Highlights from Riot Blockchain's Q3 Report

Riot Blockchain, one of the largest publicly traded bitcoin miners, just revealed the state of its finances and operations in its latest quarterly report. How is it going with the Texas-based miner? Find out in this article.

The bitcoin mining industry is currently in crisis mode. The share prices of most public mining companies have plummeted by more than 90% from their all-time highs, and the latest icing on the cake is that several of these companies are warning they might run out of cash soon.

Things have gotten so bad that many are wondering which bitcoin miners will go bust. The more optimistic of us are framing the question the opposite way: "Which bitcoin miners are so strong that they will not only survive the bear market but could capitalize on it?"

We must dive deep into the public bitcoin miners' financial reports to answer such questions. This article goes through my main findings from Riot's Q3 report to determine how strong this company is.

Riot still has a solid and liquid balance sheet

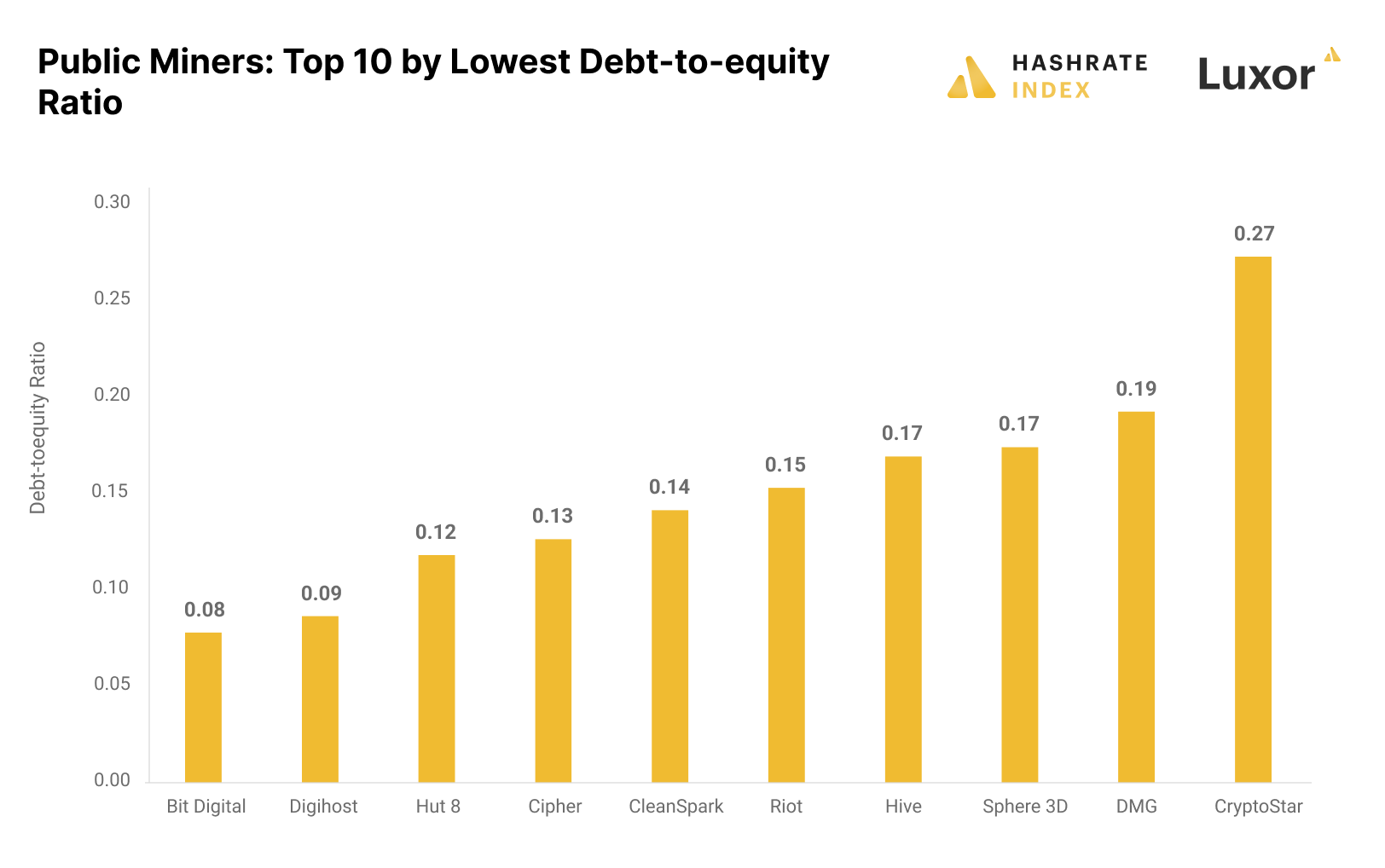

Nothing is more important in a bear market than having a healthy balance sheet. Riot has historically favored equity over debt when financing its operations. This financing strategy has resulted in the Texas-based miner having among the lowest debt-to-equity ratio of the public bitcoin mining firms.

The chart above shows the ten public bitcoin miners with the lowest debt-to-equity ratios. Riot is in sixth place with a debt-to-equity ratio of only 0.15. In more traditional industries, below 2 is generally considered healthy, but the number should ideally be significantly lower in the bitcoin mining industry due to the extreme volatility. For perspective, bankruptcy-threatened Core Scientific has a debt-to-equity ratio of 24.

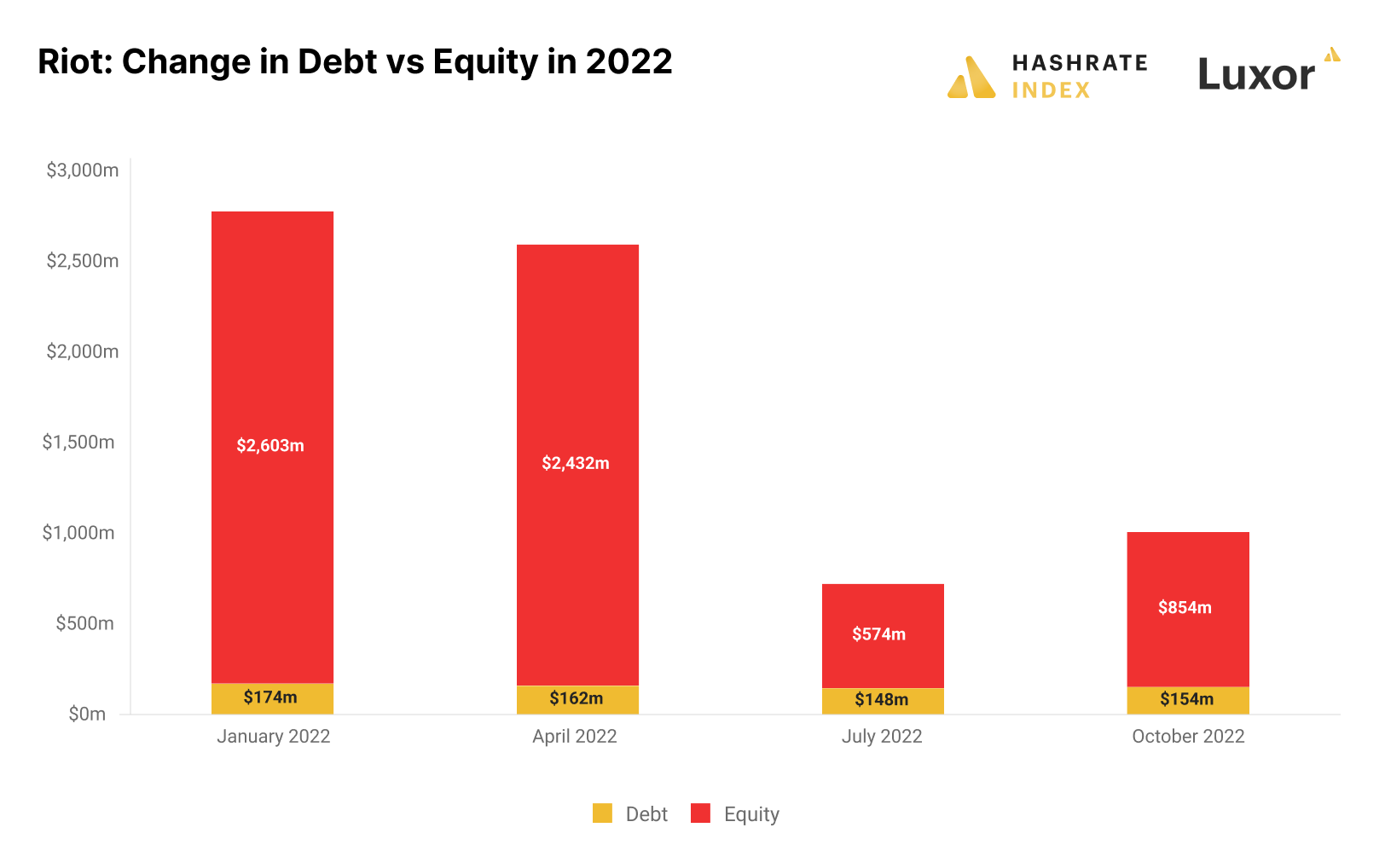

Many public bitcoin miners have seen their balance sheets weaken considerably over the past months as the bear market has ravaged. This has not been the case with Riot.

Although the value of Riot's equity has decreased significantly in 2022, its debt levels have shrunk as the company has paid down obligations. Its low debt burden has two main advantages for the company. Firstly, its cash flows are not burdened by the periodic debt service payments that currently are strangling the liquidity of several of its competitors. Secondly, the company has room to take on debt if needed to improve liquidity. This is a luxury more indebted companies don't have.

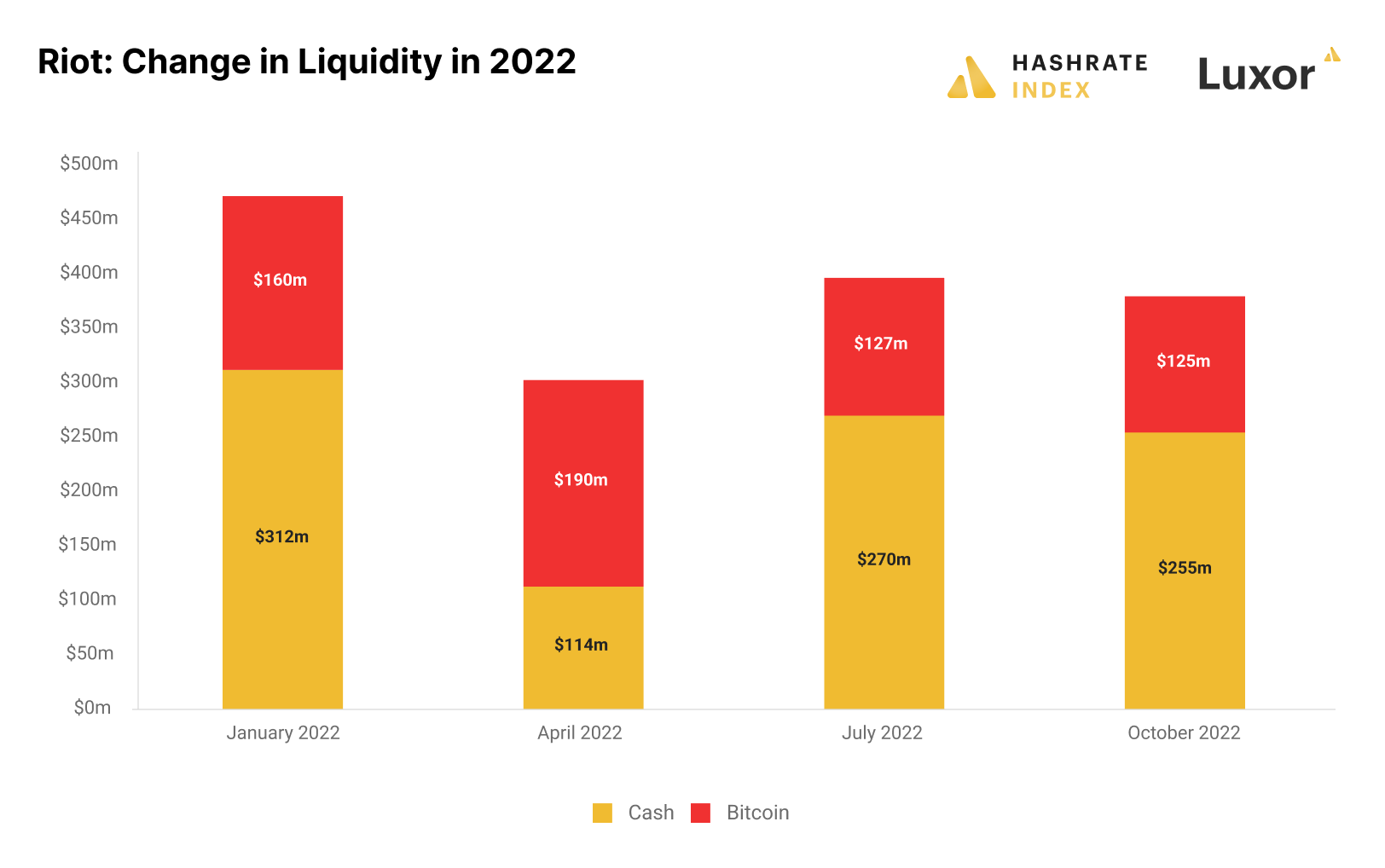

Not only is the balance sheet solid, but it's also very liquid, with enormous cash and bitcoin reserves. Riot has $255 million of cash and 6,766 bitcoin, giving them total liquidity of $380 million. The sheer tremendousness of Riot's liquidity becomes apparent when comparing it to the $27 million liquidity of Core Scientific.

Riot's liquidity position hasn't materially changed since July and is even better than in April. Having all this cash on the balance sheet is extremely valuable and makes it possible for the company to expand aggressively. The cash is dearly needed as the company just broke ground on developing the world's largest bitcoin mining facility in Corsicana, Texas, which will have a power capacity of 1 GW and is estimated to commence operations in Q4 2023.

How did Riot get into such a great financial position? The company has raised $298 million in equity this year as part of an at-the-market offering. This equity raise has been vital for the company. In hindsight, it was also an excellent decision, as raising equity has gradually become more challenging over the past months.

Riot significantly reduces its power costs by curtailing its energy usage, but the downside is reduced up-time

Riot operates in Texas. Wind and solar make up a large percentage of the power generation capacity in the state, resulting in the power supply being relatively volatile. ERCOT, the grid operator, has developed several demand response programs that allow flexible power consumers to adjust their power consumption after the available power supply.

Bitcoin miners like Riot have become the main participants in these demand response programs. The basic idea is that Riot, and other bitcoin miners, reduce their power consumption when power is scarce. In return, they receive a financial benefit. This financial benefit can be viewed as a reduction in Riot's power costs. Ergo, Riot sacrifices some up-time for lower power costs.

Riot participates in two main demand response programs. One of them - 4CP - requires Riot to reduce its electricity consumption during peak periods in the four hottest months of the year (June, July, August, and September) and, in return, gives Riot substantially reduced transmission fees the following year. It's unclear how much Riot saves by participating in the 4CP program, but it's likely several million per year.

Riot also has a long-term fixed-price power contract that allows them to reduce its power consumption and sell the power back to the grid. By doing this, the miner receives power credits, which it uses to lower its electricity bill the following month. In Q3 alone, Riot earned $13.1 million in such power credits.

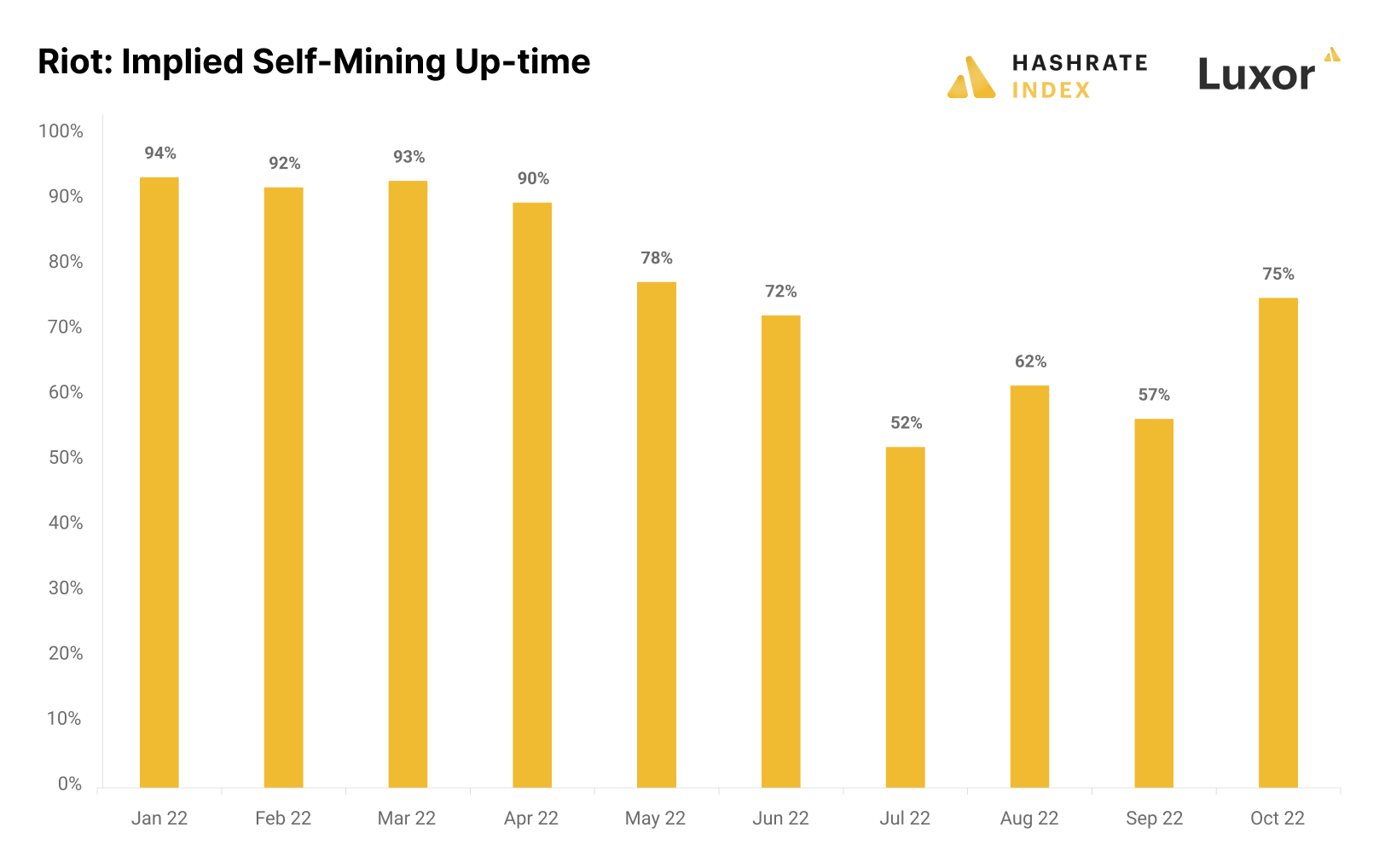

The downside of Riot's participation in these demand response programs is reduced up-time. We can find out how Riot's up-time has been affected by participating in these programs by seeing how their implied self-mining up-time has changed this year.

We see that Riot's up-time was consistently above 90% in the first four months of the year before dropping to 78% in May and reaching a low of 52% in July. The up-time stayed very low throughout the summer as Riot participated in demand response programs that helped alleviate pressure on the ERCOT grid as heat waves led to soaring power demand. With the summer heat long gone, Riot's up-time has improved and was 75% in October.

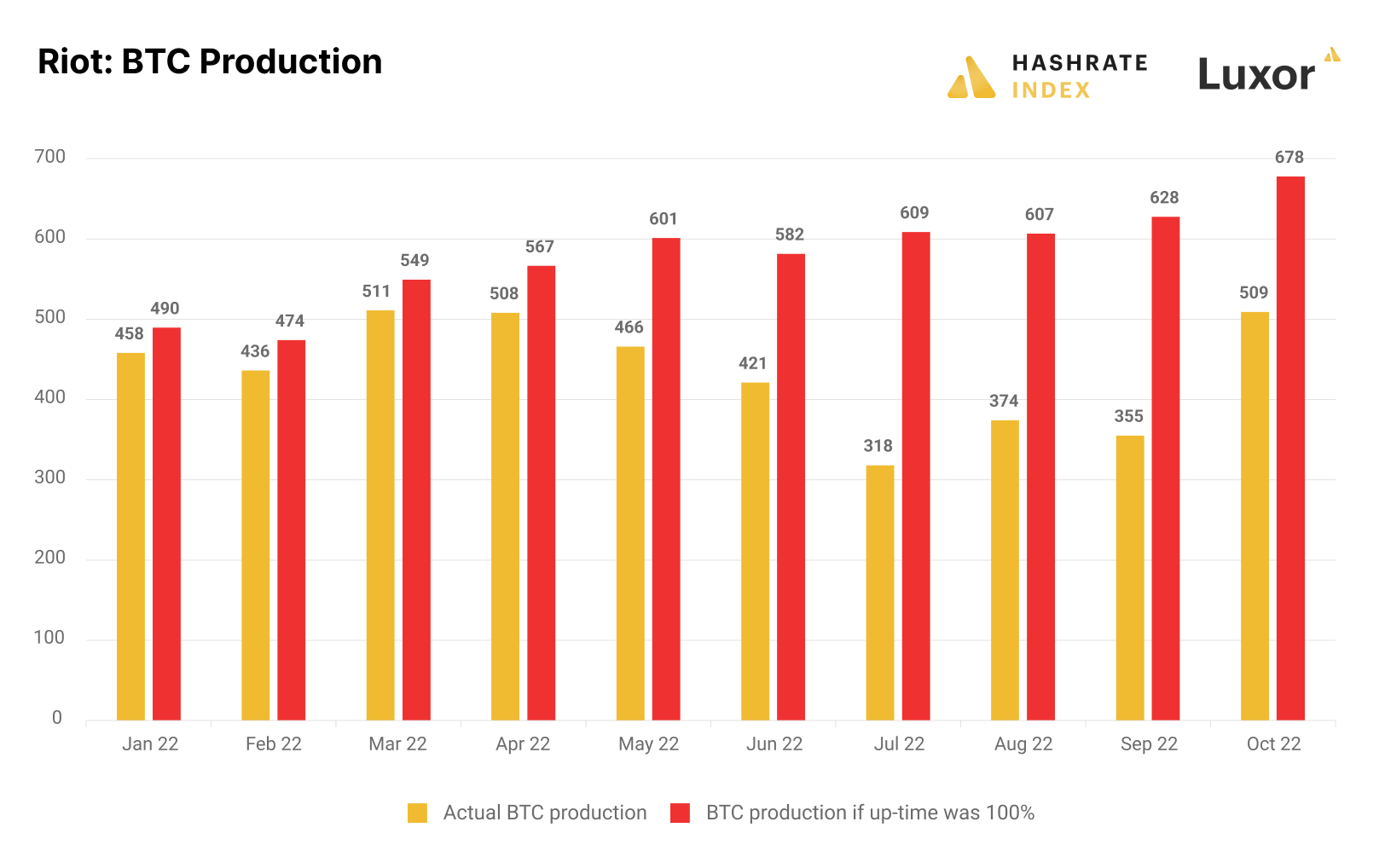

Reduced up-time means less bitcoin produced. The chart below compares Riot's actual bitcoin production with how much it would have generated if its machines were running 100% of the time.

We see that low up-time in Q3 (July, August, and September) severely held back Riot's bitcoin production. During these three months, Riot produced 796 less bitcoin than it would have if it ran its machines 100% of the time. With the average bitcoin price during Q3 of $22,400, this reduced up-time corresponds to a lost revenue of $17.8 million.

The company earned $13.1 million in power credits this quarter, along with significant reductions in transmission fees for the next year, which combined should be well above what the company lost by turning off its machines. Due to these reduced power costs, the reduced up-time is somewhat acceptable.

Although the company has significantly ramped up production lately, I will still pay close attention to its up-time going forward as this factor is crucial for paying down the capital expenditures of the machines. Bitcoin mining machines have limited life spans; generally, you will want to run them close to 100% of the time to maximize the return on the investment.

Riot still has decent bitcoin production margins – if accounting for the power curtailment credits

In the previous section, I explained how Riot is sacrificing some up-time to achieve reduced power costs. In its latest investor presentation, the company stated that it has an industry-leading power rate of $0.029 per kWh. The caveat is that this power rate includes the power credits and reduced transmission costs the company achieves by participating in demand response programs. Ergo, the company must significantly reduce its up-time to achieve this power rate.

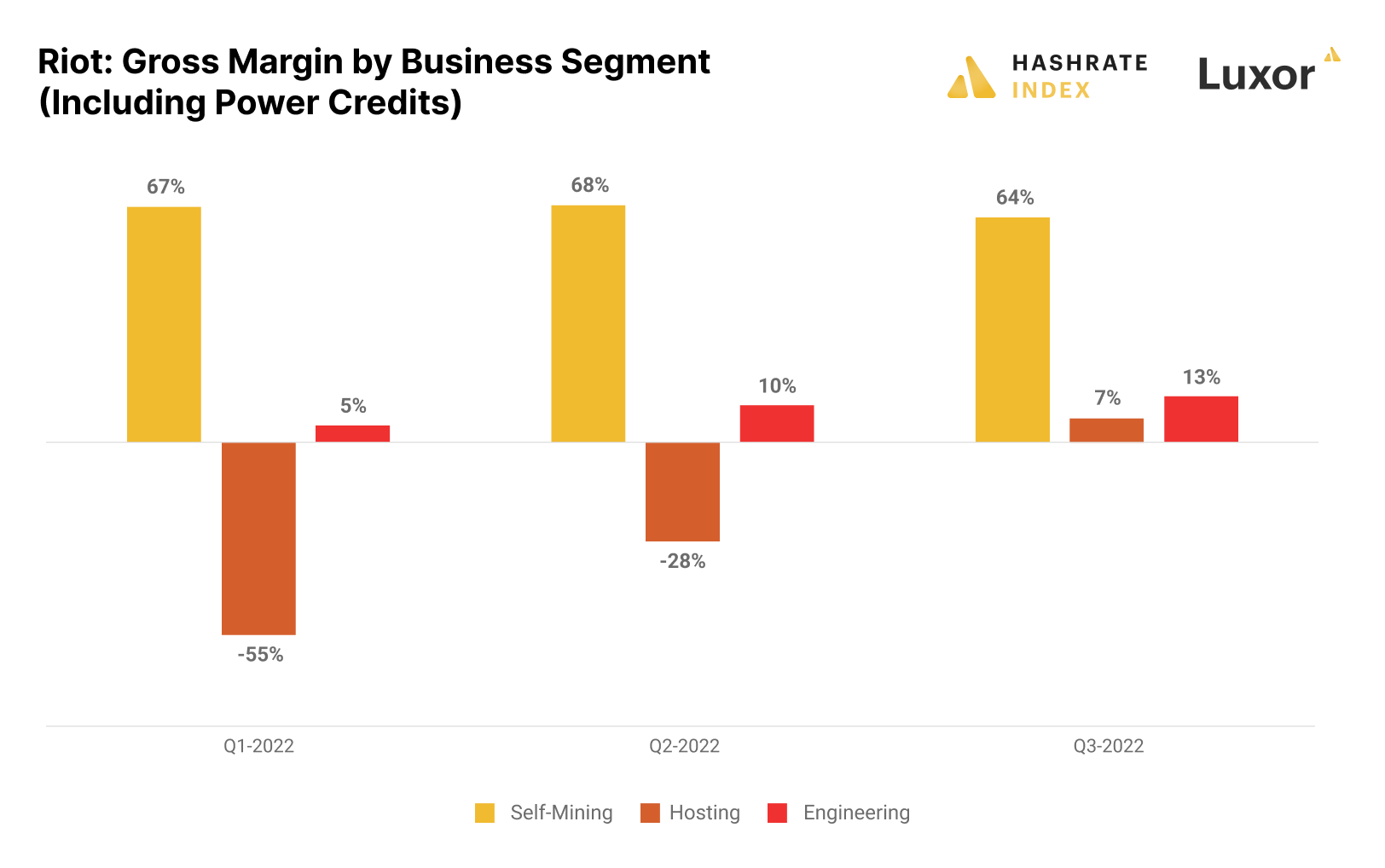

The power credits Riot earns are effectively reducing its power rate. Therefore, I subtracted the power credits from the company's direct costs when calculating Riot's gross margins. It's important to be aware that the company's gross margins would have been significantly lower if it weren't for these power credits.

Riot's self-mining segment booked revenues of $22 million in Q3. The gross self-mining margin has been relatively stable this year, between 64% and 67%. Many other bitcoin miners who didn't have a fixed-price power purchase agreement have seen their power costs soar over the summer, but Riot has managed to keep its power costs low thanks to its participation in the demand response programs.

Riot also hosts machines for other bitcoin mining companies. The company's hosting segment generated $8 million in revenues in Q3. This segment has historically struggled with negative margins, but we see a consistent improvement this year from -55% in Q1 to 7% in Q3. An important caveat is that this gross margin also depends on the reduced power costs, which are a function of Riot's participation in demand response programs.

Riot is also building up an engineering segment structured around developing technical solutions for other mining firms. This segment has become important for Riot, as it had revenues of $15.8 million in Q3 and also sees steadily improving gross margins from 5% in Q1 to 13% in Q3.

Conclusion

With its strong balance sheet and low production costs, Riot is in an excellent position to not only survive this bear market, but to capitalize on it by aggressively expanding. The company is currently focused on building out two mega-mines in Texas that will require enormous capital expenditures, so it needs all the cash it has on hand.

The company has an industry-leading power rate that it achieves through a complex power strategy centered around turning off its machines when power is scarce. This strategy has led to a significant reduction in up-time, meaning that the company produces less bitcoin than it should, given its hashrate. Still, this reduced bitcoin production is an acceptable trade-off for achieving such a low power rate. I expect the company to improve its up-time significantly in the following months.

Riot's low power rate enables the company to produce bitcoin with a solid gross margin even in the bear market. The company also has growing hosting and engineering business segments which still have low but steadily improving margins. These business segments may become important sources of income in the future, but it's still the self-mining division that brings in the cash.

I'm very bullish on Riot and consider this quarterly update a great one.

Disclaimer: I hold Riot, CleanSpark, and Bitfarms.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.