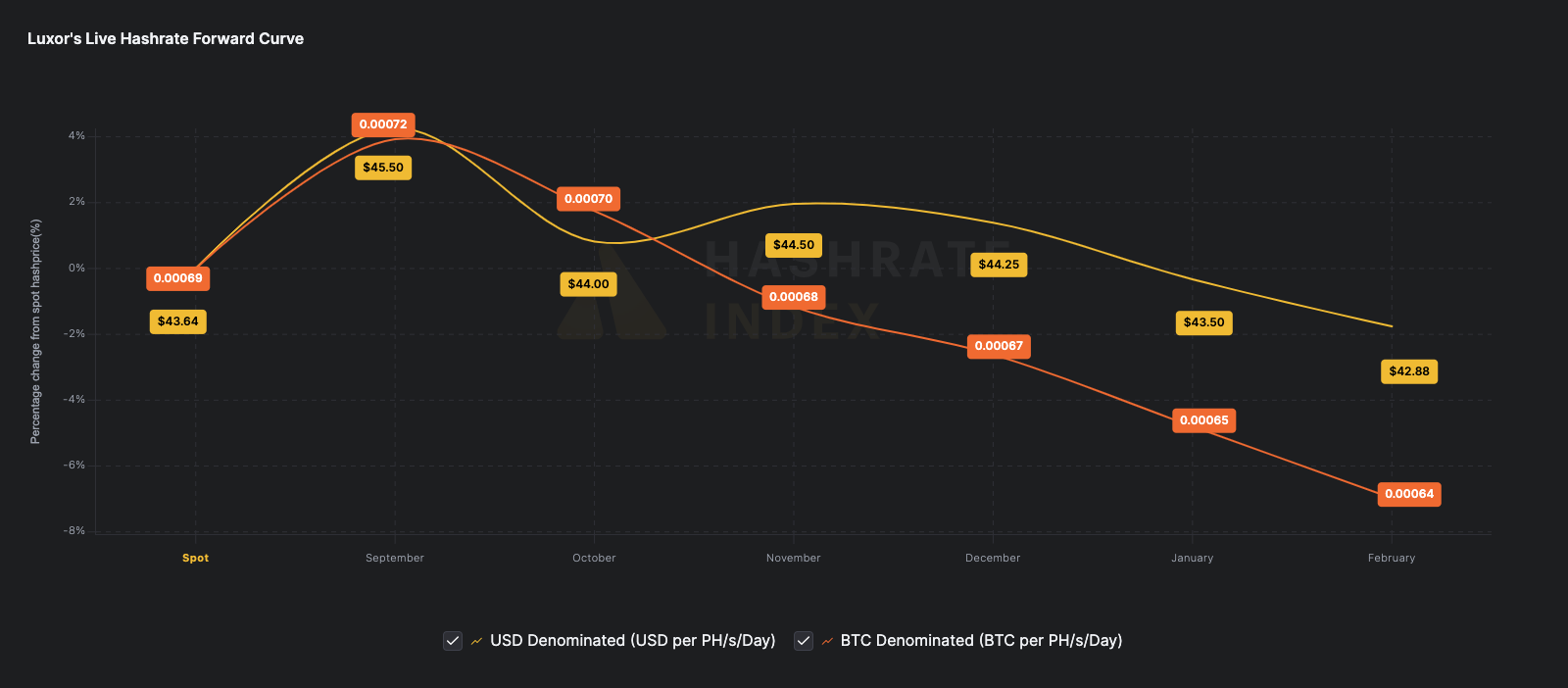

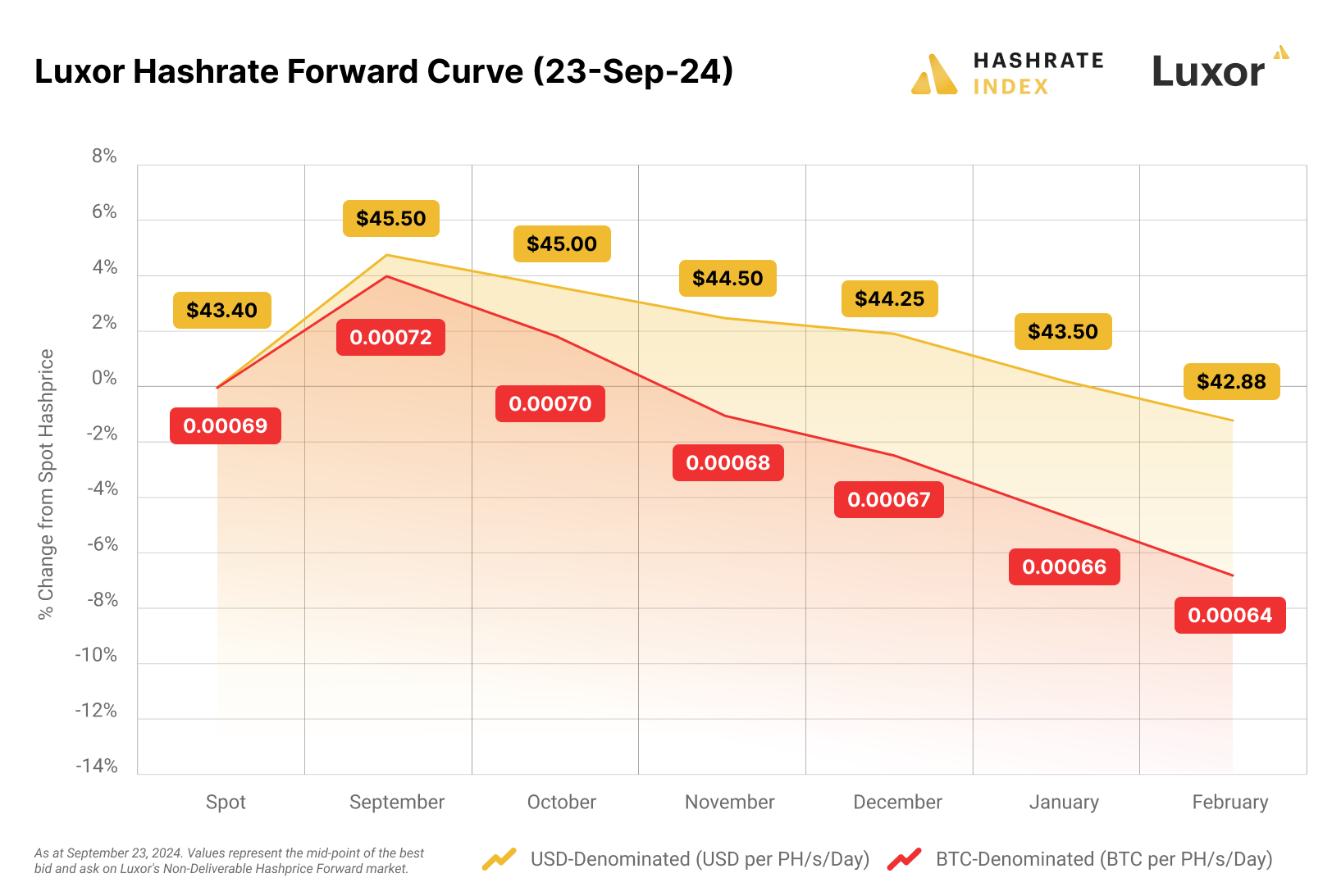

Luxor's Hashrate Forward Curve is now live on Hashrate Index. To view and start participating in the market, register with Luxor Derivatives.

Are you ready to experience Hashrate Index V3.0? Click here to begin your journey.

For more details, you can refer to the product changelog.

Luxor Hashrate Forwards Market Update

For this week's Hashrate Forwards market update, USD contracts are trading in contango whereas BTC contracts are trading in backwardation. Miners can lock in a ~$42.88 hashprice for up to six months into the future.

Bitcoin Mining Market Update

A positive trend for this week's update. Hashprice and hashrate are up, network difficulty is expected to decrease. Miners collected a total of ~3,024 BTC in block rewards, equivalent to ~$187.1 million. Transaction fees constituted 1.67% of block rewards, totalling 52.61BTC, equivalent to ~$3.25 million.

Bitcoin Transaction Fee Update

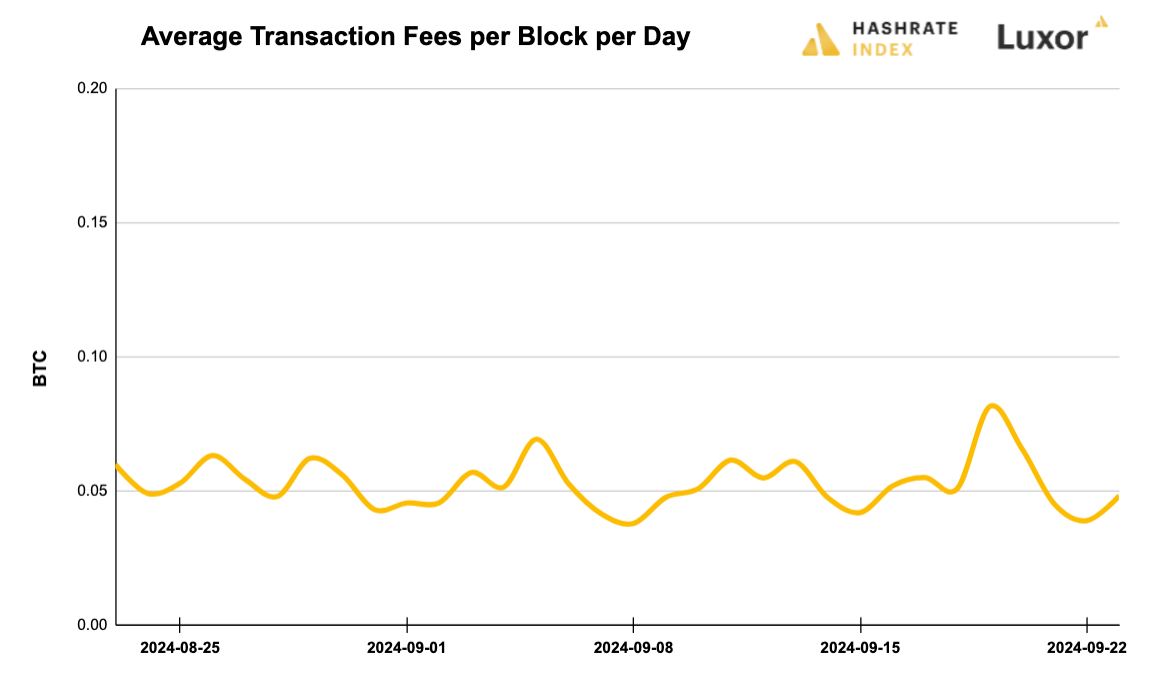

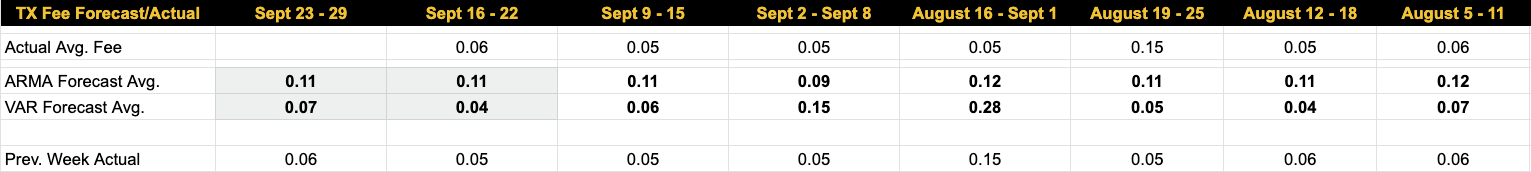

Over the past week, Bitcoin miners collected an average of 0.0550 BTC per block per day in transaction fees compared to the prior week's 0.0528 BTC, a 4.17% increase.

Our transaction fee projection models remain relatively bearish as we expect a low-fee, low-volatility environment to persist in the medium term. For this week, our VAR model forecasts 0.07 BTC per block per day and the ARMA estimates 0.11 BTC per block per day.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- Bitcoin Miners Riot and Bitfarms Reach Settlement Ahead of Shareholder Meeting

- Hut 8 and BITMAIN Expand Innovation Partnership with Launch of Next-Generation BITMAIN Miner

- Rhodium Seeks Court Order for Bitcoin Mining Sales in Chapter 11

Bitcoin Mining Stocks Update

Bitcoin mining stocks trended slightly up throughout the past week, reflecting a 1.34% increase in our Bitcoin Mining Stock Index.

5-day changes to Bitcoin mining stocks as of prior week's market close:

- RIOT: $7.19 (+3.16%) | Mkt Cap: $2.18B

- HUT: $11.17 (+2.20%) | Mkt Cap: $1.02B

- BITF: $2.00 (+1.01%) | Mkt Cap: $0.91B

- HIVE: $3.11 (+4.25%) | Mkt Cap: $0.385B

- MARA: $15.54 (-0.83%) | Mkt Cap: $4.58B

- CLSK: $8.99 (-1.43%) | Mkt Cap: $2.28B

- IREN: $7.50 (+3.37%) | Mkt Cap: $1.42B

- CORZ: $11.98 (+8.42%) | Mkt Cap: $3.09B

- WULF: $4.50 (+12.22%) | Mkt Cap: $1.72B

- CIFR: $2.90 (-3.33%) | Mkt Cap: $0.953B

- BTDR: $7.13 (+4.85%) | Mkt Cap: $0.992B

- FUFU: $3.44 (-31.88%) | Mkt Cap: $0.560B

- CAN: $1.01 (+00.00%) | Mkt Cap: $0.291B

Have a great week, and Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.