The public miners are gaining an increasing share of Bitcoin’s hashrate

The public miners keep expanding at the speed of light, leading their share of Bitcoin’s hashrate to surge. This article shows the development of the public miners’ hashrate share during the past year and discusses whether it will keep growing.

Many public miners went public during the bull market in 2021, giving them plenty of capital to use for expanding operations. They poured this money into mining rigs they would receive from the manufacturer throughout 2022 and early 2023. These machines are coming online now, and we see a surge in the public miners’ hashrate as a result.

The private miners didn’t have access to this expansion funding and have seen a considerably slower growth rate than the public miners over the past year. As a result, public miners have taken over an increasingly larger share of the Bitcoin mining network.

The public miners’ share of the Bitcoin hashrate has skyrocketed over the past year

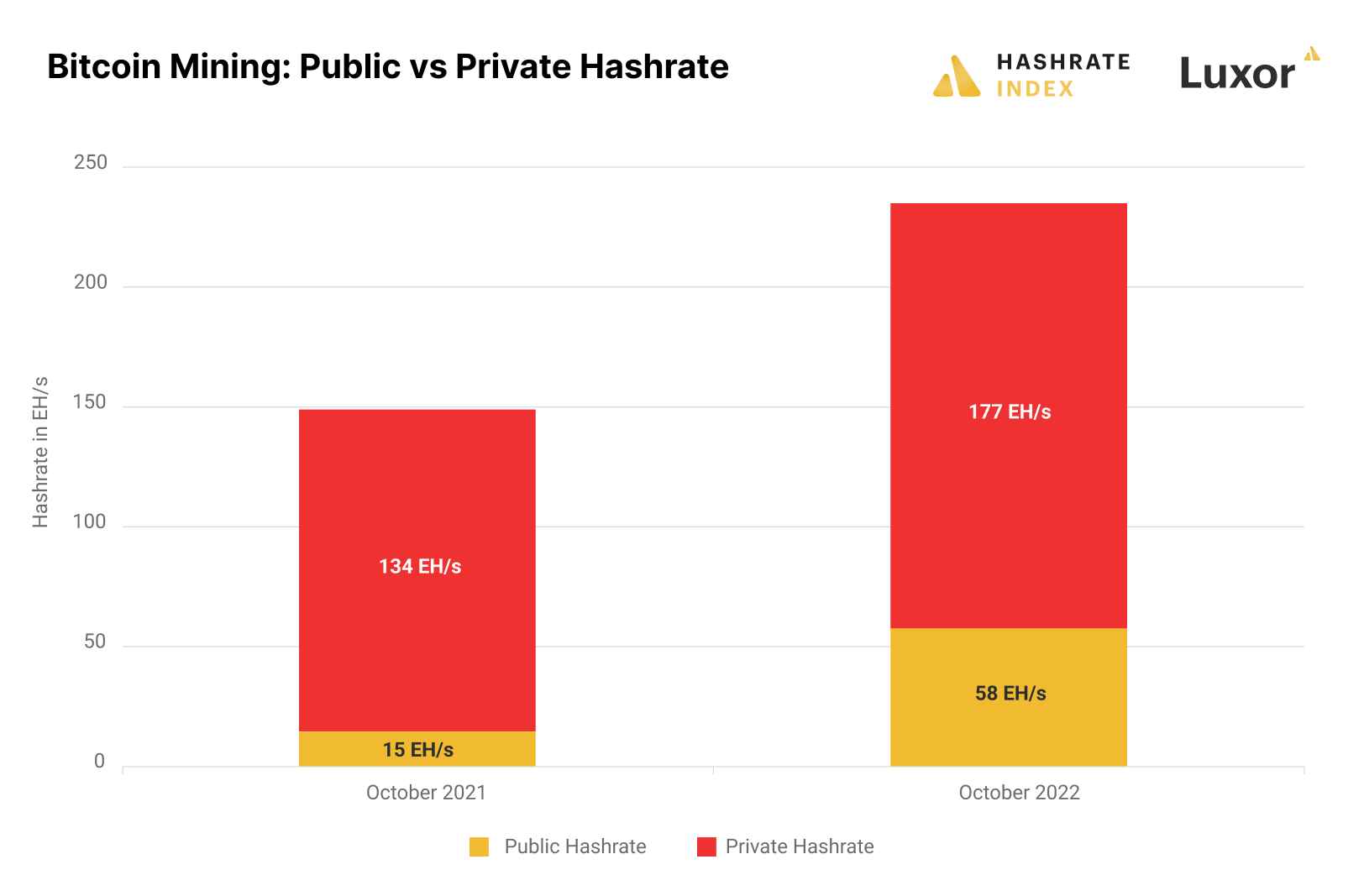

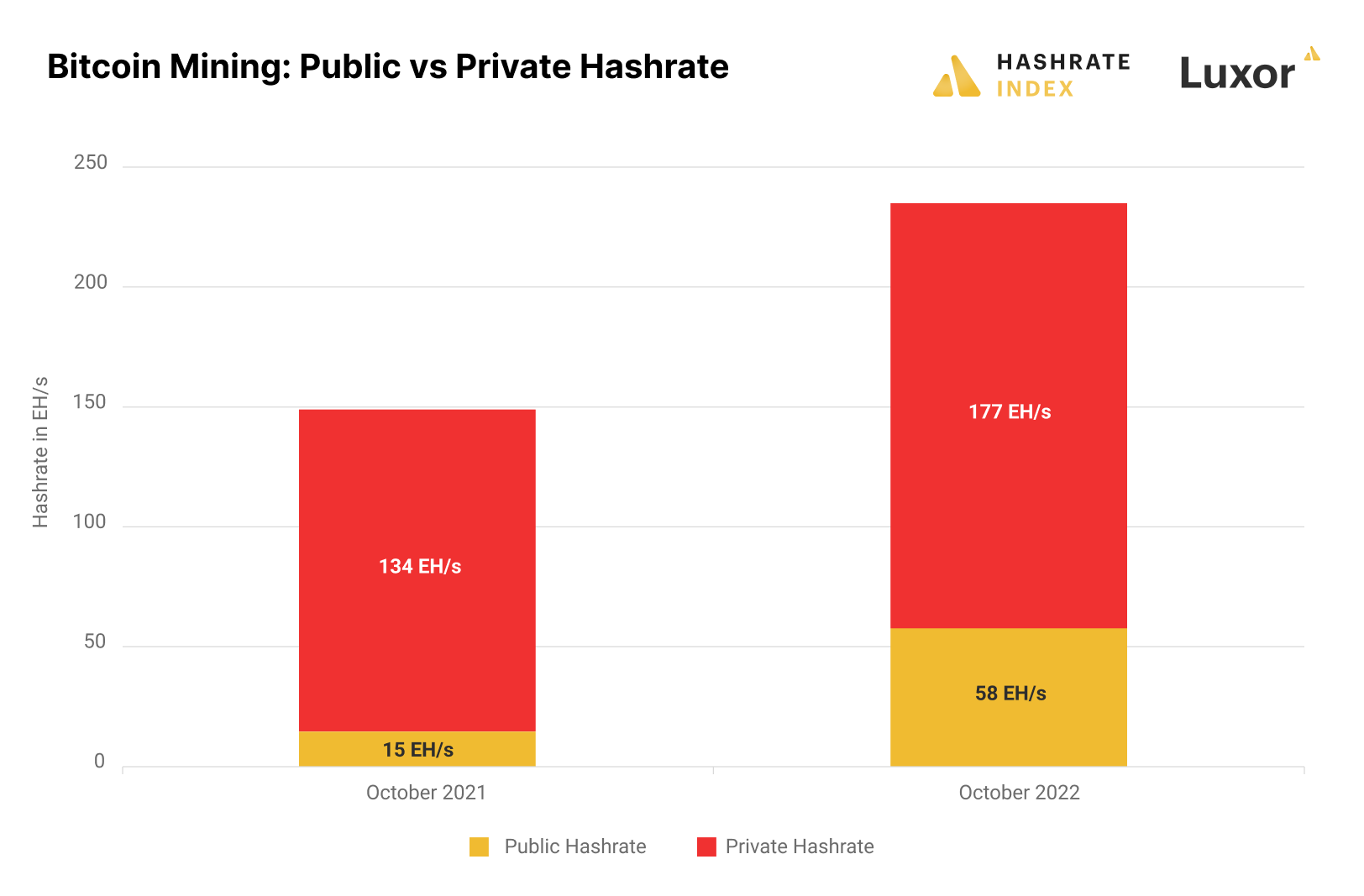

The chart below shows how Bitcoin’s hashrate was split between public and private miners one year ago and now. In October 2021, before the public miners initiated their grandiose expansion plans, these companies collectively only hashed at 15 EH/s. The private miners were still the undisputed mining kings, with a total capacity of 134 EH/s, making up 90% of the network.

Fast forward to October 2022, and the public miners’ capacity has increased by 295% compared to the meager 58% growth of the private hashrate. The public hashrate is now 58 EH/s, while the private hashrate is 177 EH/s. The private miners are still leading in terms of hashrate, but the public miners are indeed catching up.

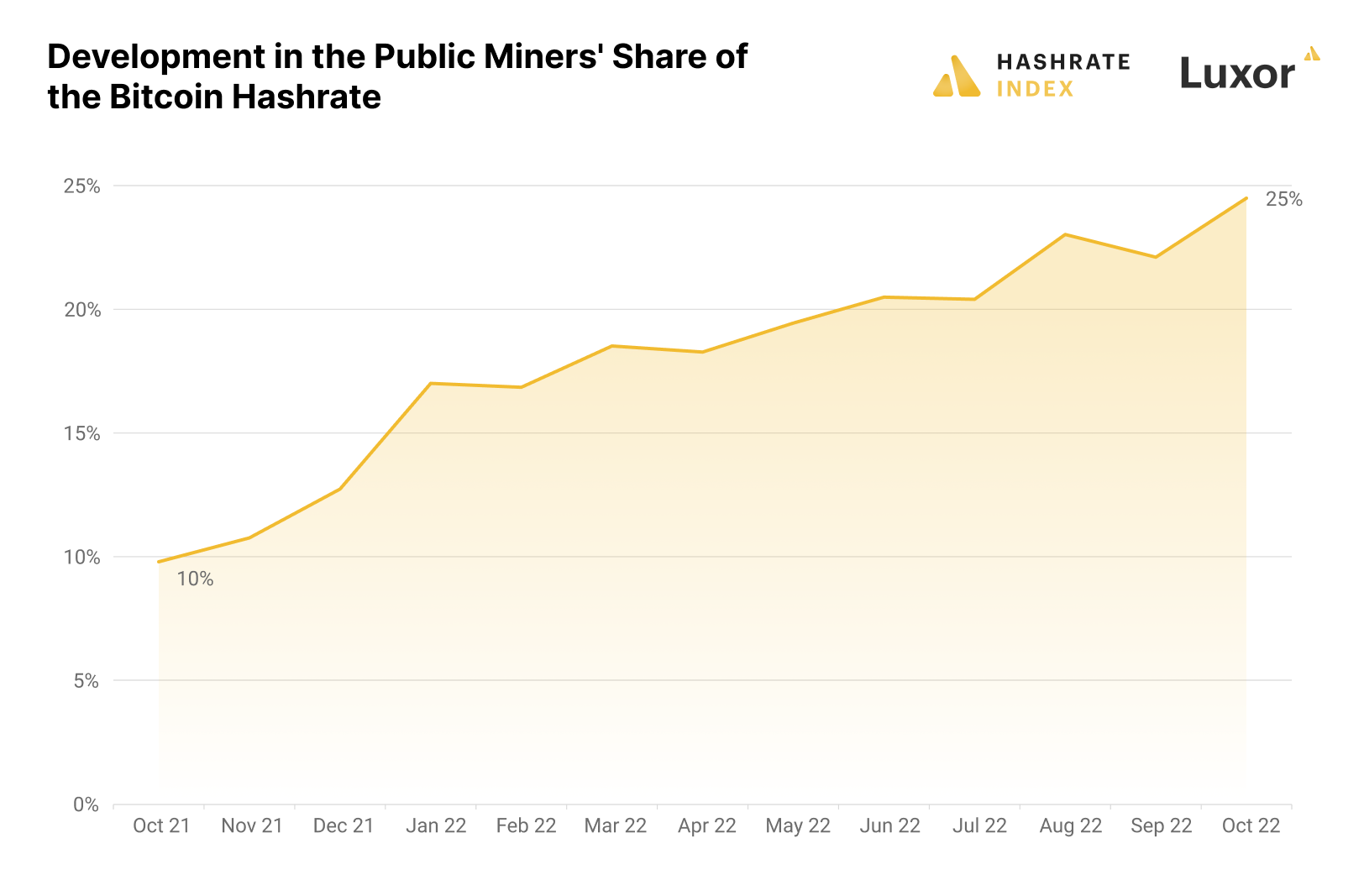

This chart shows how the public miners’ hashrate share has steadily grown during the last year. The public hashrate first surged in January 2022 when Core Scientific, the world’s biggest bitcoin mining company by hashrate, went public. This number has since gradually increased, now sitting at 25%.

During 2021’s bull market, several private mining companies planned to go public. Most of these deals have been postponed or canceled due to the raging bear market, meaning that except for Core Scientific’s public listing, this growth in the public miners’ share of the Bitcoin hashrate has come from an organic increase in the public miners’ capacity.

The biggest public bitcoin miner has a 5% share of the total hashrate

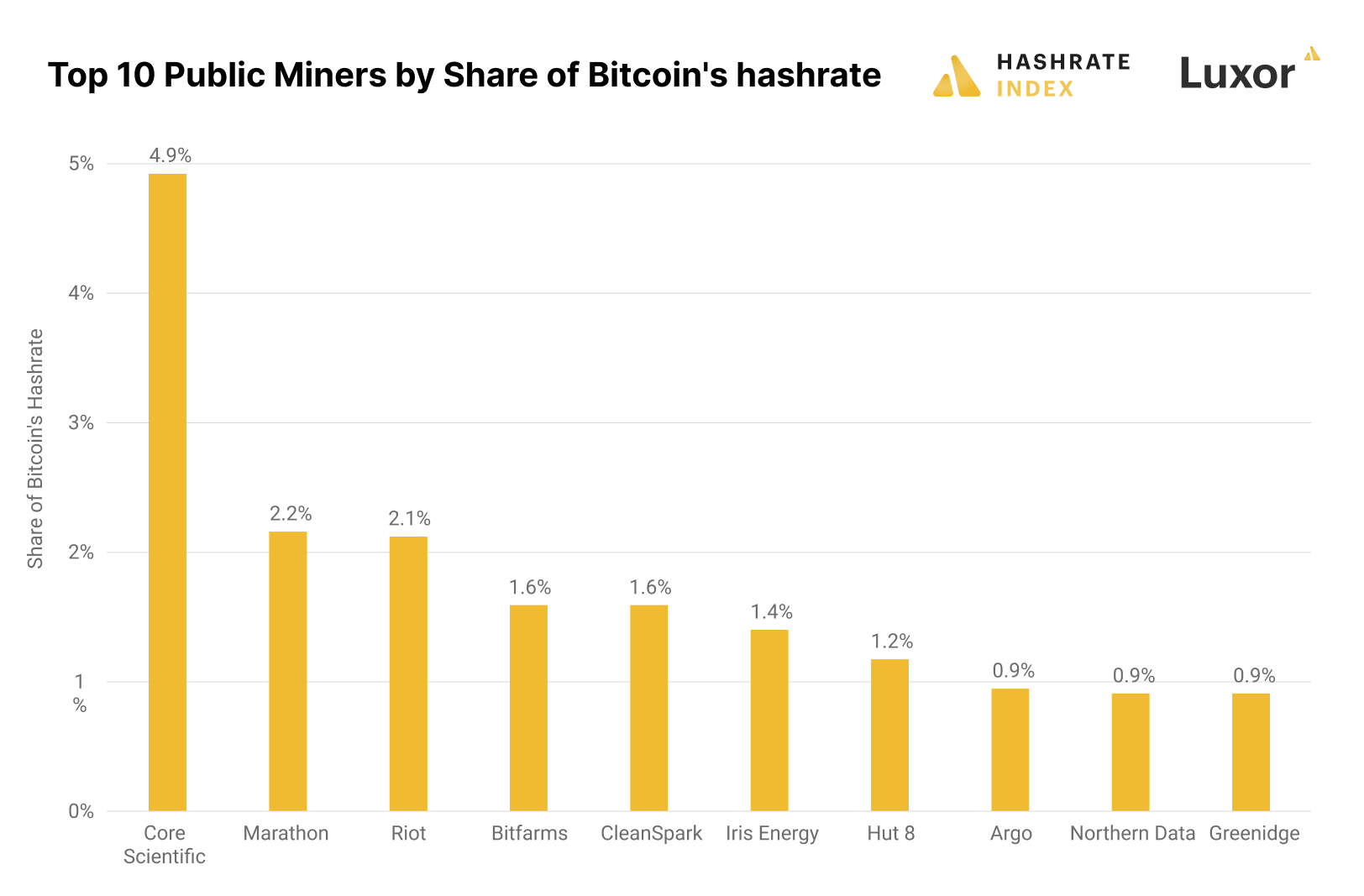

Core Scientific going public in January 2022 led to such a bump in the public miners’ share of the Bitcoin hashrate because the company is so massive. At that time, it operated a self-mining hashrate of 6.6 EH/s, which has since grown to 13 EH/s.

Core Scientific’s 13 EH/s make up almost 5% of the total Bitcoin hashrate. This massive share makes it the by far biggest public miner and most likely also the largest private miner. The company is far from done expanding, planning to add 4 EH/s before the end of the year, bringing its total capacity to 17 EH/s.

Marathon and Riot follow behind, each controlling over 2% of Bitcoin’s hashrate. These companies also have extreme expansion plans. Riot plans to grow from its current 5.6 EH/s to 13.5 EH/s by mid-2023, while Marathon aims to expand its 5.7 EH/s to 23 EH/s by mid-2023. You can read more about these expansion plans in this article.

In total, we find seven public bitcoin miners with a hashrate share of more than 1%, while several of the around 25 public miners are in the 0.5% to 1% area.

Will the public miners keep taking over the Bitcoin mining network?

As explained in the intro, the driving force for the public miners’ rapid capacity increases is that they could access cheap capital during the bull market of 2021, which soon became funneled into massive mining rig purchases. The private miners couldn’t access that capital and were thus unable to fund these expansions. In hindsight, the private miners proved to be the lucky ones, as the public miners’ mining purchases have gone far underwater as the market turned sour.

The public miners still have massive upcoming deliveries of mining rigs, and some of them even have tens of thousands of mining rigs sitting in storage waiting to be plugged in. They will therefore keep expanding their capacities until they get all these machines up and running, ensuring that the rapid growth in the public hashrate continues until mid-2023. At the same time, I doubt we will see the growth rate of the private hashrate considerably increase, meaning that the public miners’ share of the total hashrate will keep growing for several months into the future. These dynamics could lead the public miners’ share of the Bitcoin hashrate to reach 40% by mid-2023.

Still, many miners struggle financially as the hashprice sits at all-time lows. These financial problems are especially prevalent among public miners, and some will not be able to handle a further decline in cash flows. If some of these companies go bankrupt, their assets could be auctioned away to better-positioned private miners, pressuring down the public miners’ share of Bitcoin’s hashrate.

In addition, most public miners operate in North America, which has been hit hard by energy price rises. Some companies, like Northern Data, operate in Europe, where the energy price inflation has been the most severe. In the long term, as the industry becomes increasingly competitive, miners will have to look for cheap and stranded energy found in remote places in South America, Asia, and even Africa.

Given that most public mining companies prefer to stick to their home turf in the US and Canada (Bitfarms is an exception), we will likely see these companies miss out on some of the cheapest energy opportunities that exist globally. Private miners are the most likely to take advantage of these international opportunities. Therefore, I believe that in the long term, we will never see public miners control more than a maximum of half of the mining network.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.