Hashrate Index Roundup (April 29, 2024)

Hashprice is at an all-time low -- let the games begin.

Happy Monday, y'all!

The bottom's dropped out for hashprice.

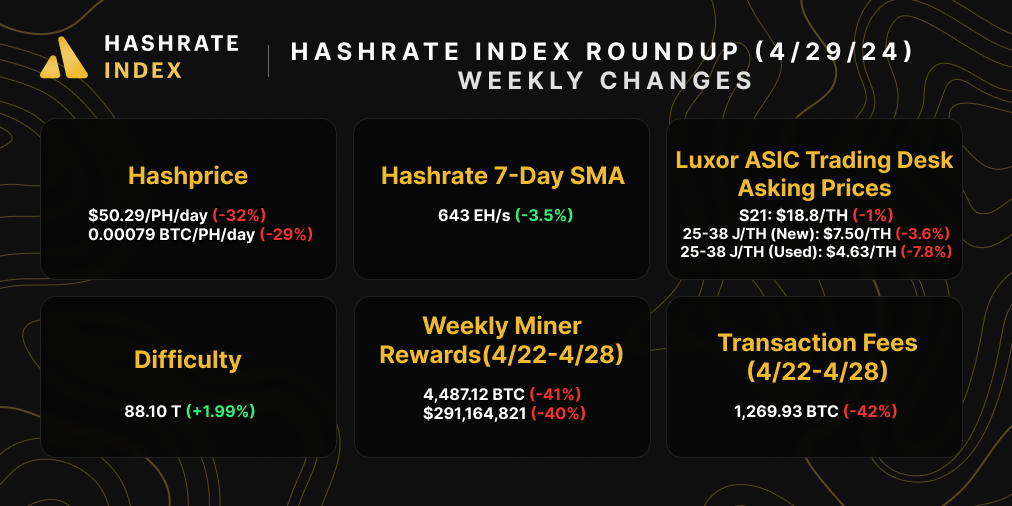

Today, hashprice printed all-time lows of $49.44/PH/Day and 0.00079 BTC/PH/Day. These all-time lows mark a 50% decline from hashprice right before the Halving and a staggering 70% decline from hashprice right after the halving when miners were splurging on blocks turgid with Runes-related transaction fees. (If you need a primer on Runes and how ordinal degens bid up fees after the Halving, we wrote about it for last week's Roundup).

The party's over for Runes (at least for now), so transaction fees have deflated and hashprice with it. Troublingly, though, there was an average of 1.13 BTC in transaction fees per block over the last week (which equates to 36% of the current subsidy of 3.125), and over the last 24 hours, the average fee per block has been 0.35 BTC (11% of the current subsidy). So fees are still pretty elevated, and hashprice could fall significantly still if fees continue to taper off.

Now that we've established that hashprice is in the shitter, let's take a look at the hashcost (a.k.a hashprice breakeven) for popular mining rigs at $0.06/kWh power costs. Hashcost is presented in terms of $/PH/Day, and it represents the cost per day to operate a mining rig/fleet:

- S21 (200 TH): $25.20

- M60S (186 TH): $26.64

- S19 XP (141 TH): $30.96

- M50S++ (150 TH): $31.68

- S19k Pro (120 TH): $33.12

- S19j Pro (100 TH): $43.92

- M30S++ (112 TH): $44.64

Margins are getting thin out there y'all. But if it's any consolation – and admittedly, it's not much of one – blocks are coming in more slowly as hashrate starts to come offline as a result of the all-time low hashprice, so we're projecting a -2% difficulty adjustment on May 9.

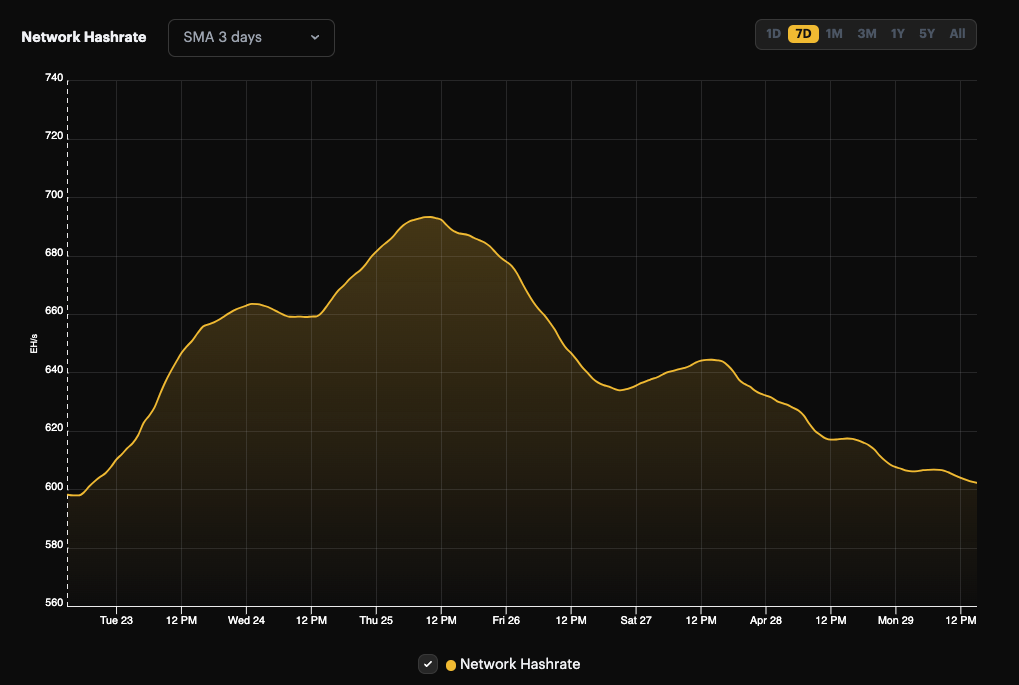

We can see hashrate tapering if we look at the 3-day average over the last week. Now, admittedly, this could be luck variance playing with hashrate estimates, so we'll have to wait to see what the 7-day average looks like at the end of next week to get a clearer picture; that said, the decline in light of hashprice's fall from grace is notable, and it stands to reason that some hashrate would come offline at these levels.

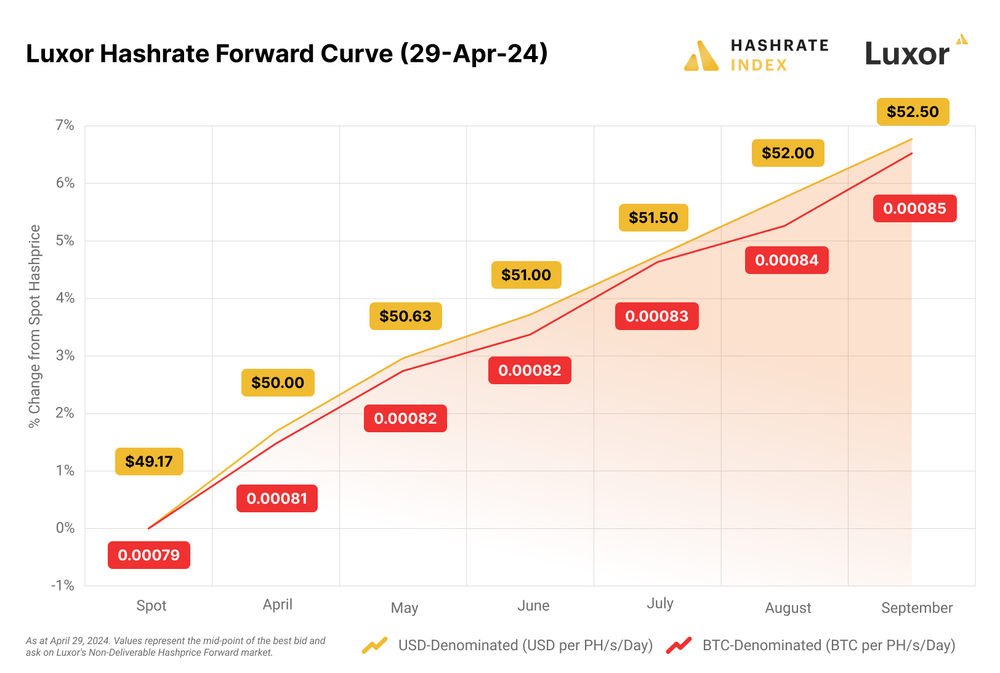

Naturally, most miners are fretting over where hashprice goes from here. It's worth noting that Luxor's Hashrate Forwards are trading in contango through September, which means that the contract prices for these forward contracts (which are essentially future contracts, although they trade OTC and not on an exchange) are trading above the current spot price. This means that Luxor Hashrate Forward traders expect hashprice to increase over the next five months by way of either an increase in transaction fees or a decrease in Bitcoin mining difficulty.

And after that tiny dose of hopium, on to the rest of the newsletter...

Sponsored by Luxor RFQ

The Antminer S21 is here, and Luxor's ASIC Trading Desk is accepting orders for this model right now! If you'd like to place a preorder for the Antminer S21, please fill out this form. Secure your order for Bitmain's most efficient and powerful ASIC miner today!

Bitcoin Mining Market Update

The only green metrics in our update are hashrate and Bitcoin's mining difficulty (the two metrics that miners don't want to see in the green). As we touched on earlier, transaction fees have shrunk significantly, so weekly mining rewards have cratered accordingly. ASIC prices continue to fall after the Halving, with used new-gen equipment falling below $5/TH.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- Jack Dorsey's Block Mining: 3nm chip headed to the foundry

- Key Measure of Bitcoin Mining Profitability Nears All-Time Lows

- Bitcoin Miner Boosting Memecoins Allure Already Begins to Wane

- Amid Shifts in Bitcoin Mining Economics, Steep Discounts Emerge for Older ASIC Rigs

Bitcoin Mining Stocks Update

Bitcoin mining stocks in our update fell across the board (with the exception of Marathon) last week, perhaps in response to the grim reality of post-halving margins setting in, and our benchmark Crypto Mining Stock Index is down 2.4%.

Weekly changes to Bitcoin mining stocks:

- RIOT: $11.08 (-0.27%)

- HUT: $8.34 (-8.20%)

- BITF: $1.89 (-6.90%)

- HIVE: $2.83 (-3.74%)

- MARA: $18.03 (+3.74%)

- CLSK: $18.12 (-3.31%)

- IREN: $4.69 (-13.31%)

- CORZ: $3.17 (-1.55%)

- WULF: $2.33 (-6.43%)

- CIFR: $4.04 (-9.02%)

- BTDR: $6.03(-7.94%)

- SDIG: $3.15 (-13.70%)

Happy Hashing, and have a great week!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.