Hashrate Index Q1-2024 Report: The Specter and Fallout of the Halving

Q1-2024 and the Fourth Halving are in the books. We cover their impact in our latest report.

Our Q1-2024 report is here, and in light of the Fourth Bitcoin Halving, we decided to shake things up for this report by running the numbers for Q1 while also diagnosing the immediate impact of the Halving.

Bitcoin’s Fourth Halving has come and gone, and the event will go down as the most impactful Halving yet for a number of reasons. For one, the Bitcoin mining industry has never been larger nor has there ever been so much at stake. Further, Bitcoin has attained a mainstream acceptance that it never enjoyed in past Halvings, something that is best exemplified by the Bitcoin ETFs that launched in January of this year. And activity on the Bitcoin network has never been higher, including from alternative, non-financial use cases (namely, Inscriptions/Ordinals and Runes) that are boosting transaction fees when miners need them most.

In this report, we provide a recap of Q1-2024 through the lens of the Fourth Bitcoin Halving, and we include data through April and the first week of May where applicable to show the immediate impact of the event on network data, hashprice, ASIC prices, Bitcoin mining stocks, and other aspects of the mining industry. You can download the full report below:

For the remainder of today's newsletter, we've included a small sample of the data and analysis we packed into the report.

Bitcoin's Hashrate Grows then Slows

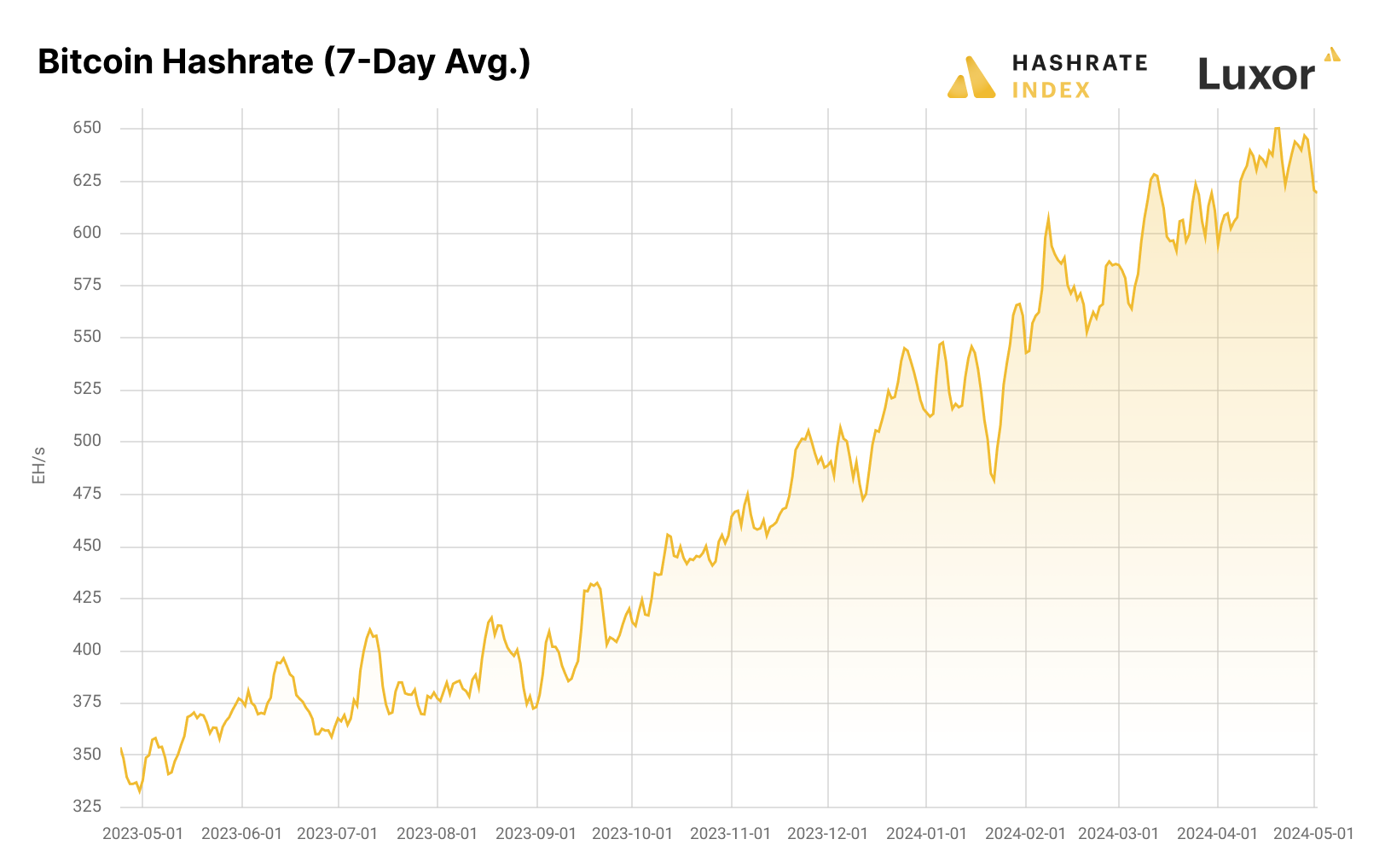

Bitcoin’s 7-day average hashrate increased by 19% over Q1-2024 to 611 EH/s. As of May 6, 2024, Bitcoin’s 7-day average hashrate was 604 EH/s, making the year-to-date change 17% and the year-over-year change 73%.

hashrate began to taper off the network the week of April 29. We can see this drop both on the 3-day average and the 7-day average, as shown in the chart below. As of May 8, Bitcoin’s 7-day average hashrate had dropped 11% from 650 EH/s the day of the halving to 581 EH/s. For comparison, the 2020 Halving sun set 15% of Bitcoin’s hashrate in its aftermath.

Hashprice Explodes Then Hits All-Time Lows

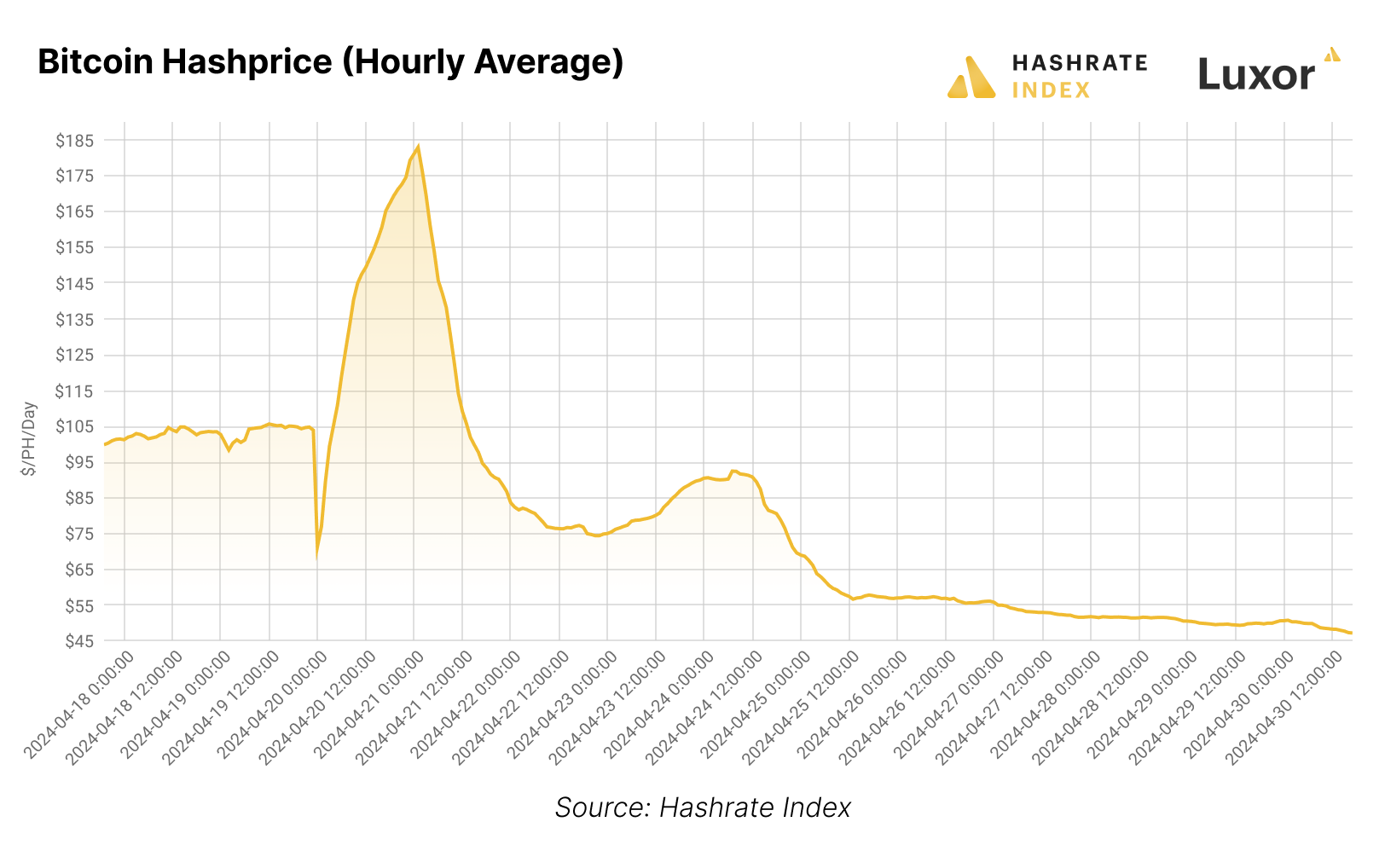

Bitcoin’s USD hashprice rose 11% over Q1-2024 to $109.57/PH/Day, which was also a 38% increase year-over-year. On a BTC-denominated basis, hashprice fell 33% to 0.00156/BTC/PH/Day, a 44% decrease year-over-year.

As we write this section on May 2, 2024, USD hashprice is $45/PH/Day after printing an all-time low of $44.43/PH/Day on May 1, 2024.

As the chart below shows, hashprice fell to $71.40/PH/Day on the hour of Halving, but it quickly recovered to above $100/PH/Day and topped off at $183/PH/Day the day after the Halving thanks to Runes-related activity, the highest level since April 2022 (all times in the chart below are UTC). As Runes trading fell off a cliff, hashprice did too, dropping below $50/PH/Day on April 28, 2024 for the first time ever.

At All-Time Lows, Hashprice is Trading in Contango

Hashprice is lower on a USD basis than it has ever been, but Hashrate traders think that the bottom is in (for the short-term, at least). Indeed, it’s worth noting that, as of May 6, 2024, Luxor’s Hashrate Forwards are trading in contango through October, which means that the contract prices for these forward contracts (which are essentially future contracts, although they trade OTC and not on an exchange) are trading above the current spot price.

The chart below shows the BTC-denominated curve for Luxor Hashrate Derivatives contracts from November 2023 to May 2024. We derive this forward curve by taking an average of the lowest ask and highest bid on Luxor’s Hashrate Forward order book on the first trading week of each calendar month for each Forward contract month. So for example, for the November data point, we take the ask-bid average for forward contracts in the first week of November for November, December, January, February, March, and April forward contracts. We then compare these forward prices to monthly average spot prices for hashprice.

How Runes Impacted Transaction Fees

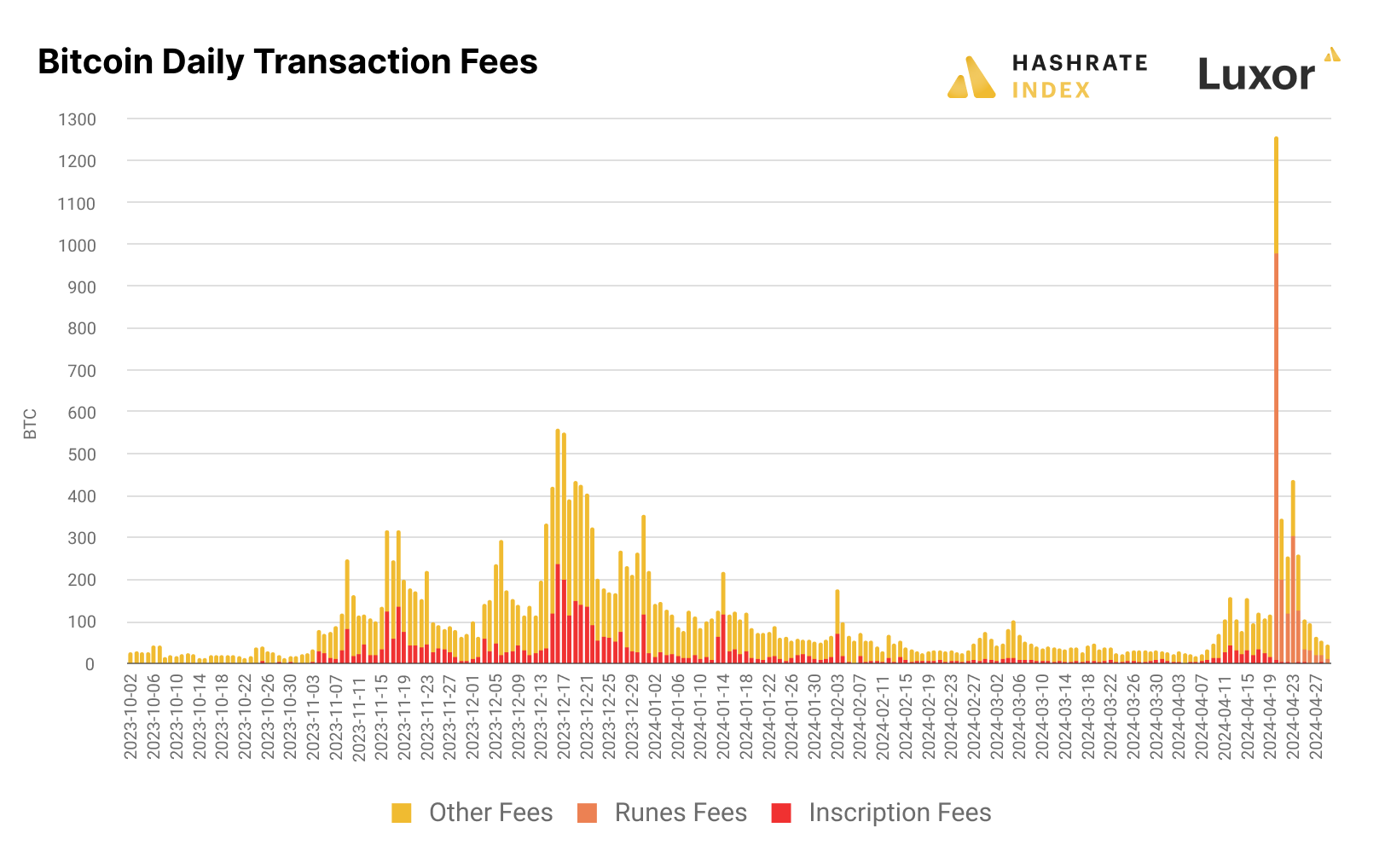

Miners have Runes to thank for the eye-popping transaction fee activity that kept hashprice frothy in the days after the Halving. This new standard for so-called fungible tokens launched on Halving block 840,000, and they were responsible for 36.75 out of 37.63 BTC in transaction fees that were included in this block, making block 840,000’s USD value a record-breaking $2.6 million at the time it was mined.

Per data from Matt Kimmell’s Dune Dashboard, Runes generated 1,819.8 BTC in transaction fees worth $117 million between the Halving and block 841,539, and they made up 43% of all transaction fees miners earned in this timeframe. For comparison, miners earned 23,445 BTC in fees worth $797.70 million in 2023.

As the chart above shows, Runes trading activity has waned significantly. Indeed, as of April 30, 2024, miners earned the bulk of Runes transaction fees (87%) in the first four days of their introduction.

ASIC Market Slows Down Ahead of Halving

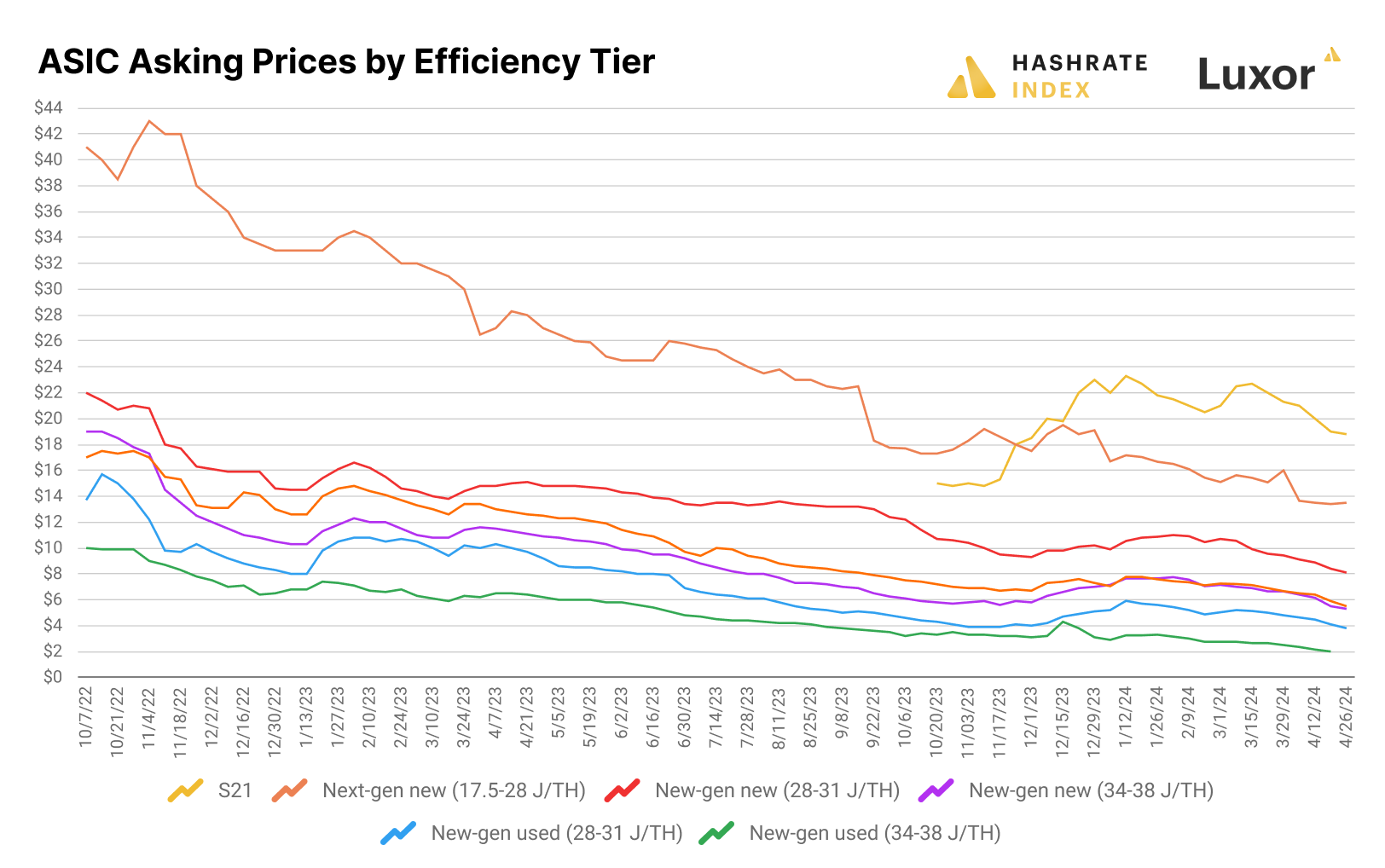

Unsurprisingly, the ASIC market cooled down significantly leading up to the Halving. Despite Bitcoin’s price hitting an all-time high and despite hashprice posting a Q1-2024 average of $91.14 (a 13% increase over Q4-2023’s average), ASIC prices trended down over the quarter, and buying activity stagnated in the weeks leading up to the Halving.

Despite further positive changes to hashprice and a higher hashprice average over the quarter when compared to Q4-2023, ASIC prices for all tiers fell over the quarter, and they continued to fall over the course of April before and after the Halving as miners and ASIC traders priced in the Halving’s impact on hashprice.

Bitcoin Miners Now Have to Jockey with AI Data Centers for Power

AI datacenters consumed relatively small amounts of energy in 2023 compared to other data centers, but that will change over the coming years as AI demand ramps up and new AI data centers come online around the world. Bitcoin miners will compete with these data centers for power resources, something that could inhibit Bitcoin’s global hashrate growth.

Taking data from a recent International Energy Agency report, global energy use from AI data centers could grow by a factor of 10 by 2026. In the chart below, we show traditional data center, Bitcoin mining, and AI data center power consumption for 2022, an estimate for 2023 (since there are no clear, public reports on data center numbers for the year yet), and projections for 2026. For Bitcoin mining data, we consult Cambridge’s Bitcoin Electricity Consumption Index. For AI data, we use projected figures for 2026 from the IEA report and we estimate 2023 data by cobbling together estimates for Chat-GPT’s electricity use per day and extrapolating this out to the rest of the AI compute industry based on Chat-GPT’s marketshare. For traditional data centers, we use IEA data for 2022 and projections for 2026, and we estimate 2023’s power usage according to annual growth rates for data center power use according to the International Data Corporation.

Hashrate Growth is the Name of the Game for 2024

Public miners were proactive in 2023 and ordered boat-loads of next-generation rigs, namely the S21, T21, M50 series, M60 series, S19k Pro, and S19 XP. These orders will be delivered on a rolling basis throughout the year, and many miners also put money down on options to purchase additional units at a locked-in rate at a later date. Assuming these miners can deploy these units once they are delivered – and not sit on inventory, as we’ve seen in the past with mass ASIC orders – then 2024 and 2025 will see a tidal wave of hashrate come online from these public companies. Case in point, the top public miners have had 76.6 EH/s worth of equipment on order for 2024, 12.9 EH/s of which should have been delivered in Q1-2024 assuming delivery timelines stayed on track.

We cover all of these topics (and many more) in depth in our report, so please give it a download, share it around, and let us know what you think!

Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.